Bitcoin on Friday, November 14 sunk to its lowest price since May – dipping to the mark of $97,000. The asset reflected a price drop of 5.64 percent over the last day, to trade at $97,433 at the time of writing. The asset is undergoing major volatility with its price struggling to stabilize for the time being. Its last day’s price was reported at $103,500 based on figures from CoinMarketCap.

Bitcoin had been on a downward spiral all of this week owing to the evolving political dynamics in the U.S., coupled with other macro-economic factors. Analysts say that $96,000 now acts as a key support for BTC, while the immediate resistance stands at $102,500.

“Although the U.S. government has reopened, delays in key economic reports have added short-term uncertainty around the Fed’s December rate decision,” Mudrex CEO Edul Patel told CoinHeadlines, predicting that long-term sentiment for BTC remains strong as whales continue to accumulate, having purchased over 45,000 BTC in the past week.

Ether joined Bitcoin to succumb to the market pressure and register a steep fall. The asset’s price dipped to around $3,100 after it saw a dip of over 10.5 percent over the last day. At the time of writing, ETH was retailing at $3,175, down from its previous day’s pricing of $3,536.

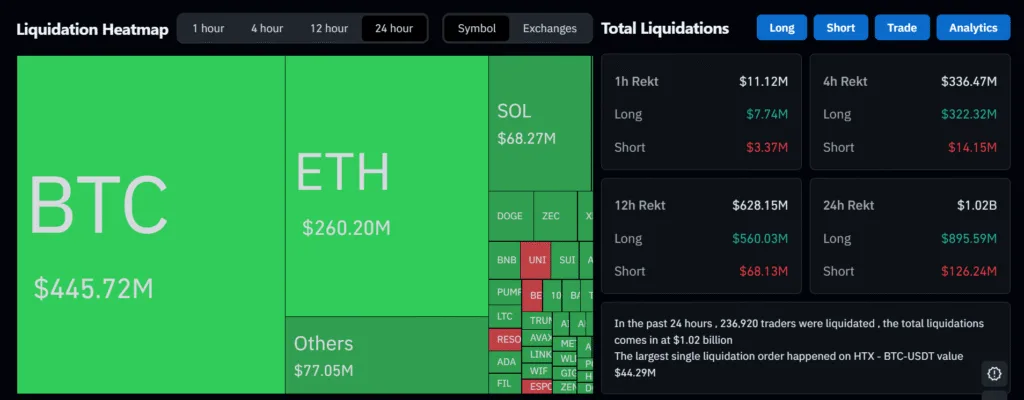

According to CoinGlass, $1.02 billion have been liquidated from the market in the last 24 hours.

Source: Coin Glass

A majority of altcoins logged sharp declines owing to the ongoing volatility. XRP, BNB, Solana, for instance, saw losses within the range of five percent to nine percent in the last 24 hours. Dogecoin, Cardano, Chainlink, and Stellar also clocked price drops of nearly ten percent. Zcash, that clocked a stellar performance in the last two months, also reflected a loss of over four percent to trade at $496.

The top ten cryptocurrencies are fluctuating in prices, nudging analysts to advise caution to investors.

“The broader crypto market is under pressure, reflecting a risk-off environment driven by macroeconomic uncertainty. Total market capitalization is retreating, and altcoins are generally underperforming. For Bitcoin, the immediate focus is on defending the psychological $100,000 mark, while a rebound requires a sustained break above $106,000 to mitigate prevailing bearish sentiment,” Sathvik Vishwanath, Co-Founder and CEO, Unocoin told CoinHeadlines.

The overall crypto market cap slipped by 4.65 percent in the last 24 hours. The valuation of the sector presently stands at $3.29 trillion. The score of 22 on the Fear and Greed Index also indicates the fear sentiment intact among investors.