Coinbase has reportedly entered into late-stage discussions with BVNK to explore the latter’s acquisition. The crypto exchange, touted among the largest in the world, is possibly preparing to shell out $2 billion to purchase the stablecoin infrastructure firm owing to the institutional and political winds favouring the assets.

BVNK is a London-based company that enables merchants to tap into enterprise-level stablecoin services, Bloomberg reported citing sources familiar with the matter. Coinbase Ventures is already an investor in the British firm.

While elaborate details on the deal remain awaited, the agreement is expected to be finalized by early 2026 or before the wrap up of 2025. Earlier last month, reports had emerged claiming that even Mastercard was interested in acquiring BVNK in a bid to strengthen its position in the stablecoin arena.

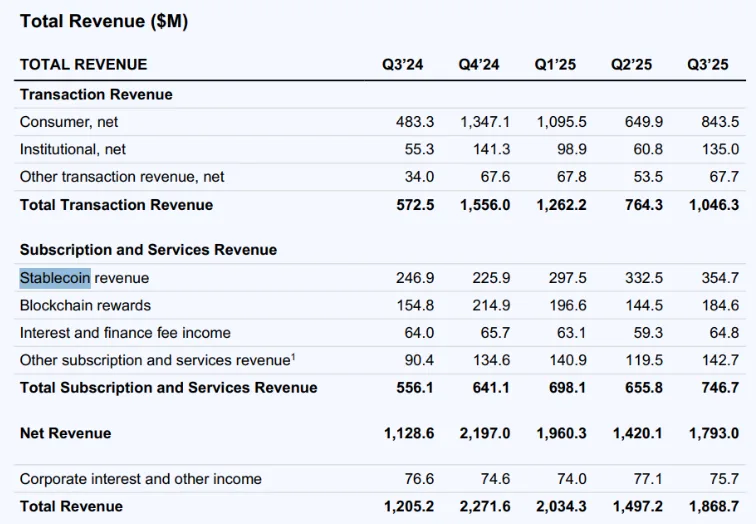

The speculations around Coinbase considering this acquisition comes just days after the exchange revealed it churned $354.7 million in revenue from stablecoin services – a notable rise from the $297.5 million and $332.5 million that it had roped in in the first two quarters of the year.

Source: Coinbase

Action in the stablecoin market has particularly intensified after the U.S. recently passed the GENIUS Act into law, defining clear directions for the issuers of these fiat-pegged tokens. Tether and USDC are the top two stablecoins with the current market caps of $183.44 billion and $75.75 billion respectively, as per CoinMarketCap.

Owing to all this buzz, Coinbase is increasingly showing interest in participating in the stablecoin arena. Last week, for instance, the exchange announced a collaboration with Wall Street giant Citi to test and improve the utility element of stablecoins.

Coinbase Ventures also recently led a $14.6 million funding round in Bastion’s white-label stablecoin platform.