Nasdaq-listed Forward Industries, Inc., announced that it has acquired ~ 6,822,000 SOL tokens for $1.58 billion. This move marks the initial execution of its newly adopted Solana treasury strategy. The purchase is supported by a $1.65 billion private investment in public equity (PIPE) financing led by Galaxy Digital, Jump Crypto, and Multicoin Capital.

The latest purchase signals institutional conviction in SOL and Solana’s blockchain. Even if Forward acquired SOL gradually, open-market and on-chain transactions of this magnitude tighten supply, which may help put upward pressure on the price. The tokens were picked up for an average of ~$232 per SOL. Forward acquired non-locked SOL via a mix of open market and on-chain transactions. One particular transaction noted was about $1 million via DFlow, a decentralized exchange aggregator tailored to Solana.

Staking & yield implications

In the announcement, the company said it will be staking all of its SOL tokens. This, in turn, will remove tokens temporarily from active circulation and reduce liquid supply, but can simultaneously generate yield for the company. If other companies follow suit, there could be an increase in demand for staking services, and validator infrastructure may rise sharply.

Forward Industries joins a growing group of publicly traded firms that have been building Solana treasuries. Canadian investment firm SOL Strategies has a considerable SOL exposure. Similarly, DeFi Development Corp and Upexi, Inc. have been regularly buying the token.

Building the world’s largest Solana treasury company

Kyle Samani, Chairman of the Board of Directors of Forward Industries, said, “We are building the world’s largest Solana treasury company, a strategy that will both advance the Solana ecosystem and deliver long-term value for our shareholders. We are pleased to make some of our SOL purchases on-chain, which is the first of many activities we expect the Company to do natively on-chain.”

By pivoting from its traditional manufacturing cum design roots, the company is placing a large bet that Solana, trusting that it will continue to appreciate in value and utility. For the Solana ecosystem, this could mean greater legitimacy, higher staking participation, and potentially greater demand and price support.

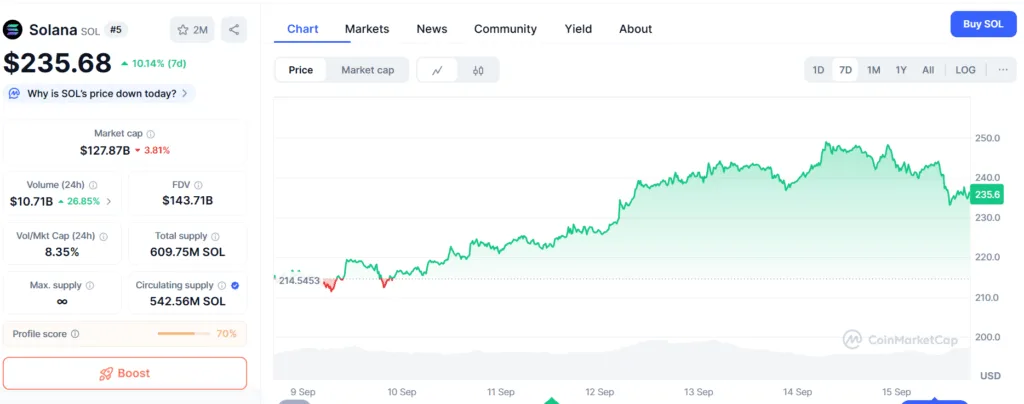

As of this announcement, media reports indicate SOL has seen gains in response. SOL was reported up ~10.14% over seven days, and nearly 30% over the prior 30 days.

Source: CoinMarketCap.com