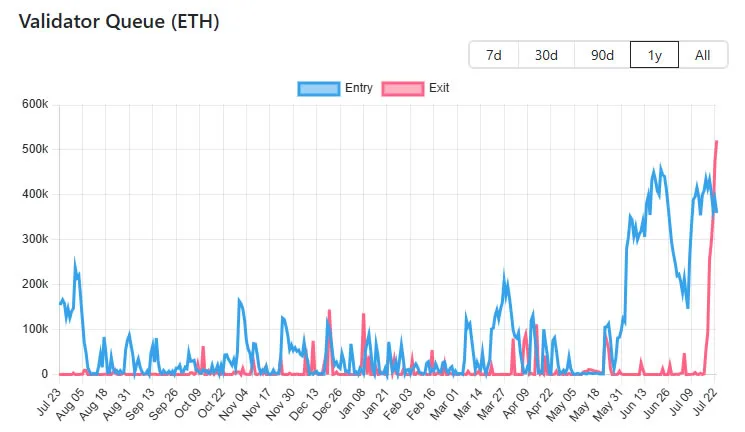

Ether (ETH) has slipped over 7% from its yearly high, triggered by a surge in the validator exit queue, which now stands at its longest in 18 months. More than 644,000 ETH (approx. $2.3 billion) are lined up for unstaking, raising questions around profit-taking, validator rotation, and overall market sentiment.

The Ethereum network currently shows a validator exit queue of 11 days, reflecting renewed activity as stakers opt to withdraw funds. While some observers fear potential sell pressure, staking protocol Everstake emphasized that this shift is likely due to validator operator changes, restaking, or yield optimization, not a sign of mass panic.Supporting this narrative, entry queues have grown. Currently, around 390,000 ETH ($1.2 billion) are waiting to be staked, resulting in a net outflow of only 255,000 ETH. Corporate buyers like SharpLink and BitMine have been aggressively accumulating ETH , signaling long-term strategic interest according to ValidatorQueue.

Ethereum validator exit queue surges. Source: ValidatorQueue

Price volatility amid ETF inflows

ETH briefly dipped below $3,550 after reaching a seven-month high of $3,844, reflecting mild profit-taking by traders. However, demand remains robust, with over $2.5 billion flowing into US spot ETH ETFs in just the past week, despite the lack of a staking ETF product. ETH has still gained over 50% in the past month, indicating strong bullish momentum.

The exit queue pressure may also stem from DeFi disruptions, notably Justin Sun’s $600 million ETH withdrawal from Aave, which caused Lido’s stETH to briefly lose its peg to ETH—meaning its price dropped below the 1:1 ratio it’s meant to maintain—leading to reduced liquidity. In a tweet, Marcin Kazmierczak, co-founder at RedStone staking platform, said that this event may have triggered a wave of stETH liquidations or conversions, adding to network churn.