By 2030, a tenth of the worldwide post-trade market volume may be managed using tokenized assets and stablecoins, as stated in a recent Citi report.

The Securities Services Evolution Report from the bank, released on Tuesday, collected responses from 537 finance executives among custodians, banks, broker-dealers, asset managers, and institutional investors in the Americas, Europe, Asia-Pacific, and the Middle East during June and July 2025.

Tokenization gains traction

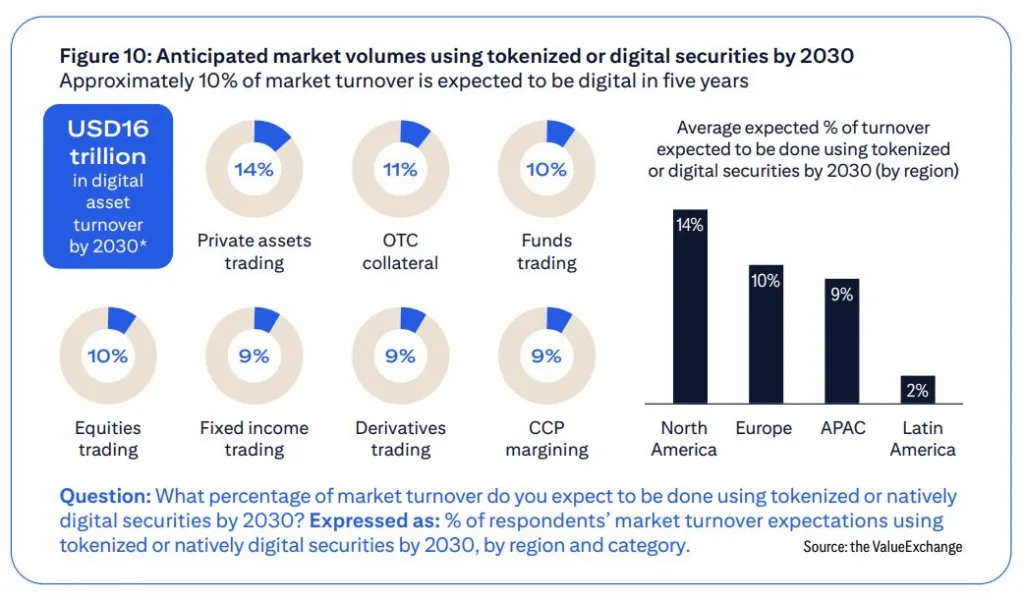

Citi mentioned that stablecoins issued by banks were anticipated to take a prominent role in facilitating collateral efficiency, tokenization of funds, and trading of private assets. The survey findings indicate that $16 trillion in digital asset transactions may transition to tokenized or digital securities in the next five years

Trading in private assets (14%), OTC collateral (11%), and funds trading (10%) were pinpointed as the sectors most probable to transition to tokenization by the decade’s close.

Regional outlook

The U.S. is anticipated to spearhead adoption, with survey participants forecasting that 14% of market turnover will employ digital or tokenized assets by 2030, in contrast to 10% in Europe, 9% in Asia-Pacific, and 2% in Latin America.

AI in post-trade operations

The report additionally emphasized the increasing adoption of generative artificial intelligence (GenAI) in post-trade operations. More than 50% of participants indicated that their companies were experimenting with AI tools, with 83% of brokers, 63% of custodians, and 60% of asset managers evaluating onboarding solutions. AI is being progressively tested for reconciliation, reporting, clearing, and settlements.

“In a world where faster, cleaner onboarding literally means money, this use case appears to be a perfect starting point and an opportunity to bridge the gap between retail and institutional clients,” Citi noted.

Industry at a tipping point

Citi noted that the adoption of digital assets has moved from initial experimentation in 2021 to strategic execution now. As momentum increases, the report stated that the industry remains “tantalizingly close” to a tipping point that could revolutionize global post-trade operations regarding speed, cost, and resilience. Citi noted that digital asset adoption has evolved from initial experimentation in 2021 to strategic implementation at present.

Liquidity and efficiency continue to be the main factors influencing blockchain investment, with the majority of respondents anticipating that distributed ledger technology (DLT) will significantly affect funding expenses and operational needs by 2028.