Bitcoin, the most expensive cryptocurrency, is often referred to as the “digital gold”. While it has become quite the catchy slogan for the reigning king of crypto assets, the narrative does testify to a BTC-gold pattern that is etched into market history. The trader community have observed this pattern wherein repeatedly Bitcoin price has surged following an explosion in gold rate.

This week, the price of gold hit an all time high of $3,871 per troy ounce (t.oz) — briefly nearing $3,900 per t.oz. In the backdrop of this development, BTC rose from $109,500 to its present price of $118,680 — clocking a weekly gain of 8.72 percent.

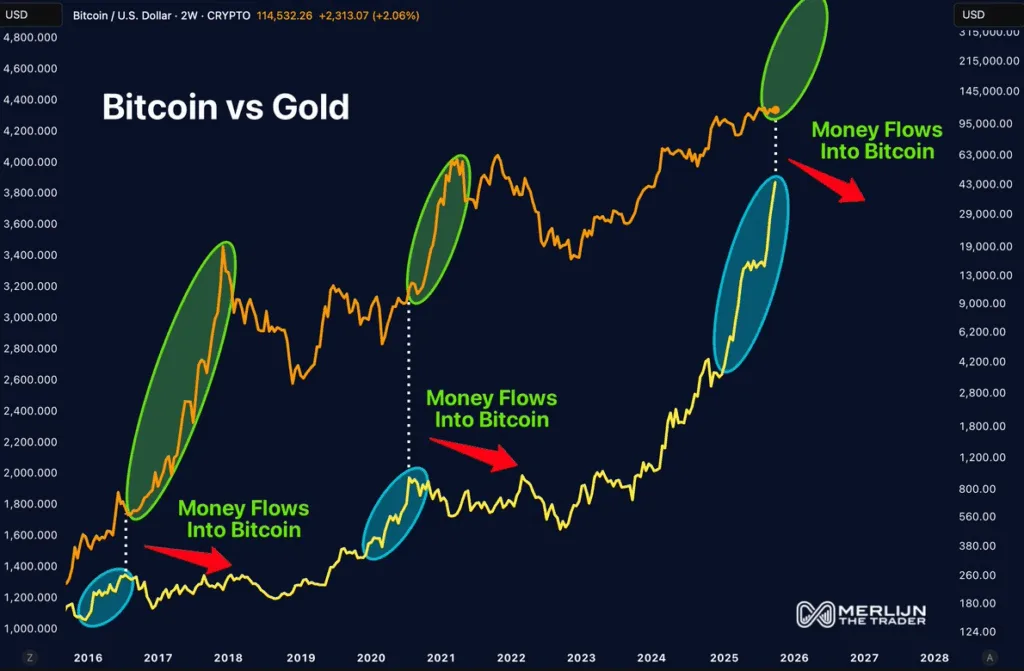

The pattern notably started 2017 when the price of gold peaked from $1,150/t.oz in January to $1,375/t.oz in September. Bitcoin followed gold’s surge to rise from $1,000 to $5,000 — between January and September, 2017. Bitcoin had ended the year having touched $20,000 with a 2,000 percent price hike.

Speaking to CoinHeadlines, Arjun Vijay, the co-founder of Giottus explained that land and BTC have emerged as two significant sources that impact the value of Gold. Vijay said, while land is a secular asset that impacts all asset classes, BTC’s influence on the $4 trillion dollar crypto industry makes it an impactful asset.

“The purchasing power of money is subject to decrease. So we measure the worth of money in terms of assets that don’t change much in quality over long periods of time, like land or gold,” the Giottus co-founder said. “Over the last few years, Bitcoin has emerged as a strong asset that has a capped supply of 21 million tokens and it has been primarily designed to be a sovereign store of value. Unlike any fiat, BTC is neutral and doesn’t give particular advantage to any one country — much like gold.”

After 2017, the BTC-gold price explosion repeated the pattern in 2020 despite the deadly COVID-19 pandemic. In August 2020, gold touched the pricing of $2,075/t.oz — soon after which, BTC climbed to $29,000 in December from $12,000 in August.

As per Vijay, “after the pandemic, geopolitical tensions and fiat depreciation have been on a rise and in this unpredictable unprecedented global order, people have been hedging their wealth by investing in bitcoin and gold. Till we find the new equilibrium the hard assets are going to be on a rise. There is also a virtuous cycle as the price rise brings more inflows which increases the price further.”

Members of the crypto circle are now closely analyzing the value of BTC expressed in terms of gold to observe how many troy ounces of gold is required to buy one Bitcoin to monitor the co-relation in the prices of these assets.

As per Andre Dragosch, European head of research at Bitwise, this repeated price pattern of gold and BTC, “could be the start for a risk on rally and rotation into Bitcoin.”

Investors, however, are strongly advised to do thorough research before making financial decisions. While BTC has stabilized in the last few years, it still remains impacted by micro and macro economical and geopolitical developments.