Industry experts warn that as global regulatory efforts targeting stablecoins tighten, demand for “dark stablecoins” may soar.

Ki Young Ju, CEO of blockchain analytics firm CryptoQuant says stricter regulations by governments around the world could drive crypto users to seek alternatives that preserve privacy and resist government intervention.

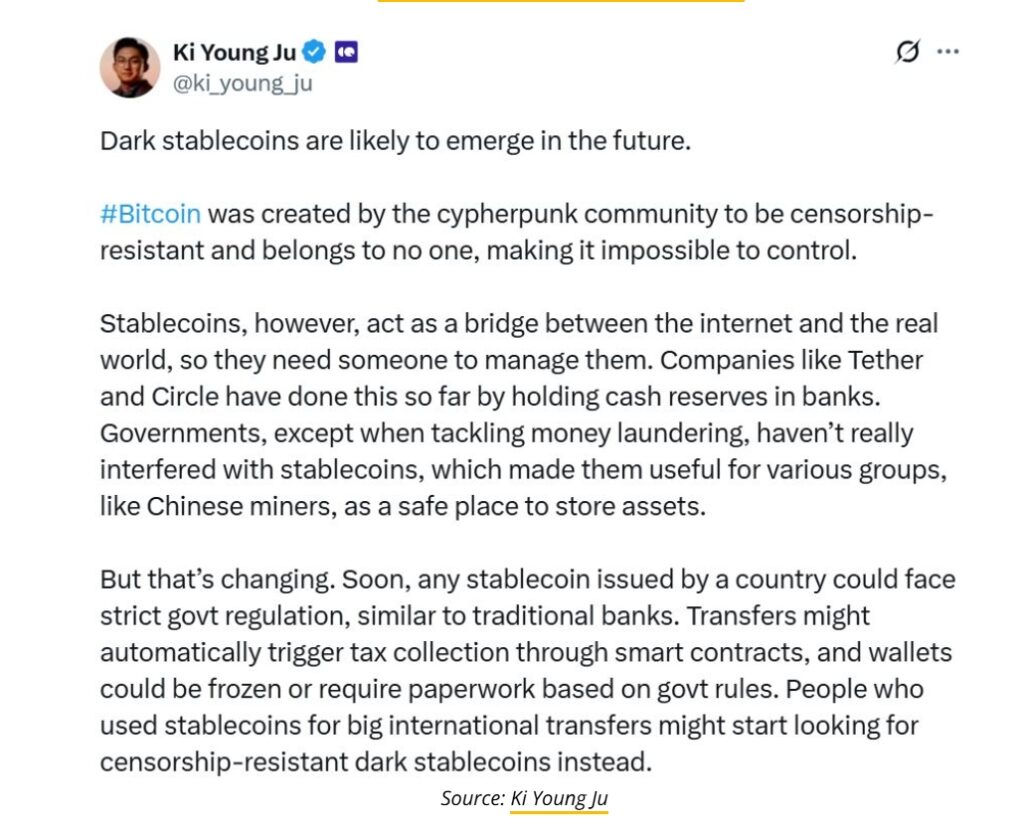

In a May 11, 2025 post on X, Ju noted that stablecoins have long been favored for international transfers and asset storage due to their relatively low regulatory friction. However, that landscape is changing fast.

“Soon, any stablecoin issued by a country could face strict government regulation, similar to traditional banks,” Ju wrote.

“Transfers might automatically trigger tax collection through smart contracts, and wallets could be frozen or require paperwork based on government rules.”

He added that such measures could lead users to adopt “censorship-resistant dark stablecoins”, or stablecoins designed to operate beyond the reach of regulatory frameworks.

The remarks come as lawmakers in the United States consider new stablecoin legislation under a more crypto-friendly presidential administration led by Donald Trump. The proposed rules aim to provide a legal framework for the issuance and use of stablecoins, particularly for payments.

Meanwhile, the European Union has already moved forward with its Markets in Crypto-Assets (MiCA) regulation, which enforces transparency and oversight on stablecoin issuers.

In light of these developments, Ju speculated that a new class of stablecoins could emerge, specifically those backed by algorithmic mechanisms rather than external reserves like fiat currencies or gold. These algorithmic stablecoins would maintain their peg using decentralized protocols, making them more resistant to regulatory interference.

He also pointed to the possibility of stablecoins issued by jurisdictions that do not censor financial transactions, or scenarios where companies like Tether choose to disregard U.S. regulatory requirements.