In an effort to combat insider trading and market manipulation in the cryptocurrency and equity markets, the Commodity Futures Trading Commission (CFTC) is merging Nasdaq’s state-of-the-art monitoring software into its antiquated surveillance systems. The action is part of a larger trend by US regulators to match traditional financial supervision with the quickly changing digital asset market.

Nasdaq’s head of regulatory strategy and innovation, Tony Sio, claims that the tool provides “tailored algorithms that spot suspicious patterns particular to digital asset markets.” In order to help authorities combat pump-and-dump schemes, wash trading, and insider disclosures that erode investor trust, the software attempts to bridge long-standing compliance gaps by evaluating order book data in real-time and connecting actions across traditional and crypto venues.

Surveillance meets DeFi’s core debate

In cryptocurrency, financial surveillance is still a contentious topic. Real-time surveillance, according to supporters, is necessary to draw in institutional participants that are leery of unregulated markets, while detractors caution that it runs the risk of establishing a digital “prison” that violates the principles of decentralization.

At the same time, the US Treasury Department is investigating the possibility of integrating digital identity checks into smart contracts for decentralized financing (DeFi). This contentious proposal, which was included in the White House’s July crypto report demands for changes to the NIST digital identification principles as well as stricter know-your-customer (KYC) procedures. Testing digital IDs based on mobile devices and implementing federal cybersecurity standards to mandate identity verification in DeFi ecosystems were among the recommendations.

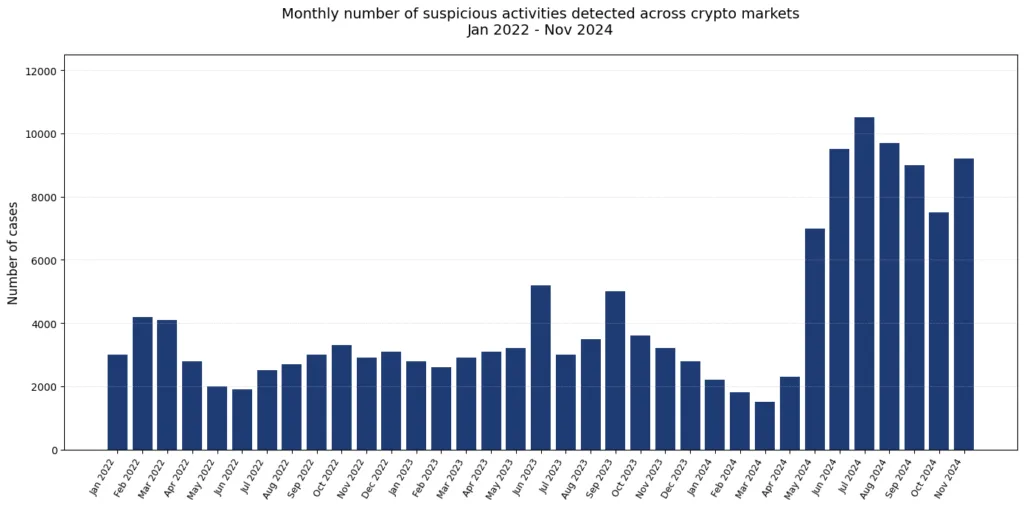

The numbers behind fraudulent tokens

The spike in suspected pump-and-dump tokens further highlights the need for surveillance enhancements. According to data, monthly token counts associated with such schemes on Ethereum, Base, and BSC increased sharply starting in early 2024. They reached over 10,000 in July 2024 before declining in the late fall. This pattern highlights the scope of the manipulation issues that regulators are rushing to resolve.

Balancing oversight and innovation

Treasury suggestions highlight striking a balance between protecting personally identifiable information and ensuring secure verification in response to worries over overreach. Without totally destroying permissionless architecture, future rules might compel DeFi protocols to implement identification layers.

Industry participants are still divided, with some seeing regulatory integration as a necessary cost of widespread adoption and others seeing it as a slippery slope that could undermine freedom and privacy in digital money. Although the CFTC’s partnership with Nasdaq indicates that enforcement measures are catching up, the struggle between innovation and oversight is still ongoing.