A news report by CBS News’s 60 Minutes alleges that President Trump pardoned Binance founder Changpeng “CZ” Zhao soon after Binance supported and propelled the Trump family’s crypto venture, World Liberty Financials (WLFI). The report claims that Binance donated software and offered an Emirati-backed $2 billion deposit, largely held in World Liberty’s USD1 stablecoin, to help propel WLFI from a fringe token to a major market player.

What does the documentary accuse WLFI of?

The documentary frames this timing as a potential conflict of interest, questioning whether commercial gains intersect with the use of executive clemency. Critics say money from foreign sovereign-linked actors routed through USD1 and WLFI may have created leverage over White House decisions. 60 Minutes cites DOJ critics who argue the pardon did not meet typical vetting standards.

Interestingly, when the President was asked about CZ and the presidential pardon, Trump outrightly, denied knowing the crypto czar and said many had lobbied in his favour saying that that he was accused of, wasn’t even considered a crime.

CZ’s lawyer Teresa Goody Guillén also refutes these pay-to-play claims during her appearance on Anthony Pompliano’s podcast. She emphasized that the pardon was granted after multi-step review process involving several government agencies.

Market impact on WLFI and USD1

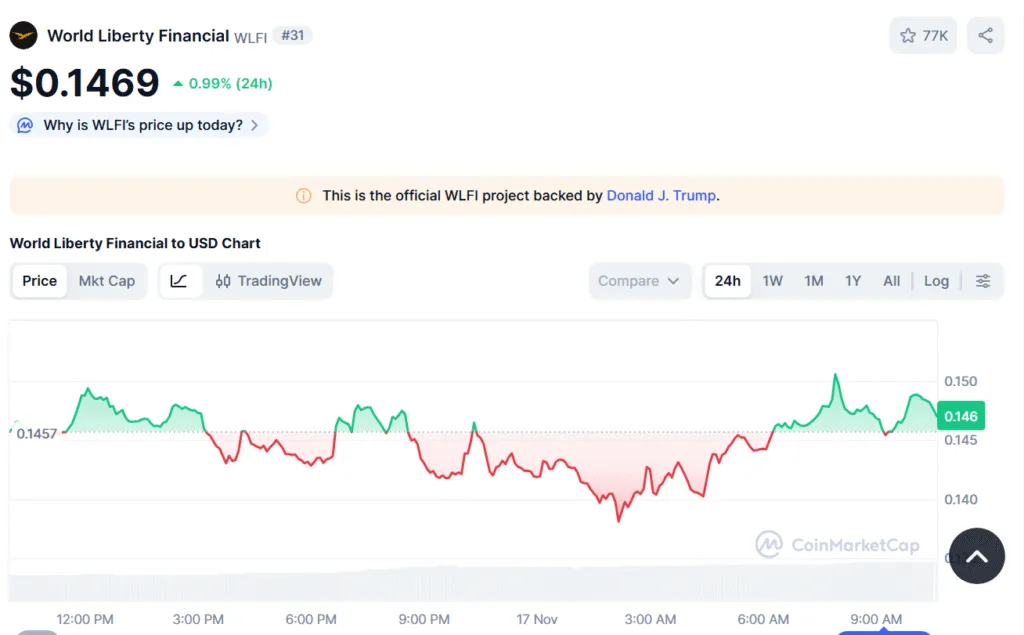

WLFI has been volatile but active ever since its launch in September 2025. It has been trading around $0.147, up 0.99% in the last 24 hours, at the time of reporting. The token has a market cap in the multi-billion range and has seen heavy daily volumes and has gained over 11% in the past 1 month.

Technical charts show that the token is defending a $0.14 point-of-control support and eyeing resistance near $0.153 according to CoinMarketCap data. RSI is currently near neutral and moving average convergence/divergence (MAC/D)indicator recently flipped slightly positive, setting up a breakout-versus-correction tradeoff.

Similarly, the stablecoin tied to the group USD1 is trading essentially at peg (~$0.999–$1.00), with roughly $2.7 billion circulating and deep liquidity available. Beyond politics, WLFI’s spike in interest reflects real cash flows. However, media scrutiny linking those flows to presidential action, will play its own course.