The crypto community is keenly observing Bitcoin’s price movement after the asset registered a massive dip over the last few days. On Tuesday, November 18– Bitcoin’s price trajectory found itself within the range of $89,900 and $91,400. At the time of writing, the asset was retailing at $91,440 having clocked a loss of under one percent in the last one hour.

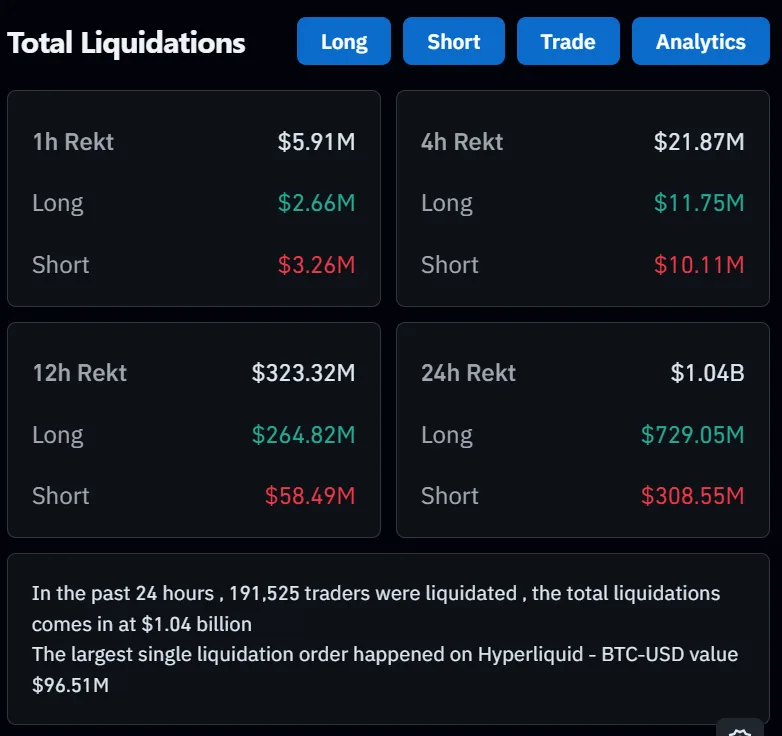

With Bitcoin having slipped under critical support levels, automated sell offs have led to massive liquidations that touched $1.4 billion within the last 24 hours.

Engaging with the investors, crypto key opinion leaders (KOLs) posted their two cents on the situation.

Richard Teng, the CEO of Binance told the community that volatility is part of the journey.

“The best defense is a clear strategy, patience, and diligent,” Teng said, suggesting traders to do their own research.

Arthur Hayes, the co-founder of BitMEX and Strategy chief Michael Saylor also addressed the situation on X — insinuating that market fluctuations are part of the game.

Cameron Winklevoss, the co-founder of the Gemini exchange meanwhile, propagated the “buy” sentiment among investors given that the most expensive crypto asset, BTC, is trading at its seven-month low price.

“This is the last time you’ll ever be able to buy Bitcoin below $90,000,” he said.

Seconding on Winklevoss’ “buy” sentiment, Saylor made it a point to disclose that his Bitcoin treasury company, Strategy, has acquired 8,178 Bitcoin worth $835 million in the last one week.

At the time of writing, Coinglass’ liquidation heatmap showed $4.21million have been liquidated from the market, out of which over $184,000 were pulled from the Bitcoin ecosystem.

Source: CoinGlass

As per the Fear and Greed Index score of 15 shows that investors are under extreme fear at the time of writing.