Circle, the issuer of the USDC stablecoin, has unveiled two AI tools this week to let developers stitch their products with its ecosystem. These tools are – a generative AI chatbot and a Model Context Protocol (MCP) server – that allows AI applications to perform tasks using external resources.

How will these AI tools work

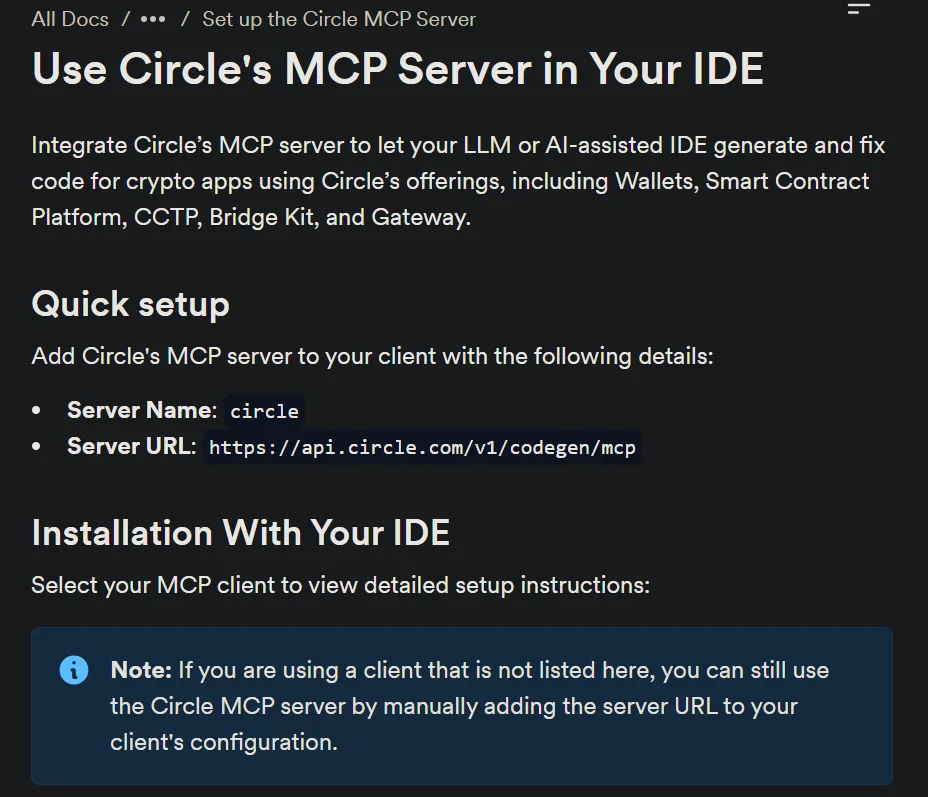

Circle explained that its AI Chatbot will let developers generate codes to support their product ideas. Its MCP server will enable developers to connect the AI chatbot to external tools, data, and code repositories to fetch code-related information from.

“With our new AI chatbot and MCP server, you can create code right in your browser or your preferred Integrated Development Environment (IDE),” the official X handle of Circle Developer posted on November 10. “Go from idea to integration to production onchain faster than ever.”

Developers will be able to integrate USDC payments with their products with these AI tools from Circle. Additionally, they will also be able to add Cross-Chain Transfer Protocol (CCTP), compatible wallets, and contracts in their programmes.

“The tooling uses Circle’s APIs, SDK metadata, and docs for accuracy and reliable output,” the post added.

Circle leadership testifies to AI utility

Jeremy Allaire, the co-founder and CEO of Circle also shared the development, inviting developers to start building code using the Circle infrastructure.

Nikhil Chandhok, the Chief Product and Technology Officer of Circle said with this development, the stablecoin firm is putting AI at the heart of on-chain DevEx (developer experience).

“Our new AI code gen experience delivers fast code generation for the Circle platform, available in our docs or in popular IDEs through the new Circle MCP server,” Chandhok noted.

Circle, with its present valuation sitting at $23.87 billion, is aiming at becoming the first digital currency bank in the U.S. Last week, Circle also unveiled the testnet of its Layer-1 blockchain dubbed Arc.

In the second quarter of this year that ended in June, Circle claimed that USDC circulation rose by 90 percent hitting the market cap of $61.3 billion in May. The company also completed a $1.2 billion IPO earlier this year.