Blockchain data reveals BlackRock moved over $660 million in BTC and ETH to Coinbase Prime as redemptions hit crypto ETFs. BlackRock, the world’s largest asset manager, has transferred over $664 million worth of Bitcoin and Ethereum to Coinbase Prime, raising speculation of a looming sell-off. The movements, flagged on August 5 by blockchain trackers, include 2,544 BTC (valued at $292 million) and 101,975 ETH (worth $372 million at the time of transfer).

Although the firm has not confirmed any sale, moving crypto assets from cold storage to a custodial exchange like Coinbase Prime is typically seen as a pre-sell maneuver. The action comes after months of steady accumulation and coincides with growing outflows across major U.S. crypto ETFs, including BlackRock’s own iShares Bitcoin Trust (IBIT).

ETF redemptions signal institutional rebalancing

Bitcoin ETFs have posted a four-day streak of outflows, shedding around $1.5 billion collectively. Ethereum ETFs have also been under pressure, logging two days of redemptions totaling nearly $600 million before bouncing back with $73.2 million in modest inflows.

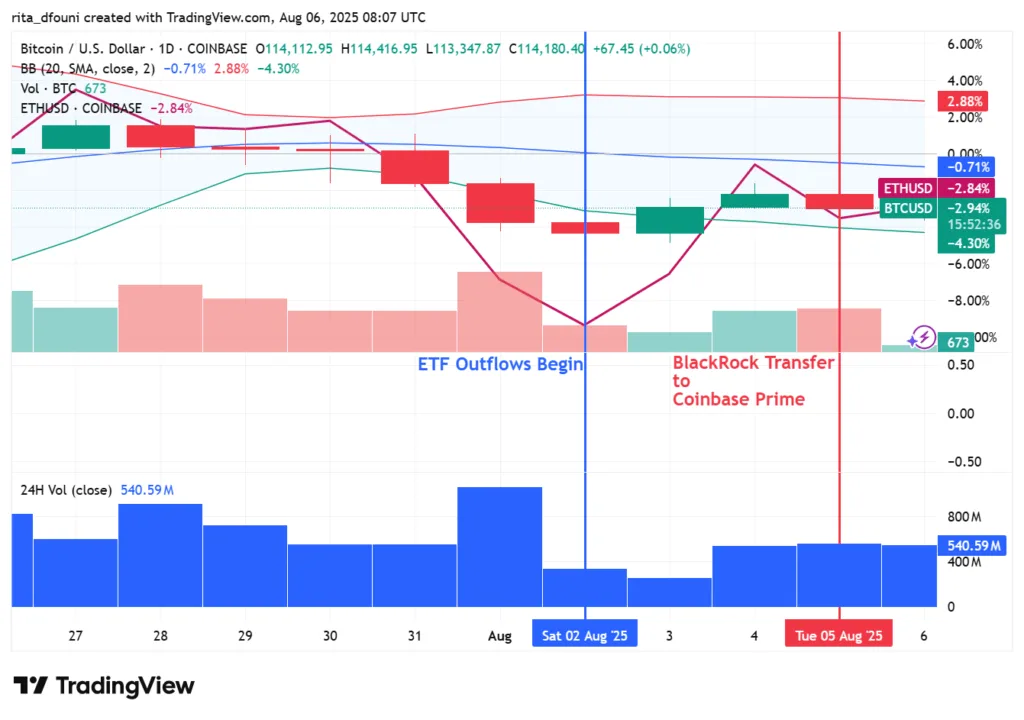

BTC & ETH Price Reaction to ETF Outflows and BlackRock Transfers, August 2025

Bitcoin and Ethereum fell over 4% between August 2 and 6, coinciding with over $2.1 billion in ETF outflows and BlackRock’s $664M wallet transfer to Coinbase Prime.

Analysts suggest the timing of the BlackRock wallet movements may reflect a broader institutional profit-taking strategy, particularly as BTC and ETH pull back from multi-month highs. The outflows mark a reversal from Q2 trends, when ETF inflows helped drive crypto valuations higher.

Market slips as BTC and ETH lead losses

Bitcoin is currently trading just above $114,000, down 0.39% on the day and 3.6% over the week. Ethereum has fallen to $3,625, recording a 1.4% daily drop and nearly 5% weekly loss. The total crypto market cap has dropped to $3.79 trillion, down 5.3% from its earlier peak of $4 trillion this year.

Broader weakness is seen across altcoins and memecoins. Solana (SOL), XRP, and PEPE are each down over 3% in the last 24 hours. Memecoins like BONK and Popcat (POPCAT) have also fallen sharply, with losses ranging between 3% and 5%.

Despite the recent activity, BlackRock continues to hold substantial crypto reserves. The firm still owns over 741,000 BTC and 3 million ETH, valued at approximately $84.5 billion and $11 billion, respectively.