Metaplanet, the publicly traded Japanese investment company, will continue acquiring Bitcoin despite the ongoing market crash. Company CEO Simon Gerovich addressed panicked shareholders on Friday, confirming to them that Metaplanet will not deter from its corporate BTC treasury strategy in the face of volatility.

In a statement shared on X Gerovich said, “We are fully aware that, given the recent stock price trends, our shareholders continue to face a challenging situation. However, there is no change to Metaplanet’s strategy. We will steadily continue to accumulate Bitcoin.”

Bitcoin, at the time of writing, was trading at its yearly low of $66,800 on international exchanges. In the backdrop of Bitcoin’s mega slippage, Metaplanet’s share on the Tokyo Stock Exchange fell by 5.56 percent on Friday. Each Metaplanet share is presently trading at JPY 340 with a reduction of JPY 20 per share.

Source: Google

Metaplanet CEO, however, holds firm belief that accumulating BTC will eventually expand the company’s economic growth in the long term.

“To all our shareholders who continue to support us unwaveringly despite the daily fluctuations,” Gerovich added to his post.

Source: X/ @Gerovich

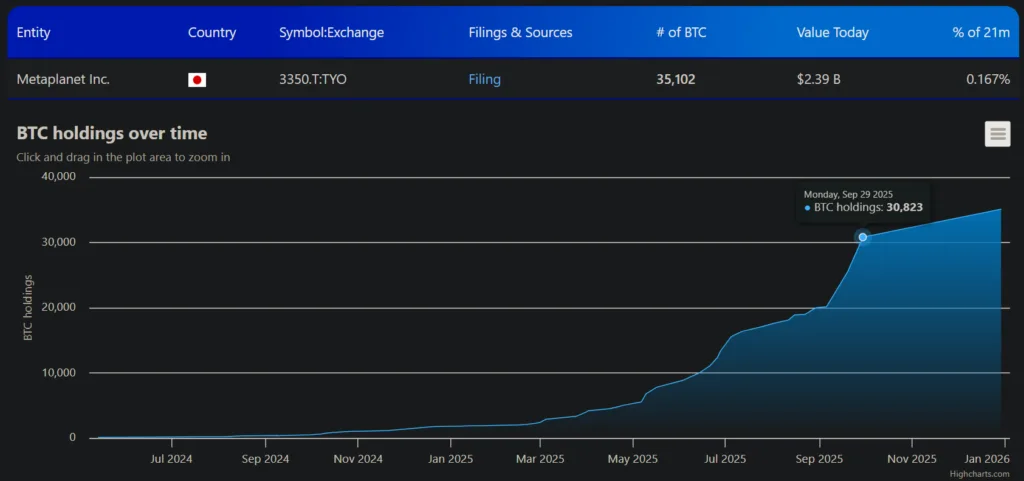

Founded as a hotel management and real estate company in 1999, Metaplanet branched out into other sectors including Web3 over the years. In April 2024, the company picked Bitcoin as its prime treasury reserve asset.

Since April 2024, the Tokyo-headquartered company has managed to acquire 33,102 Bitcoin.

Source: BitBo

As of January this year, Metaplanet was the fourth largest corporate BTC treasury after Strategy, Mara Holdings, and Twenty One Capital.

In the fourth quarter of 2025, Metaplanet had acquired a batch of 4,000 BCT tokens.

Instead of just holding BTC in its reserves, Metaplanet has also been using them for financial rollings. In November 2025, for instance, Metaplanet kept a part of its BTC treasury as collateral to borrow $100 million to buy more BTC.