Cryptocurrency investment firm Metaplanet acquired 136 BTC on Monday, pushing its total BTC stash to 20,136 BTC, as per an X post. According to CoinGecko, the company is the 9th largest holder of BTC in the world.

The update in purchases comes after a slew of changes made on September 2nd to the firm’s articles of incorporation, including an increase in the maximum number of authorized shares to 2.72 billion shares, enabling virtual-only shareholder meetings, and new provisions made for Class A and Class B shares.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Metaplanet purchased the BTC for 2.2 billion yen

The newly turned crypto investment firm purchased the new BTC for 2.2 billion yen ($15.1 million) at an average purchase price of 16.5 million yen ($111,381) per BTC.

The company adopted its Bitcoin treasury strategy in 2024, transitioning the majority of its operations towards the acquisition of Bitcoin. Metaplanet was founded in 1999 with its initial business operations focused on the management of hotels in Japan.

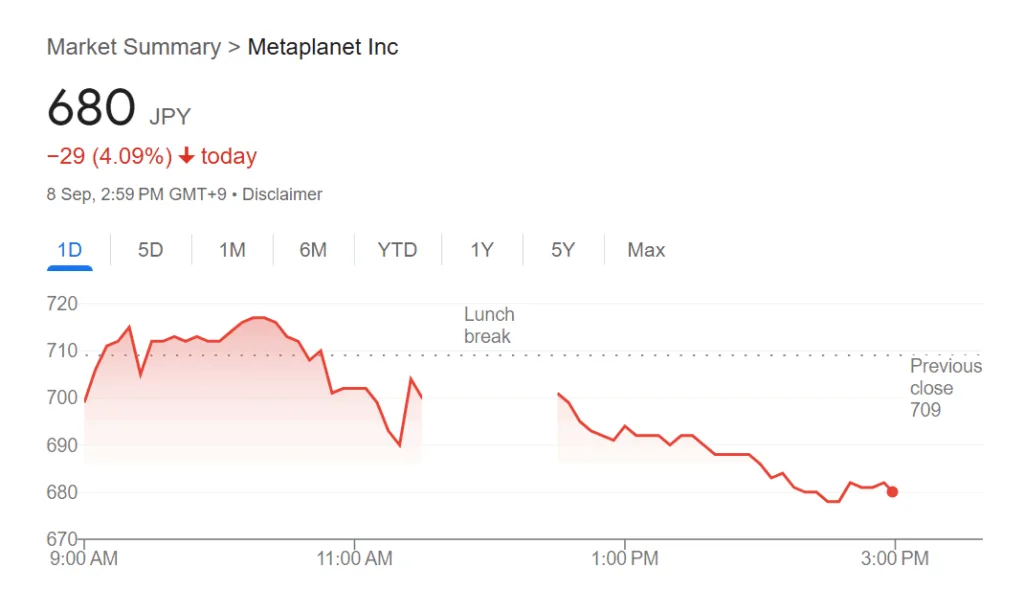

Source: Google Finance

At the time of writing, Metaplanet shares were priced at 680 JPY, down by 4.09%.

Regarding its Bitcoin treasury strategy, which continues to move ahead at an aggressive pace, Metaplanet has clarified that its BTC investments do not translate to shareholders having a stake in the company’s Bitcoin.

The company maintains its policy of not paying dividends to shareholders. Also, Metaplanet has clarified that the company’s metrics of BTC yield, BTC Gain, and BTC yen gain are not to be considered traditional financial metrics but rather as supplemental metrics.

Johann Wilfred

Johann Wilfred