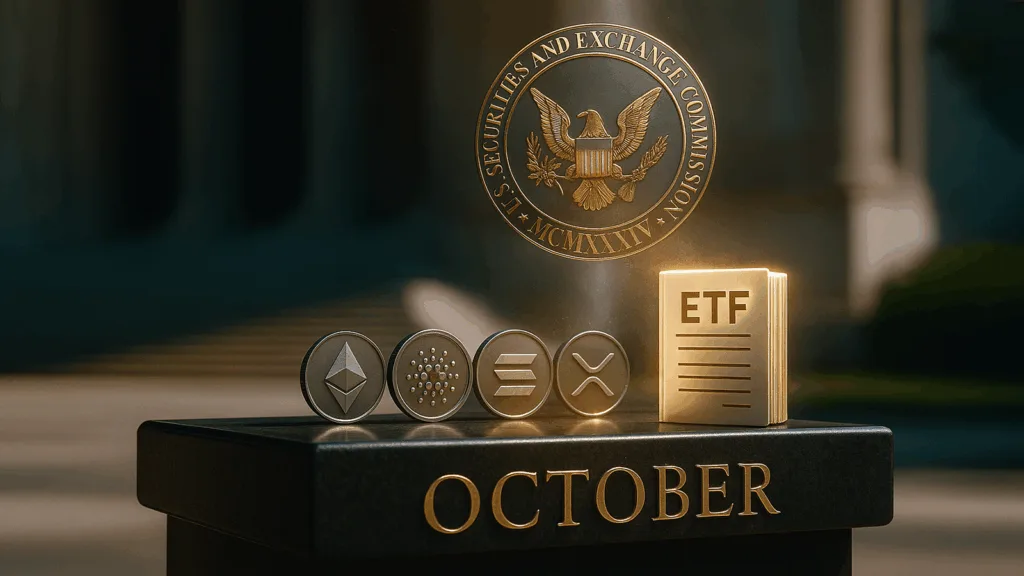

October 2025 is shaping up to be a major month for US crypto markets, as the Securities and Exchange Commission (SEC) reviews 16 exchange-traded fund (ETF) applications. Unlike previous waves focused on Bitcoin and Ether, many of the new proposals target altcoins such as Solana, XRP, and Litecoin.

This round of filings has drawn attention due to potential shifts in regulatory approaches, signaling faster approvals for altcoin ETFs and broader access for investors.

A new era for SEC crypto regulation

On Sept. 17, the SEC approved “generic listing standards” for exchange-traded products tied to spot commodities, including digital assets. Analysts say the new framework could streamline approvals by reducing the need for case-by-case exemptions, accelerating crypto’s integration into mainstream financial products.

Trump administration has contributed to a push for regulatory clarity. President Trump and the Trump administration came into office with a mandate from voters to bring regulatory clarity to the crypto industry in the US. It’s really been a whole-of-government effort, noting that bipartisan support has boosted confidence among businesses and investors.

Demand for altcoin ETFs

Analysts are watching whether altcoin ETFs will attract demand comparable to Bitcoin. Bloomberg Intelligence ETF analysts noted that Solana and XRP stand out due to existing futures markets but cautioned that inflows may not match Bitcoin-level volumes. Long-term growth may favor diversified basket or index products rather than single-asset ETFs.

Grayscale’s latest diversified index fund as a step toward broader crypto exposure. It is Encouraged not only to be bringing these single-asset ETPs to market but also the first diversified index-based crypto ETP, a one-stop-shop solution for portfolio exposure.

What approval could mean for investors

Seyffart predicted that approvals could lead to rapid expansion in ETF offerings, including staking Solana ETFs, covered call products, and leveraged or inverse products. Analysts agree that while October may not immediately generate massive inflows, it marks a turning point, bringing altcoin ETFs closer to mainstream adoption in US markets.