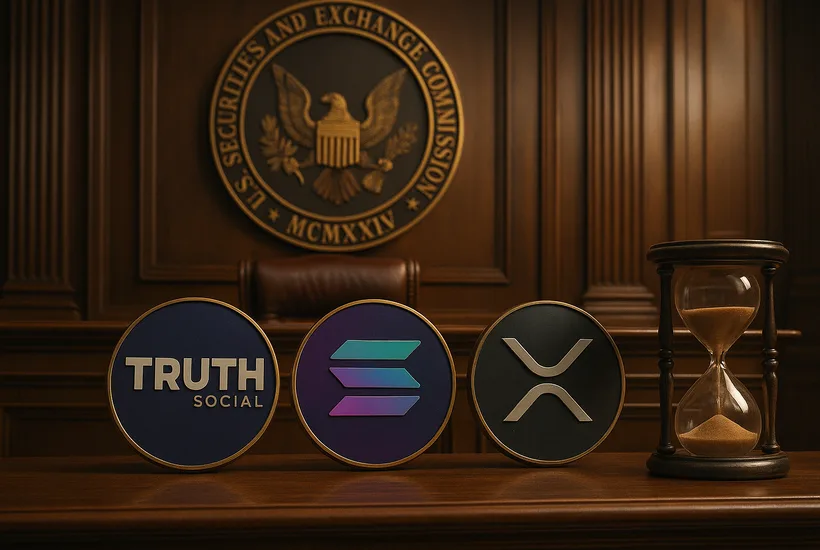

Recommendations on a number of well-known bitcoin exchange-traded funds (ETFs) have once again been delayed by the U.S. Securities and Exchange Commission (SEC), with new dates set for October. New deadlines of October 8 for NYSE Arca’s Truth Social Bitcoin and Ethereum ETF, October 16 for 21Shares and Bitwise’s Solana ETF applications, and October 19 for the 21Shares Core XRP Trust were established by the regulator in notices submitted on August 18.

First filed on June 24, the Truth Social Bitcoin and Ethereum ETF is set up as a commodity-based trust that owns Bitcoin, which is worth $115,376, and Ether, which is worth $4,242. The product works similarly to other spot Bitcoin and Ether ETFs that are currently offered in the U.S. market, despite bearing the branding of former US President Donald Trump’s Truth Social platform. Through submissions by 21Shares and Bitwise, Cboe BZX has applied for the first U.S. spot Solana ETFs. By owning SOL tokens, which are presently worth $180, investors will have direct exposure to Solana’s price performance. A different application from 21Shares aims to launch the Core XRP Trust, which is intended to hold XRP at $3.02 and monitor its success in the market. As the 180-day deadline for the SEC’s evaluation of the XRP product drew near, the agency gave itself a another 60 days.

October set to be a pivotal month for crypto ETF decisions

These most recent extensions align with the SEC’s overall strategy for the year. The regulator postponed decisions on a number of altcoin ETF submissions in March, including those involving Litecoin, Dogecoin, and XRP. One of these was the spot Litecoin ETF offered by CoinShares, which sought to hold LTC, which is now worth $116.52, and issue shares that were backed by the asset. Bitwise’s bid to implement in-kind creations and redemptions for its spot Bitcoin and Ether ETFs was similarly delayed by the SEC; a judgment is now anticipated in September. The SEC seldom grants early approvals, according to analysts. James Seyffart, an ETF analyst for Bloomberg,points out on X that early judgments would be extremely uncommon because nearly all of the pending 19b-4 filings have final due dates in October.

SEC ETF decision deadlines cluster in October 2025, marking a pivotal month for crypto market approvals.

October is a crucial month for ETF judgments because of the proximity of these deadlines. A dozen spot Bitcoin ETFs, a number of Ether products, and an expanding pipeline of altcoin-based funds awaiting regulatory approval are presently available on the U.S. market. More than 100 crypto-related exchange-traded funds (ETFs) are listed worldwide, indicating the industry’s quick growth and assimilation into conventional markets. With over $87 billion in assets under management through its iShares Bitcoin Trust, BlackRock remains the industry leader in exchange-traded funds. Most investor inflows have been drawn to it due to its unparalleled scale, liquidity, and brand strength, making it difficult for rivals to catch up. The next phase of diversification for cryptocurrency investment products may be represented by the launch of Solana and XRP ETFs, but everyone is still waiting for the SEC’s eagerly anticipated rulings in October.