Digital bank and BNPL firm Klarna has launched its very own stablecoin, in a bid to enter a growing and lucrative part of the digital assets market, as per an official press release. The stablecoin is called KlarnaUSD and it is backed by the US dollar.

The launch was done on Tempo, a mainnet blockchain that was launched by payment processing company Stripe in collaboration with paradigm.

The update comes after Klarna announced a $6.5 billion agreement with funds of Elliort Investment Management.

According to Coinmarketcap.com, the total market capitalization of all stablecoins is approximately $313 billion, which forms 10% of the crypto market valued at $3 trillion.

“With 114 million customers and $112 billion in annual GMV, Klarna has the scale to change payments globally: with Klarna’s scale and Tempo’s infrastructure, we can challenge old networks and make payments faster and cheaper for everyone,” said Klarna’s co-founder and CEO Sebastian Semiatkowski.

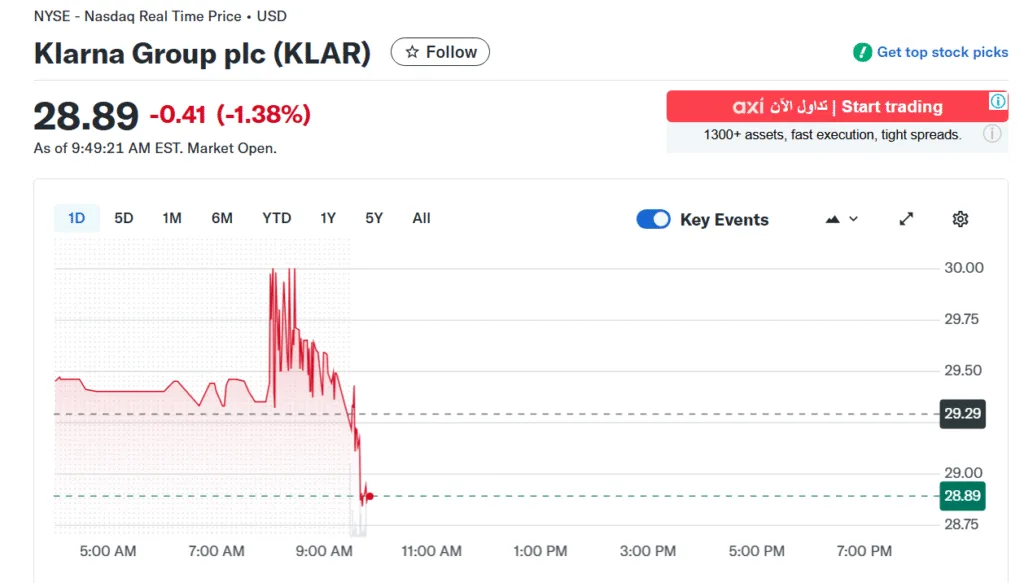

At the time of writing, Klarna Shares—which went live on U.S. stock exchanges via IPO this year—were trading at $28.89.

Source: Yahoo Finance

“The important part isn’t that Klarna launched a stablecoin. It’s that a regulated digital bank is committing to a public chain being built by Stripe. When Revolut is picking Polygon and JPMorgan is issuing on Base, it’s hard to ignore the shift,” said Lavneet Bansal, a consultant working across stablecoins and Web3.

“Fintechs are choosing open settlement rails over permissioned systems because that’s where the speed, global reach, and developer ecosystem now live. Public chains have reached a point where fintechs trust them more than permissioned or private networks,” he also said.