- Finder wins legal battle against ASIC over crypto yield product

- Court rules Finder Earn is not a financial product or debenture

- Ruling sets major precedent for Australia’s fintech and crypto sectors

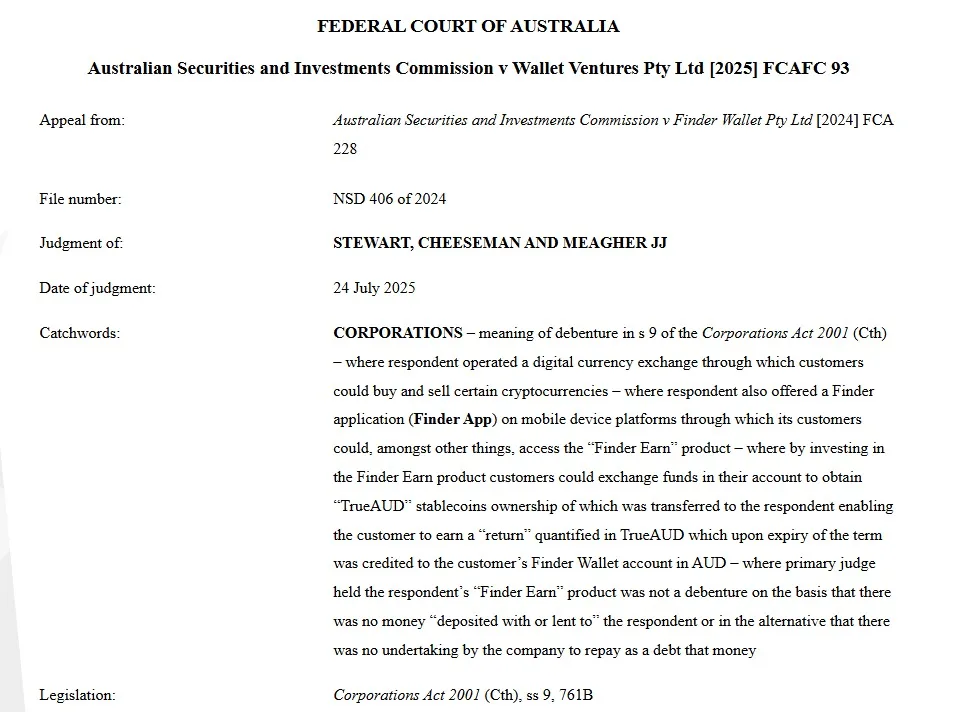

Australia’s Federal Court has ruled in favor of fintech company Finder.com in a landmark decision that clears its crypto yield product, Finder Earn, from being classified as a financial instrument. This verdict deals a major blow to the Australian Securities and Investments Commission (ASIC), which had filed an appeal challenging a previous ruling. The decision, handed down by Justices Stewart, Cheeseman, and Meagher on Thursday, upheld the original judgment made in March 2024 that Finder Earn does not constitute a debenture and therefore does not require a financial services license under the Corporations Act.

Finder court ruling. Source: Federal Court of Australia

A defining moment for Crypto regulation in Australia

The product, which operated between February and November 2022, allowed users to convert Australian dollars into TrueAUD (TAUD) stablecoins and deposit them in the Finder Wallet to earn annual yields between 4% and 6%. At the heart of the case was whether such a service fell within the legal definition of a financial product. The court confirmed that Finder Earn’s structure, where funds were not lent to third parties but held internally and repaid voluntarily by the company, did not meet the threshold to be considered a debenture. Finder noted that all customer funds—totaling over 500,000 TAUD, or roughly $336,000—were returned in full after the service ended.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

This is the first time an Australian court has tested the legal boundaries of a crypto yield product in relation to existing financial laws. The ruling sets a significant precedent for the country’s fintech and crypto industries, offering much-needed clarity for similar products and services. Finder welcomed the decision as a win for innovation, while ASIC said it is carefully considering the implications of the judgment. As regulatory frameworks struggle to keep pace with emerging blockchain technologies, this case could become a defining reference for future legal and policy debates in Australia’s digital finance sector.