- Memecoins demonstrate that currency is essentially a meme, formed and upheld by shared belief.

- Their development relies on community, humor, and virality rather than technical fundamentals.

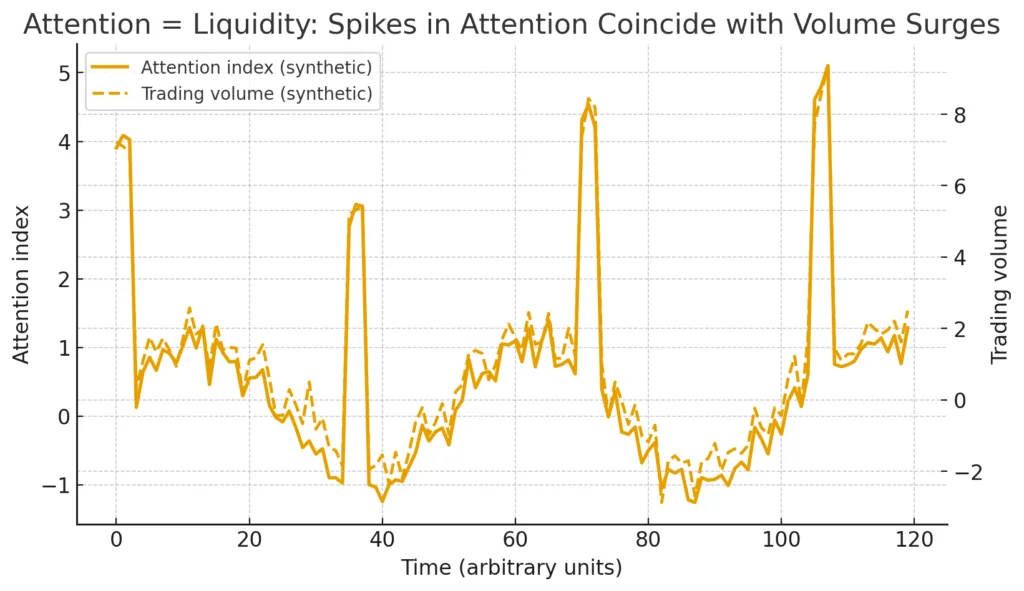

- Attention acts as liquidity viral tweets, memes, and trends can rapidly generate billions.

- Many memecoins fall apart once the excitement diminishes, but some manage to transform themselves by offering genuine real-world value.

- They make speculation accessible, providing retail investors a cultural gateway into finance.Memecoins represent initial versions of social tokens, combining culture, identity, and capital.

Memecoins have continually been viewed as the troublesome child of the cryptocurrency world, a disorderly and amusing niche that challenges the rigid reasoning of financial analysis. They are the punchlines that somehow gained momentum, the inside jokes that transformed into billion-dollar industries. At first look, the idea that a picture of a Shiba Inu dog or a green frog meme might drive complete market cycles seems ridiculous, nearly comical compared to conventional finance. However, the mere reality that billions of dollars have been invested in tokens with minimal to no intrinsic utility indicates that something important is occurring. Memecoins might not adhere to the logical valuation frameworks that support stocks, bonds, or even Bitcoin, yet they possess value nonetheless. Their worth is social, cultural, and speculative, rooted in the dynamics of internet virality, community identity, and the psychology of shared belief.

To grasp memecoins, it is essential to acknowledge that finance has always involved more than just figures. Markets have been influenced as much by narratives as by fundamentals, from tulip mania in seventeenth-century Holland to the dot-com bubble of the late 1990s. Memecoins eliminate the facade of reason and expose the fundamental dynamics of speculation driven by narrative. They reveal that individuals invest not only for utility or discounted cash flows but also for what ownership signifies: identity, belonging, and the promise of disproportionate returns. Dogecoin, introduced in 2013 as a satire, demonstrated that humor could attract investment. A meme became more than just a joke; it represented a challenge to financial elitism, a virtual uprising against those who previously informed small investors that markets weren’t meant for them. It transformed into a cultural asset before that phrase was ever coined.

The rise of memecoins underscores the merging of finance and culture, where attention transforms into a type of liquidity. In today’s world, tweets from stars such as Elon Musk can cause prices to soar, not due to financial reports or tech advancements, but because attention is itself a source of revenue. Memecoins fundamentally represent markets for attention. Anyone who can seize the crowd’s imagination, even for a moment, can trigger remarkable price surges. However, this is not simply a disorder. Memecoins exhibit recognizable structures and consistent patterns in their ascent, consolidation, and eventual collapse or evolution. They trace paths akin to viral trends, existing at the convergence of financial speculation and online humor.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Therefore, when inquiring about the “value” of memecoins, the response is intricate. It does not represent value in the conventional meaning of future cash flows discounted. It doesn’t even provide utility in terms of blockchain infrastructure or applications in decentralized finance. The worth is found in cultural capital, in the memes themselves, and in how communities come together around a concept that is humorous, relatable, and emotionally impactful. Although numerous memecoins will eventually lose their significance, their cultural essence guarantees that new ones will consistently arise. They unveil a future in which the distinction between money and culture fades, where the internet’s laughter transforms into the background music of speculative finance.

The foundations of value in Memecoins

To grasp the significance of memecoins, one must initially question the conventional methods used to assess financial value. Economists, analysts, and investors typically evaluate assets by considering concrete results, consistent revenue sources, or the robustness of a protocol. Bitcoin, even with its fluctuations, is considered digital gold due to its code’s inherent scarcity and a defined monetary policy. Ethereum is validated by its function as the fundamental layer for decentralized applications, where fees and activities act as proof of its utility. Memecoins, on the other hand, disrupt this reasoning. They frequently arise lacking a clear purpose, plan, or team for development. If they have whitepapers, they are infused with humor instead of technical precision. Nonetheless, they continue to attract liquidity, media coverage, and whole communities of dedicated supporters. This contradiction necessitates a reassessment of the origins of value in financial markets.

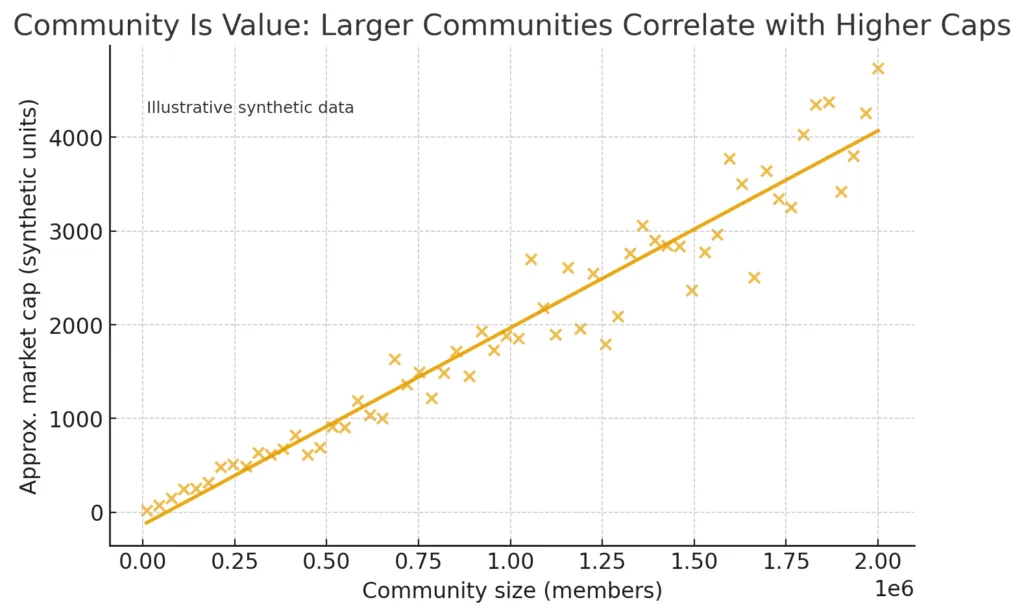

The primary foundation of memecoin worth is its community. Cryptocurrencies are fundamentally social assets, and memecoins reduce this truth to its essence. A token such as Dogecoin or Shiba Inu is more than just a piece of code or a market symbol; it serves as a unifying element for shared identity. The groups that develop around these coins gain their own identity, going beyond mere price trends. Digital town squares are formed through online forums, Telegram groups, Reddit threads, and Twitter hashtags, allowing holders to create memes, share stories, and build a sense of community. In contrast to conventional stocks, where shareholders are mainly inactive, memecoin holders play an active role in the cultural creation of value. Each meme circulated, every tweet boosted, every joke repeated serves as a promotional act, lowering marketing expenses while increasing exposure. The community doesn’t merely back the coin; it transforms into the coin.

Narrative serves as the second essential foundation. If the community supplies the workforce, the narrative offers guidance. Memecoins flourish not due to addressing genuine issues but because they narrate tales that connect with the spirit of the times. Dogecoin’s creation as a satire of cryptocurrency speculation resonated because it ridiculed the gravity surrounding financial elites. Shiba Inu’s claim to be the “Dogecoin killer” positioned it as a competitor, a fresh underdog in a virtual landscape. Pepe’s rise in 2023 harnessed the lasting cultural impact of internet memes, elevating absurdity to a valued quality. These stories are not intricate; indeed, their strength is found in their straightforwardness. They are attainable, reproducible, and amusing. In contrast to technical documents that need extensive analysis, memecoin stories can be expressed in just one image or a single sentence. In an environment where focus lasts only seconds, this straightforwardness is a significant advantage.

The third pillar is reflexivity, a notion famously articulated by George Soros. Reflexivity encompasses the feedback cycle in which perception influences reality, and reality subsequently influences perception. This dynamic is always present in memecoins. As prices increase, images of sky-high profits inundate social media. These images entice potential buyers who worry about losing out, which further increases prices. As the price rises, the coin seems more legitimate, leading more individuals to think that the joke has evolved beyond just a joke. This recursive cycle can change a token lacking inherent value into a multibillion-dollar asset, at least for a limited time. On the other hand, when prices decline, memes shift to hopelessness, energy diminishes, and groups break apart. The worth of memecoins is thus not fixed but dynamic, continually reshaped by shared perception.

However, it would be inaccurate to imply that these three pillars community, narrative, and reflexivity function independently. They rely on each other. A vibrant community nurtures a story, an engaging story promotes reflexivity, and reflexivity draws in additional community members. Collectively, they form a mutually reinforcing system capable of producing remarkable growth. What makes memecoins noteworthy is not their alleged absence of fundamentals, but their revelation of the fundamentals that support all markets. Stocks increase not just due to financial statements but also due to trust. Fiat currencies retain their superiority not due to intrinsic scarcity but due to trust in governments. Gold maintains its appeal not for its ability to generate returns but due to thousands of years of human culture infusing it with significance. Memecoins clearly highlight this relationship.

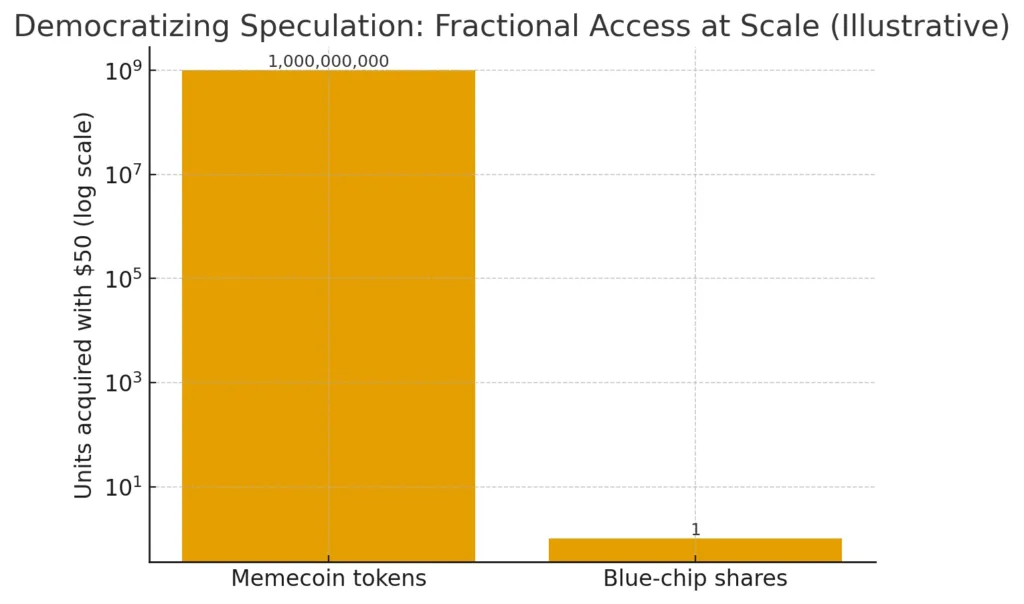

It is important to highlight that memecoins benefit from being easily accessible. In contrast to Bitcoin during its initial stages, which needed technical expertise for acquisition and storage, memecoins can be effortlessly bought on contemporary exchanges, frequently in small fractions that make owning them seem accessible to individual investors. The psychological appeal of purchasing billions of tokens for just a few dollars is hard to exaggerate. It fosters the impression of extensive possession and the enticing chance of acquiring wealth if the value increases. This democratization of speculation renders memecoins not only financial tools but also emblems of inclusivity. They inform the minor investor: you can also have a slice of the pie, you can also catch the wave, you can also transform a joke into wealth.

Nonetheless, critics contend that these foundations are weak. Communities can scatter as swiftly as they are created, stories can fade in importance, and self-reflection can decline as easily as it rises. This is accurate, yet fragility does not diminish worth. Rather, it emphasizes the unpredictable and theatrical characteristics of memecoins. They are dynamic cultural experiments rather than fixed stores of value, with each serving as a trial to see if humor, identity, and speculation can merge into something lasting. Their value might not be in addressing logistical challenges such as supply chains or payment systems, but in highlighting that money is essentially a narrative, a shared conviction that operates only while people consent to its validity.

Ultimately, the principles of memecoin worth compel us to rethink what supports markets overall. They remind us that humans do not function only based on logical reasoning, but also on stories, symbols, and collective beliefs. In numerous aspects, memecoins represent the most genuine reflection of this reality. They lift the curtain of practicality and reveal the fundamental workings of belief-driven markets. To regard them as insignificant is to ignore the fundamental forces that influence all types of value.

How Memecoins grow: The lifecycle

Each memecoin starts in anonymity, typically inspired by a tweet, a meme, or a quickly crafted smart contract launched on a blockchain. What distinguishes the select few that attain billion-dollar valuations from the multitude that fade into obscurity is not programming but culture. Their development exhibits a recognizable lifecycle, reflecting the patterns of internet virality. Grasping this evolution means comprehending not merely how memecoins achieve popularity, but also why their narratives hold significance from the outset.

The genesis phase is when the seed is sown. This phase is often marked by absurdity, irony, or sheer randomness. Dogecoin, for instance, originated as a spoof of the cryptocurrency sector, featuring its Shiba Inu mascot taken from a meme that gained popularity in 2013. Shiba Inu emerged years after as a self-styled “Dogecoin killer,” attracting those eager to join the cultural trend but with the excitement of a fresh underdog story. In recent times, Pepe coins have surfaced from the rich history of internet meme culture, utilizing visuals that were already ingrained in the shared awareness of online communities. During this initial stage, the token possesses limited liquidity and almost nonexistent market visibility, but it does have potential: the capacity to ignite interest, amusement, and early signs of identity among its initial users.

The subsequent stage is viral growth. In this instance, the coin transitions from being hidden to being publicly seen. This can occur naturally via meme sharing on sites such as Twitter, Reddit, TikTok, or Discord, but it is frequently hastened by amplification. An individual influencer’s endorsement, a perfectly timed joke from a celebrity, or a trending TikTok phenomenon can launch the coin into popular discussion. Dogecoin’s rapid ascent in 2021 was well-known for being linked to Elon Musk’s tweets, with each tweet serving as a trigger that attracted fresh waves of retail investors. Likewise, TikTok challenges in 2020 encouraged individuals to purchase Dogecoin and “make money,” transforming a joke into a shared financial experiment. At this stage, liquidity expands quickly, frequently via decentralized exchanges where tokens can be added with relative simplicity. The blend of minimal entry expenses and viral interest generates a strong flywheel, with each new purchaser expressing their enthusiasm online, thereby enhancing the meme.

As excitement increases, the community unifies. Discord servers and Telegram groups swell with fresh members, hashtags gain traction on Twitter, and the meme transforms into an identity. Investors are no longer just token holders; they have become part of a community. They exchange private jokes, produce derivative memes, and protect their selected cryptocurrency from doubters. This feeling of belonging is an essential component in maintaining momentum. In certain situations, communities create rituals and catchphrases, such as Shiba Inu’s “ShibArmy,” that strengthen unity. At this point, the memecoin evolves into more than just a commodity. It transforms into a movement, a communal trial in economic culture. The memes are more than humorous; they serve as calls to action, expressions of identity and dedication.

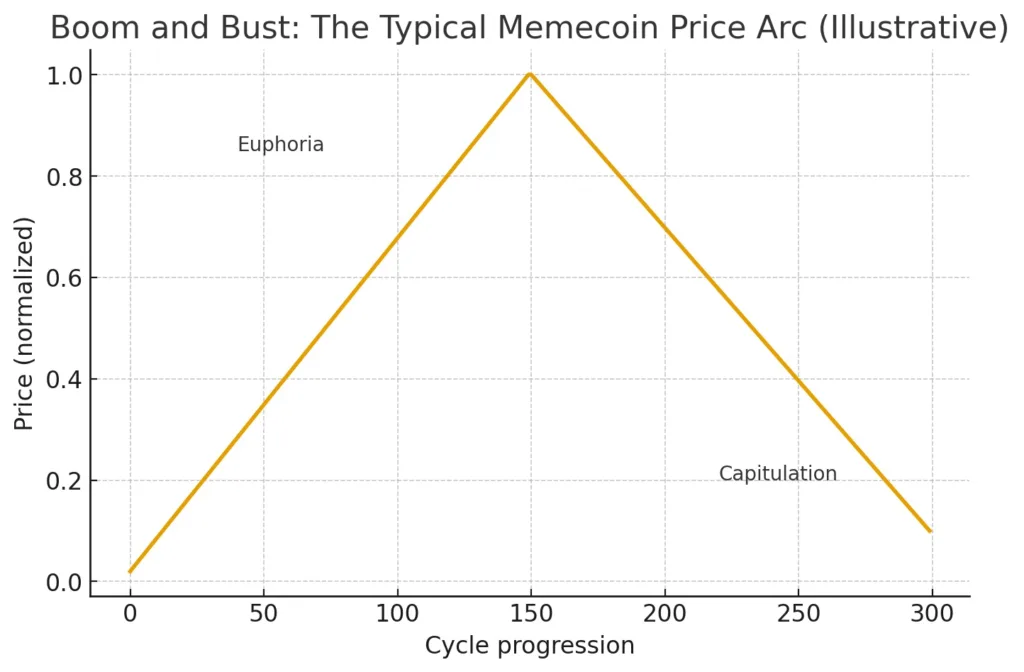

The speculative apex arrives, a euphoric climax where prices surge, liquidity spikes, and mainstream media starts to report on the phenomenon. This is the moment when memecoins frequently reach billion-dollar market values, not due to any intrinsic utility, but rather because of the strength of conviction. Graphs show rapid increases, images of instant millionaires dominate social platforms, and individual investors hurry to join in, motivated by the fear of being left out.

Exchanges list the currency, further validating it, and trading volumes soar to impressive heights. Nevertheless, this phase is also the most vulnerable. Reflexivity peaks: as the coin ascends, more individuals trust in its certainty, yet that trust grows increasingly delicate. One decline can undermine confidence, and without confidence, liquidity disappears

Following the apex, the path diverges. Certain memecoins implode nearly right away, with their communities disbanding as swiftly as they arose. Values plummet, investors leave, and the meme fades away. Most memecoins finish their journey here, becoming mere fleeting memories in the history of online culture. Yet a chosen few transform. They evolve from simple memes to more lasting concepts, frequently by establishing infrastructure or integrating into larger ecosystems. Shiba Inu, for instance, introduced ShibSwap, a platform aimed at providing the token with functionality in decentralized finance. Floki Inu launched metaverse initiatives and NFT integrations to enhance its applications. BONK, leveraging Solana’s revival, embedded itself within NFT projects and play-to-earn gaming communities. These efforts to adapt do not always succeed, yet they show the potential for a memecoin to endure past its original hype cycle.

This lifecycle reflects the structure of internet virality. Similar to how a viral video or meme spreads quickly, reaches a height of significance, and then either vanishes or becomes part of the cultural fabric, memecoins follow the same pattern. They are memes that have been financialized, and their expansion relies on the same dynamics of attention, recurrence, and communal acceptance. What distinguishes memecoins, though, is that their virality extends beyond cultural significance and is closely linked to speculative investment. Each share, each joke, each tweet has financial impacts, as it can attract new investors and provide additional liquidity. The meme itself transforms into a financial asset, able to influence price movements.

The lifecycle of memecoins illustrates the profound connection between technology and culture. From a technological perspective, the minimal obstacles to developing and releasing tokens facilitate a continuous influx of new memecoins. The framework of decentralized exchanges, smart contracts, and liquidity pools facilitates market creation and draws in early adopters. Culturally, the internet offers a rich environment for memes to grow, disseminate, and evolve. The rate at which information moves online shortens financial cycles, transforming what previously required years into days or weeks. In this setting, a coin may ascend from anonymity to a billion-dollar worth in under a month, only to plummet just as rapidly.

In the end, the journey of memecoins is a tale of reflective enhancement. They originate as jokes, thrive through virality, solidify into communities, reach a peak via speculative excitement, and then either diminish or transform. Their expansion cannot be accounted for only by graphs or programming. It should be recognized as a cultural occurrence that functions at the convergence of focus, identity, and conjecture. The lifecycle is unpredictable, yet it is not arbitrary. It operates under the principles of memes: brief, easily replicable, amusing, and infinitely versatile. Memecoins increase in value as memes do, and as long as online culture flourishes, this unique and influential segment of the crypto market will continue to thrive.

Economic and cultural drivers

The rise of memecoins is not coincidental. It is propelled by profound economic and cultural dynamics that reach well beyond the cryptocurrency market alone. Viewing memecoins solely as jockes or speculative bubbles overlooks the foundational factors that enable their success. They are products of a time characterized by inexpensive capital, social media trends, and generational changes in perspectives on finance and identity. Analyzing these factors helps us comprehend the reasons behind the continual emergence of memecoins, the significant attention they attract, and the folly of outright dismissing them as both short-sighted and deceptive.

In terms of the economy, accessibility is vital. Conventional investments like stocks, bonds, or property typically demand substantial funds, expert knowledge, and access to middlemen. Memecoins reverse this reasoning. They are inexpensive, plentiful, and readily exchangeable on both decentralized and centralized markets. With a small amount of money, an individual can obtain millions or even billions of tokens. This feeling of immense ownership is mentally impactful. It creates the false belief of being ahead, of possessing a ticket to possibly transformative riches. The financial attraction is linked not to dividends or yields but to asymmetry: the possibility that a minor investment could result in remarkable returns. In this manner, memecoins are similar to lotteries rather than stocks, with their appeal stemming more from the chance of unlikely success than from logical assessment.

This hypothetical framework is enhanced through gamification. Trading memecoins is not just about making money; it is also about enjoyment. The experience resembles the excitement of sports betting or online gaming, where the enjoyment arises from the activity itself, rather than solely the result. Price charts look like leaderboards, online conversations reflect team rivalries, and every coin turns into a competitor in an ongoing contest for attention. The market shifts from being a lifeless area of figures to becoming an engaging game for participation. Each pump, each dump, each viral meme initiates a fresh cycle of activity. Investors are not just looking for profit; they crave the excitement of involvement, the pleasure of engaging in a rapidly changing event.

Social media amplifies this dynamic. Historically, financial speculation was primarily private or limited to professional environments. Currently, any trade, every screenshot, each meme can be shared immediately with thousands of followers. Platforms like Twitter, TikTok, and Reddit serve as amplifiers, transforming isolated instances of speculation into widespread surges of interest. A viral TikTok clip encouraging people to purchase Dogecoin, a Reddit thread announcing the next Shiba Inu, or a tweet from a star can shift markets in moments. Data moves more swiftly than money, yet money closely trails it. The cycle is instant: memes generate attention, attention drives price movement, price movement inspires new memes. In this phase, the line separating culture and finance blurs.

Memecoins are influenced by the identity of different generations. Millennials and Gen Z, raised during a time marked by financial downturns, student loans, and increasing inequality, frequently perceive conventional finance as unattainable or dishonest. Wall Street, characterized by its unclear frameworks and gatekeeping methods, embodies a system that marginalized them. In contrast, memecoins are easy to access, open, and filled with humor. Purchasing Dogecoin goes beyond a financial transaction; it is an act of defiance, a means of ridiculing the seriousness of institutions that previously overlooked minor investors. It is a claim that culture and community are as significant as balance sheets and fundamentals. This generational perspective is essential, as memecoins represent more than just currency; they embody identity, community, and rebellion.

The cultural significance of memes also holds a key position. Memes serve as the common language of the online world, being brief, easily replicable, and endlessly versatile. They convey significance rapidly and affordably, enabling communities to communicate intricate feelings through straightforward, humorous visuals. When these memes are turned into tokens, they transform from mere jokes into something greater. They transform into resources that represent culture. Possessing a meme coin is similar to having a fragment of communal humor, an entry to a mutual inside joke. This is the reason communities unite so passionately in support of them. The coin is inseparable from the meme; the coin is the meme. Its worth is found in the cultural significance it creates and maintains.

Economic fluidity and cultural significance merge to establish the environment for remarkable expansion. Examine the impact of zero or minimal interest rates in the 2020s. As capital became plentiful and conventional returns diminished, speculative investments gained more appeal. Retail investors, equipped with stimulus checks or looking for options to stagnant salaries, embraced crypto not just as a financial chance but as a cultural arena. Memecoins align seamlessly with this era, delivering the potential for disproportionate profits infused with humor and identity. As economic circumstances change, the strength of this dynamic may vary, yet the cultural reasoning persists. As long as memes prevail in online interactions, memecoins will thrive.

Another factor is how memecoins diminish hierarchies of expertise. Conventional finance typically favors insiders who possess advanced degrees, exclusive access, and proprietary frameworks. Memecoins equalize speculation by eliminating entry barriers. Anyone connected to the internet can purchase, own, and engage. Information is not found solely in analyst reports or hedge fund models but rather in memes and jokes that everyone can grasp. The simplification of expertise is empowering for numerous retail investors, who view memecoins as an opportunity to engage in markets according to their own criteria. It’s not about grasping discounted cash flows or blockchain indicators; it’s about acknowledging the cultural trend and participating before it reaches its height.

Certainly, this democratization carries certain risks. The same accessibility that appeals to memecoins also renders them volatile and prone to manipulation. Pump-and-dump scams, rug pulls, and orchestrated hype initiatives can ruin unsuspecting investors. Still, the cultural context often remains evident. Losses are humorously referenced, circulated as memes, and become part of the community’s shared identity. For numerous individuals, the act of engaging, even amid defeat, turns into a key element of the narrative. The game holds equal significance to the result, and the meme persists in circulation, prepared to ignite the next cycle.

Collectively, these cultural and economic factors clarify the persistence of memecoins. They are not irregularities or deviations but rational results of the digital era. They prosper in an environment where finance serves as entertainment, where identity is revealed through purchasing, and where memes are the prevailing form of communication. They are unstable, delicate, and frequently temporary, yet they are also profoundly connected to the realities of our era. To regard them as insignificant is to overlook the deep connections between culture and capital today. Memecoins thrive as they are ideally suited to the environment of contemporary digital existence, fueled by inexpensive capital, rapid information, and the widespread attraction of humor.

The Risks and sustainability debate

If memecoins are driven by community, storytelling, and reflexivity, their risks are rooted in the vulnerability of those same foundations. In contrast to Bitcoin, which has algorithmically assured scarcity, and Ethereum, which has utility linked to decentralized applications, memecoins rely completely on shared attention. When focus shifts to another direction, the structure that upholds their worth crumbles. This vulnerability is the reason critics frequently label memecoins as bubbles, Ponzi schemes, or financial disasters poised to occur. However, supporters contend that a similar argument could apply to numerous financial assets. Every value tells a story, and memecoins merely reveal this reality. The discussion on risks and sustainability is not so much about the dangers of memecoins most acknowledge their volatility but rather what their risks indicate about the markets themselves.

The primary and most apparent risk is fluctuation. Memecoins surge quickly and plummet even quicker. They can increase in worth by a hundred times in a week, only to drop ninety percent of that worth in just days. For initial investors who successfully align with the cycle, the profits are remarkable. For those who arrive late, the consequences can be severe. In contrast to conventional investments, there are no protections, no profit statements, and no central banks to offer support. Prices are completely influenced by sentiment, which can change with a single tweet, a change in online conversation, or the rise of a new meme. This fluctuation is not by chance; it is fundamental. It is the unavoidable result of assets whose worth comes from attention instead of fundamentals.

Another danger is exploitation. The easy access to memecoins creates ideal conditions for pump-and-dump tactics. Organized teams can acquire tokens, inundate social media with excitement, and subsequently sell during the ensuing surge, ultimately leaving late investors at a loss. Rug pulls, in which developers deplete liquidity pools and disappear, are also frequent. These strategies take advantage of the conditions that render memecoins appealing: their accessibility, their rapidity, and their absence of gatekeepers. Decentralization permits anyone to develop and market a coin, but it also allows malicious individuals to take advantage of trust. The democratization of speculation that benefits retail investors also leaves them vulnerable to exploitation.

Doubters also raise concerns about sustainability. They claim that the majority of memecoins are bound to become insignificant. Lacking infrastructure, utility, or long-term plans, they cannot endure after the initial surge of interest fades. In fact, historical evidence backs this perspective. For each Dogecoin or Shiba Inu that attains enduring cultural significance, numerous memecoins disappear within a few months. Their graphs look like fireworks: a short, brilliant flash succeeded by obscurity. From this viewpoint, memecoins are not investments but short-lived phenomena, more akin to viral TikTok clips than to lasting financial assets. In this context, sustainability is nearly unachievable.

However, proponents argue that sustainability is a debated concept. Why does financial value have to be enduring? Markets have consistently featured speculative crazes, from tulips to tech stocks, with each one leaving behind lessons, frameworks, and cultural recollections. Memecoins can plummet in value, yet they persist as cultural symbols. Dogecoin continues to be culturally significant ten years after its inception, not due to its functionality, but because it has ingrained itself in the shared consciousness. Although ninety-nine percent of memecoins collapse, the one percent that survives shows the potential for longevity. Sustainability is not universal but selective, attained only by coins that either successfully reinvent themselves or maintain cultural relevance.

A different aspect of the discussion relates to legitimacy. Conventional finance values fundamentals, cash flows, and governance highly. Memecoins, on the other hand, seem untrustworthy specifically due to the absence of these indicators. However, one might claim that legitimacy is, in fact, a narrative. Fiat currencies are valid due to government enforcement. Gold is authentic due to thousands of years of cultural respect. In the late 1990s, tech stocks were considered credible even though their valuations were unrelated to profits. Memecoins, from this perspective, represent alternative stories of credibility, grounded in humor, defiance, and cultural identity. To regard them as invalid is to ignore the reality that every market is based on trust.

However, risks continue to exist for those engaged. In addition to financial loss, memecoins can encourage harmful psychological behaviors. The rapid shifts between happiness and sadness resemble gambling, featuring spikes of dopamine followed by declines. Retail investors may become fixated on the thrill, chasing the next meme coin in hopes of recovering their losses. This results in cycles of overexposure, financial pressure, and dissatisfaction. The communal aspects, though promoting empowerment, can also trap individuals in echo chambers where skepticism is ridiculed and steadfast faith is embraced. In these situations, evaluating risks logically becomes difficult, and the difference between belonging and exploitation becomes ambiguous.

Sustainability should be seen not as constancy but as flexibility. The limited number of memecoins that last past their initial hype phases achieve this by adapting. Shiba Inu created its own decentralized exchange and is still exploring ways to expand its ecosystem. Floki Inu entered the realm of metaverse initiatives. BONK became entrenched in Solana’s NFT culture. These initiatives do not assure success, yet they show that memecoins can evolve from mere entertainment into hybrid versions that merge humor with functionality. In doing so, they reflect larger trends in online culture, where humor transforms into movements, and movements develop into platforms. Sustainability in memecoins focuses on transformation rather than stability.

Looking at the bigger picture, the dangers associated with memecoins reflect the dangers of the financial markets overall. Fluctuation, manipulation, and speculative excess are not exclusive to memecoins; they are characteristics of capitalism. The dot-com bubble, the housing crisis, and numerous stock market frenzies demonstrate that even conventional assets are susceptible to irrational enthusiasm. Memecoins directly reveal these dynamics in a concentrated manner, devoid of pretension. These are financial trials carried out in real time, showcasing both the risks of speculation and the lasting strength of conviction.

The discussion on sustainability ultimately mirrors a more profound inquiry: what constitutes value? If value necessitates cash flows, then memecoins will perpetually be void. If worth demands usefulness, then the majority will not succeed. However, if value is characterized as whatever a community perceives and engages with, then memecoins are not just valuable but might represent the truest form of value in the digital era. They illustrate that money is, in essence, a meme an idea we collectively narrate and accept. Regardless of their survival or disappearance, memecoins compel us to acknowledge the vulnerability and strength of faith. They are dangerous, unsustainable, and frequently exploitative, yet they are also genuine, not despite their absurdity but due to it.

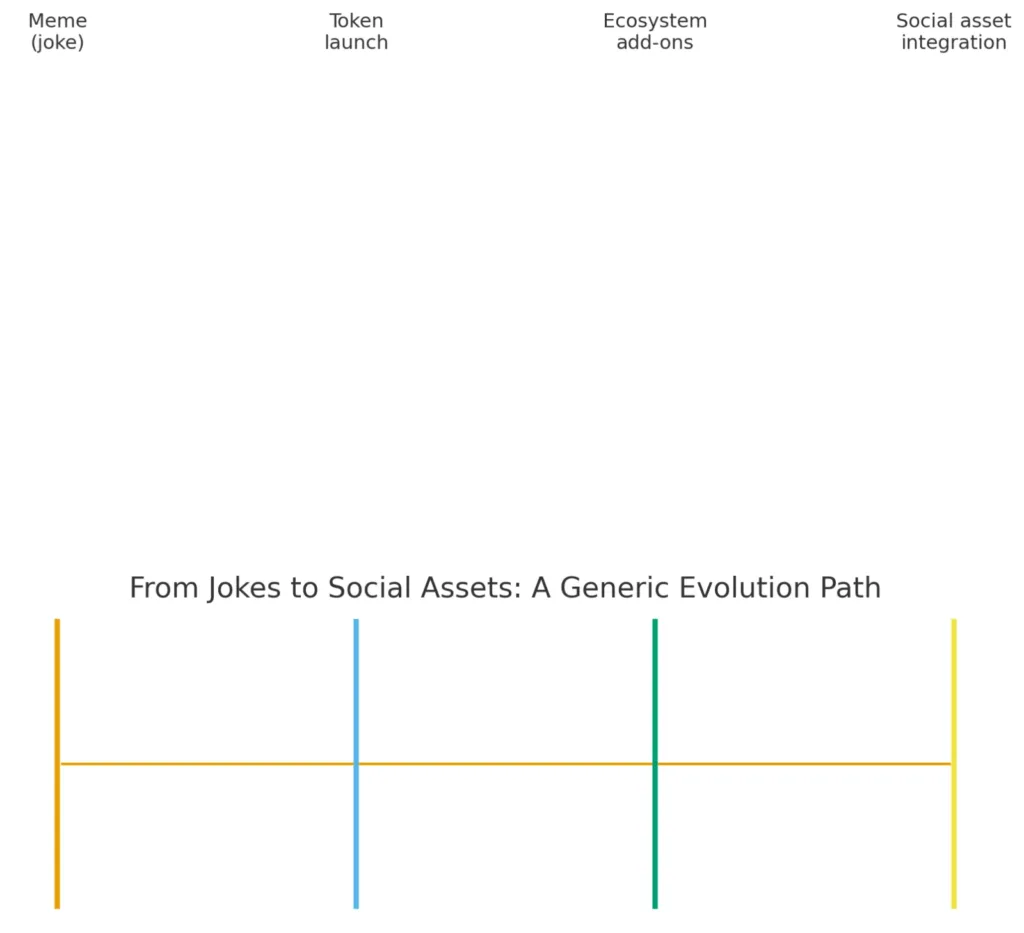

Future outlook: From jokes to social assets

As memecoins progress, the discussion is moving from whether they possess value to how that value could change in the future. The initial phase of memecoins was characterized by satire and showmanship, with coins introduced as jokes lacking any specific purpose apart from entertainment. However, the future might appear very different. What starts as a meme can transform into social asset tokens that not only amuse but also function as pathways to community involvement, cultural identity, and even infrastructure in larger digital ecosystems. If the previous ten years have indicated that humor can influence markets, the upcoming decade might demonstrate how those markets formalize that humor into enduring types of capital.

The initial path of evolution is found in merging with decentralized ecosystems. Memecoins are already expanding beyond their original format into decentralized finance, gaming, and NFT communities. Shiba Inu, initially just a copy of Dogecoin, created ShibSwap, its unique decentralized exchange, and began exploring staking methods and ecosystem tokens. BONK, the memecoin on Solana, integrated itself into the NFT ecosystem of that blockchain, providing rewards and fostering links with gaming initiatives. These experiments do not eliminate the comedic origins of memecoins but rather enhance them, prolonging the life cycle by incorporating utility. The meme serves as the gateway, whereas the infrastructure provides the coin with stability. This blend of practicality and humor might signify the upcoming stage in the evolution of memecoins.

Another possible future for memecoins is acting as cultural currencies. Just as fans utilize merchandise or collectibles to indicate their affiliation, memecoins can act as electronic symbols of identity. Holding Dogecoin goes beyond a mere financial decision; it signifies engagement in a cultural movement. With the evolution of social media platforms, incorporating tokens into user profiles, tipping systems, and microtransactions may enhance this function. Twitter, now known as X, has previously tried out crypto tipping. Envision a future in which memes are immediately monetized, with the tokens representing them serving as cultural currency. In this context, memecoins might function less as speculative assets and more as social currencies, dynamic and expressive, connected to digital identities.

Brand partnerships and widespread adoption are also potential opportunities. Memes have moved beyond internet subcultures; they now represent mainstream culture. Brands already utilize memes in their advertising to grab attention, and it’s easy to envision them incorporating meme tokens into their marketing strategies. Some merchants have begun accepting Dogecoin as a form of payment, whereas Shiba Inu has revealed partnerships with payment processors. With the evolution of crypto payment infrastructure, memecoins might act as unusual yet efficient entry points into digital commerce. A pizza chain that accepts Dogecoin might appear as a gimmick, yet it illustrates a wider trend: humor and culture serve as strong marketing assets, with memecoins representing both.

Generational changes indicate a future where memecoins persist. Millennials and Gen Z investors, raised with internet humor and digital identities, are more at ease merging finance with culture. To them, putting money into a meme coin is not unreasonable; it is a logical continuation of their existing habits of consuming, sharing, and generating value on the internet. As these generations amass greater wealth, their cultural tastes will influence markets. Similar to how baby boomers fueled the expansion of stocks and mutual funds, younger generations could make social tokens commonplace, blurring the lines between cultural engagement and financial speculation. Memecoins lead this change, acting as initial trials of what finance centered around identity might resemble.

Nonetheless, the future of memecoins faces several obstacles. Regulation is a significant concern, as governments contend with the speculative surpluses and dangers of consumer-driven markets. The characteristics that render memecoins attractive such as their accessibility, humor, and volatility also turn them into targets for regulators worried about protecting consumers. The way regulators define memecoins may influence their future path. If regarded as securities, compliance requirements could hinder their expansion. If they remain mostly unregulated, they could persist in flourishing, but this would lead to ongoing scandals and losses for investors. Achieving a balance between safeguarding participants and maintaining innovation will be essential.

The longevity of memecoins will rely on their capacity to progress beyond mere spectacle. Most meme coins will always be transient, surging with interest only to disappear once the meme loses its appeal. However, those who persist will achieve this by discovering ways to link humor with infrastructure and identity with usefulness. They will not forsake their origins in meme culture, as that humor is what allows them to connect. Rather, they will add further forms of value, resulting in hybrids that merge entertainment, community, and economic involvement. In this regard, memecoins might serve as models for wider types of social finance, where culture transcends mere marketing and becomes the core of value itself.

Envisioning the future, it’s possible to see memecoins contributing to a wider tokenization of culture. If music, art, and fandom can be represented as NFTs, why not comedy? Memecoins might evolve into assets associated with viral content, with tokens created based on trends and allocated as cultural shares. In this concept, every meme that draws interest could generate a financial product, allowing communities to possess not only the humor but also a share in its spread. This is thrilling and disconcerting. It implies a future in which culture is entirely financialized, making laughter and speculation inseparable. For some, this signifies the extremes of capitalism; for others, it reflects a natural progression of digital culture.

In the end, the perspective on memecoins isn’t centered on whether they are humorous or legitimate investments. They are each. Their humor provides them strength, but their ability to engage communities, draw investment, and transform into ecosystems ensures their sustainability. In the coming decade, numerous memecoins are expected to experience both surges and declines, yet the concept of financialized memes will endure. They have demonstrated that attention can serve as a form of currency, that culture can act as collateral, and that identity can be leveraged as capital. Regardless of whether we view this as risky or groundbreaking, memecoins are here to stay. They will keep changing, adjusting, and mirroring the cultural and economic circumstances of their era.

The future, therefore, is not a scenario in which memecoins vanish, but rather one where they evolve. From humor to social resources, from satire to models, they are revealing something significant about the essence of worth in the digital era. They demonstrate that value doesn’t have to be rational, that communities can derive meaning from humor, and that faith, no matter how irrational, is sufficient to influence billions of dollars. It appears that the humor isn’t in the memecoins, but in those who fail to recognize their influence.

Conclusion

Memecoins are frequently regarded as fleeting financial oddities, bizarre outcomes of online culture that will disappear as swiftly as they emerged. However, to overlook them is to disregard their remarkable talent for seizing capital, creativity, and identity simultaneously. They are not mere footnotes in the narrative of cryptocurrency; they are crucial for comprehending how value is being transformed in the digital era. From Dogecoin’s satirical beginnings to Shiba Inu’s “destroyer” storyline and Pepe’s revival as a symbol of web culture, memecoins have repeatedly proven that humor and speculation can combine into significant economic influencers. Their travels may seem disorderly, yet underneath, there exists a series of patterns that disclose significant insights regarding the future of the markets themselves.

Essentially, memecoins reveal that finance has historically revolved as much around belief as it has around fundamentals. Stocks are supported not just by profits but by the stories created around innovation and development. Gold maintains its charm not due to yield generation but because generations of culture have instilled in us a belief in its sustainability. Fiat currencies have value because governments assert they do, and because people agree to accept this. Memecoins merely expose this truth completely. They illustrate, in an exaggerated manner, that money is a meme an idea we collectively acknowledge, reproduce, and strengthen. What renders memecoins controversial is not their absence of fundamentals, but their unwillingness to act as if they possess them. They transform speculation into a spectacle, thereby emphasizing the performative aspect of all financial systems.

This does not negate their dangers. Memecoins exhibit high volatility, are delicate, and susceptible to manipulation. The majority will disappear following short periods of excitement, resulting in significant losses for those who join later. Communities that appear unshakeable during moments of joy can splinter suddenly when prices plummet. For numerous investors, the encounter with memecoins will lean towards disillusionment instead of gains. However, even these shortcomings are significant. They belong to the cultural narrative, emphasizing that involvement whether sharing memes, joining Discords, or collaborating in speculation is as vital as financial gains. For those who experience loss, the humor frequently alleviates the pain. For the victors, the absurdity enhances the sweetness of their triumph. This combination of danger and amusement is exactly what maintains the cycle.

The viability of memecoins depends not on their durability but on their ability to evolve. Certain cryptocurrencies, such as Dogecoin, have endured due to cultural momentum, upheld by their reputation as internet icons. Other projects, such as Shiba Inu, have sought to progress by developing decentralized exchanges, staking features, and metaverse initiatives. New entrants like BONK on Solana show how memecoins can integrate into ecosystems, becoming essential to gaming, NFTs, and community culture. These instances illustrate that although the majority of memecoins may fade away, some will evolve into hybrid versions that integrate humor with foundational structures. They will continue to be memes, but they will also evolve into platforms, social tools that connect entertainment and functionality.

The greater importance of memecoins reflects what they uncover about our era. We exist in a time when culture disseminates more rapidly than capital, yet capital swiftly trails culture. A viral clip can affect markets, a tweet from a celebrity can shift billions of dollars, and a joke can transform into an investment strategy. Memecoins represent the epitome of this trend. They represent the financialization of virality, the monetization of memes, and the institutionalization of online humor. They demonstrate that attention is the rarest resource available, and that those who seize it, even momentarily, can convert it into riches.

In the future, memecoins could act as models for a wider range of social tokens. If NFTs proved that art and culture could be monetized, memecoins reveal that humor and identity can be as well. They could facilitate the creation of tokens linked to fan communities, digital networks, or cultural events, transforming the concept of belonging into a commodity. In this regard, memecoins are not outliers but initial trials in a future where culture and capital cannot be separated. Regardless of whether it is viewed as dystopian or freeing, this is a future that must be acknowledged.

For investors, the takeaway from memecoins is contradictory. On one side, they are extremely dangerous, providing minimal security and a large chance for loss. Conversely, they represent the potential for remarkable, uneven returns, which are seldom offered by conventional assets. Navigating this paradox demands both financial expertise and cultural understanding, including the skill to analyze memes, decipher stories, and feel the dynamics of online communities. In the realm of memecoins, trading tactics are closely linked to social interactions, and gaining an edge relies equally on wit and evaluation.

In terms of culture, memecoins symbolize the financial democratization. They demonstrate that anyone, equipped with a meme and a wallet, can engage in markets. They weaken the exclusivity of conventional finance and make speculation accessible to everyone. This democratization is chaotic, frequently exploitative, and fraught with danger, yet it is also empowering. It implies that finance is no longer solely reserved for professionals and complex programs; it has also become a space for memes and emojis.

Ultimately, memecoins may not change the world like Bitcoin or Ethereum aim to, yet they have already altered our perceptions of value. They remind us that money isn’t merely digits on a display but narratives we craft, humor we exchange, and societies we create. They demonstrate that faith, even irrational faith, can influence markets. They compel us to face a truth we may wish to overlook: that in the internet era, culture is currency, and memes equate to wealth. Regardless of whether one finds humor or sorrow, the reality persists. The worth of memecoins lies not in their programming but in our engagement, our sense of humor, our need for connection, and our readiness to have faith.

Rita Dfouni

Rita Dfouni