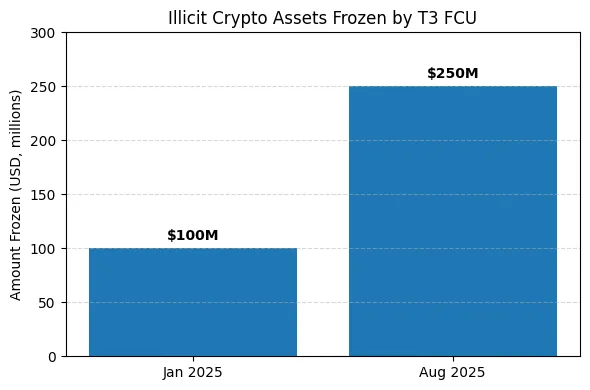

Less than a year after, its launch Tron, Tether, and TRM Labs collaborative financial crime squad, the T3 Financial Crime squad (T3 FCU), has frozen over $250 million in illegal cryptocurrency holdings. This amount demonstrates the initiative’s explosive growth as it more than doubles the $100 million announced in January 2025.

Binance has joined the unit as its first partner expansion through its recently created T3+ program. In addition to collaborating with law enforcement across the globe on cases involving money laundering, investment fraud, blackmail, terrorism financing, and other crimes, the T3 FCU is a public-private partnership that tracks and disrupts unlawful blockchain activities. According to Justin Sun, the founder of Tron, the extension will increase industry-wide cooperation to combat illegal activities instantly.

The graph shows, the Illicit crypto assets frozen by the T3 Financial Crime Unit, founded by Tron, Tether, and TRM Labs, increased from more than $100 million in January 2025 to more than $250 million in August 2025.

The growth coincides with an increase in the speed and sophistication of cryptocurrency breaches. In the first half of 2025, almost $3 billion worth of cryptocurrency was stolen, according to a report by the Swiss blockchain analytics company Global Ledger. Thirty percent of laundering was completed in a day, and in certain cases, it was finished in less than three minutes. It took an average of 15 hours to transfer the stolen money, and in around 23% of cases, the money laundering was completed before the attack was ever made public.

Also read: Top 10 crypto scams to look out for

Centralised stablecoin controls cause concerns over user sovereignty.

According to the report only 4.2%, of the stolen money was recovered inA the first half of the year as a result of this pace. Compliance teams usually have only 10 to 15 minutes to stop suspicious payments before the assets are moved out of reach, and 15% of illegal cryptocurrency flows through centralized exchanges. Enforcement and recovery operations are made more difficult by the numerous attacks that have been connected to organized cybercrime groups, state-sponsored hackers, and international fraud networks that operate across borders.

There is ongoing discussion on stablecoin issuers’ authority to freeze funds. The debate over whether centralized management in stablecoin systems compromises user sovereignty and the decentralized tenets of cryptocurrency was reignited after Tether recently froze about $86,000 in stolen USDt. Proponents, such as Paolo Ardoino, CEO of Tether, contend that stopping transactions at the smart contract level is crucial for safeguarding consumers and discouraging malicious actors. He asserted that the development of a more secure and reliable blockchain ecosystem can only be achieved by industry cooperation.