Indian Finance Minister Nirmala Sitharaman presented her ninth consecutive budget report in the Lower House on Sunday. For the crypto industry — not a lot changed with the finance ministry deciding to retain existing tax slabs on crypto incomes and transactions. Instead of providing relief to the crypto circle, however, the ministry has announced fresh tax fines for non-compliant investors.

Participants in the crypto market — traders, investors, holders — now face hefty fines for not reporting details on their crypto transactions and incomes to the tax authorities on time. These include crypto exchanges, wallet service providers, and brokers as well as retail investors.

Failing to file timely statements will attract a fine of Rs. 200 (roughly $2.18). On the other hand, submitting incorrect details could rope-in a penalty of Rs. 50,000 (roughly $546).

In India, crypto incomes are taxed by 30 percent. Additionally, one percent TDS (tax deducted at source) is also collected on each step of a crypto transactions.

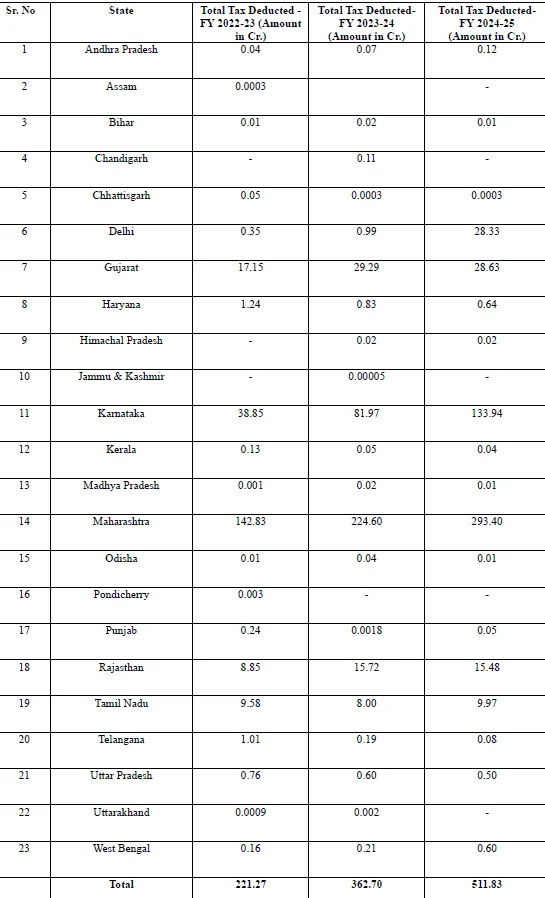

In December, Indian ministers had questioned FM Sitharaman to present details of this TDS collected from crypto transactions. As per the finance minister’s official response seen by Coin Headlines, a total of Rs. 511 crore (roughly $1.39 billion) were collected in crypto taxes between FY2024-2025.

As shown in the list above, crypto tax reporting in some states is visibly low and totally non-existent in some others.

Members from India’s crypto circle, while disappointed on the tax laws not being revised, did acknowledge that the government is setting high compliance standards for industry participants.

“The introduction of specific penalty provisions is a positive milestone for the crypto industry that validates the compliance-first model that Indian exchanges must follow,” Ashish Singhal, Co-founder, CoinSwitch told Coin Headlines.

Singhal did, however, mention that regulatory support is urgently required for India’s Web3 ecosystem to register true growth.

“While compliance and surveillance have tightened, true growth requires economic rationalization to keep Web3 innovation and talent within India. The one percent TDS, lack of offset of losses and the 30 percent flat capital gains rate, create an asymmetric environment for genuine participation. These measures risk driving Indian capital toward non-compliant offshore platforms, leaving users vulnerable to legal and financial scrutiny,” he noted.

Others cited a recent report by crypto tax platform KoinX that said that over $6 billion in crypto trading volume has shifted offshore from India owing to high tax brackets.

For now, India has not yet finalized comprehensive regulations. The timeline by when the country could make progress in this aspect remains unclear. Along with the tax remine, India has mandated all crypto firms operating in the country to first register with the Financial Intelligence Unit (FIU).

The world’s most populated nation did recently impose a ban on privacy crypto tokens like Zcash and Dash as part of refreshed anti money laundering and counter terror financing guidelines — instructing exchanges to delist these tokens.