Polygon has outperformed Ethereum in daily transaction fees for three consecutive days, marking a notable shift in on-chain activity.

According to analysts, the main reason for the jump is the high level of user engagement on Polymarket, a blockchain-based prediction market running on the Polygon blockchain.

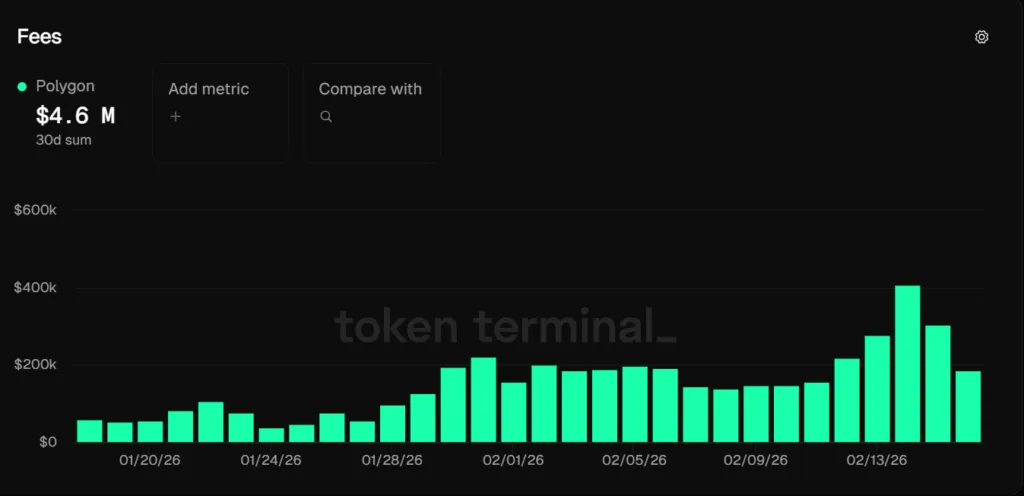

According to data from Token Terminal, Polygon earned approximately $407,100 in transaction fees on Friday, close to doubling Ethereum’s $211,700 in transaction fees on the same day.

On-chain data also suggests that this is the first time Polygon has managed to earn more than Ethereum in daily fee revenue.

What’s behind Polygon’s rise?

On Saturday, Polygon brought in about $303,000 in daily transaction fees, compared to Ethereum’s roughly $285,000, showing the competition is far from one-sided.

Much of this recent surge can be traced back to Polymarket, the blockchain-based prediction market that has become one of the most talked-about apps in crypto.

According to market analysts, Polygon’s spike in activity has been “fully driven” by Polymarket. Over the past week, Polymarket alone generated more than $1 million in fees on Polygon.

The next biggest app, Origin World, accounted for just $130,000, highlighting how heavily Polygon’s current momentum depends on one breakout application.

Polygon flags Polymarket surge as key driver of fee spike

Polygon had previously highlighted that activity on Polymarket continues to surge, underscoring the network’s recent spike in transaction fees.

In a post on X, the Polygon team noted that more than $15 million in wagers were placed on a single Oscars category, emphasizing that “Polygon is the chain underneath it all.”

The network also pointed to a growing ecosystem of trustless agents operating on its Layer 2, designed to automatically identify and act on opportunities within prediction markets.

Prediction platforms have gained momentum since the last U.S. election, prompting several crypto firms to launch similar products.

Polymarket conducts trades using Polygon-based USD Coin, further driving on-chain activity across the network.