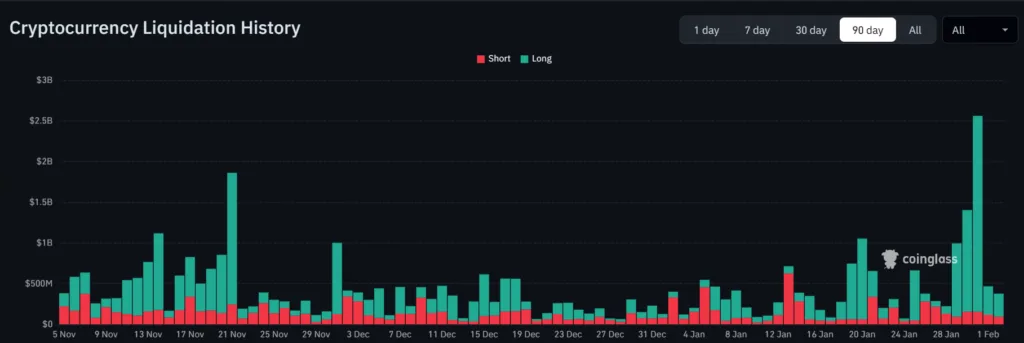

The crypto market logged mammoth liquidations exceeding $2.6 billion over the weekend, owing to an array of macro-economic factors and ongoing geo-political tensions. Bitcoin sunk to its nine-month low on Saturday to trade at as low as $77,000.

Bitcoin on Monday reflected an even lower price of $76,950 –having fallen by three percent in the last 24 hours and as much as 15 percent over the last 5 days. Ethereum, on the other hand, suffered a drop of 6.5 percent over the weekend, bringing its price to $2,260.

With the top two tokens bleeding, the overall crypto market cap also slipped by nearly three percent to tumble to the valuation of $2.5 trillion.

In conversation with Coin Headlines, market analysts laid out an extravagant spread of reasons, each of which contributed significantly in triggering this massive crypto crash even before the first month of 2026 could wrap up.

In this story we will go through the most influential factors that has thrown off the crypto market off balance.

Political peril poisons crypto

The market had been gradual in rallies and mostly remained in consolidation between December 2025 and mid-January 2026. The downfall in BTC prices started after last week, the Fed decided to keep the interest rate unchanged 3.50 percent to 3.75 percent.

Consecutively, U.S. President Donald Trump has nominated former Federal Reserve governor Kevin Warsh to replace present Fed chair Jerome Powell. In these last few months, President Trump and Powell have repeatedly been at loggerheads around interest rate decisions. Meanwhile, Warsh has maintained a pro-crypto stance for years.

A cherry on the cake — the U.S. government has entered into a partial shutdown over the weekend after the Congress failed to pass a funding bill for the Department of Homeland Security (DHS). The Democrats did not support the budget, pushing for stricter oversight on the agency after two citizens in Minneapolis were allegedly killed by immigration agents killed two citizens in Minneapolis.

Talking to Coin Headlines, Bitunix analyst Dean Chen said that the “Warsh panic” is building in the market. While the fed chair nominee supports crypto and can likely lower interest rates to align with President Trump’s directives, the market is linking his “hawkish” history with a foreseeable tightening of the money supply — cutting off the cheap liquidity that usually fuels crypto rallies.

As per Chen, traders dumped crypto because Warsh’s nomination caused the US Dollar to spike, making “risk-on” assets like Bitcoin less attractive amid an acceleration in global deleveraging acceleration wherein capital flows has become the key variable for crypto.

“The reversal in liquidity expectations triggered by the so-called “Warsh panic” led to an epic sell-off in precious metals, with gold and silver plunging in succession. The U.S. dollar strengthened, while U.S. equity futures, Asian equities, and the crypto market all came under pressure simultaneously, signaling that deleveraging is spreading across asset classes,” the market analyst from Bitunix noted.

The ongoing U.S.-Iran situation is also adding to the market pressure. As of Monday, the U.S.-Iran situation has entered a high-stakes standoff between a military buildup and diplomatic nuances. A deescalation in this situation could have a positive impact on the markets overall.

Great crash of gold and silver

After gold rallied to record highs around the last week of January, it stepped into a strong period of price correction. The price of gold, that touched $5,595 on January 29 has slipped to $4,535 per ounce as of Monday.

Silver charted a similar trajectory — hitting the price mark of $121.78 per ounce as of January 29 and having fallen to $74 as of Monday.

The crash of gold (approximately 12 percent) and silver (around 33 percent) dragged Bitcoin and other crypto assets down via a mix of forced liquidations and a stronger dollar.

Independent financial analyst Sunidhi Chopra, said gold and silver are crashing because the market ecosystem is starving for liquidity.

“In a true margin call event, funds don’t sell what they want to sell. They sell what they can sell. Gold and Silver are liquid, profitable positions for many, making them the first piggy bank to get smashed when the margin clerks come calling. This is a liquidity crisis,” Chopra said. “History tells us that during a deflationary crash (like 2008 or March 2020), metals get dragged down with equities initially. When the selling in metals stops but equities keep falling, the bottom is in. Until then, cash is king, and the deleveraging will be brutal.”

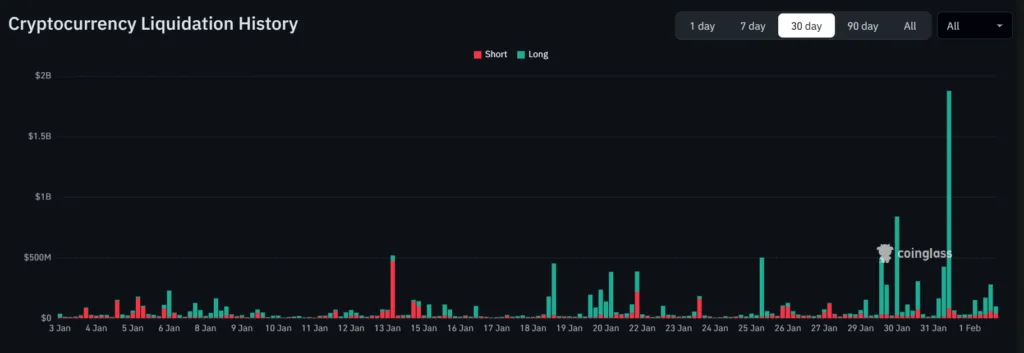

The market is undergoing a leverage overload wherein thin liquidity plus over-leveraged longs has resulted in a cascade of forced selling. As per analysts, this is a structural flaw that can turn large debts into disasters in a volatile markets.

“For crypto, whale activity and supply shocks are contributing to the market slump. Dormant whales dumping over $500 million in BTC and the ongoing unlocks and emissions in altcoins are disbalancing the markets,” Chopra noted.

Will crypto rise again?

In the coming days, analysts do not see crypto coming anywhere close to a rally.

The ongoing negotiations around the CLARITY Act, the possibility of Warsh’s appointment as the Fed chair, the ongoing partial U.S. government shutdown, and the U.S.-Iran tensions are big reasons keeping the markets down — none of which are resolvable with simple solutions or snapping of the fingers.

“In the crypto market, price action has already shown clear downside pressure, closely tracking global risk assets. Bitcoin remains in a classic high-level consolidation structure, reflecting market hesitation and caution over the liquidity outlook,” Bitunix’s Chen said.

Market commentators are now saying that this ongoing crash has shown that the current generation of crypto assets have not been able to gain any solid grounding in the actual economy.

“Their value model relies on scarcity, which primarily fuels speculation rather than utility. True currencies derive value from underlying economic activity and serve as reliable mediums of exchange. Crypto’s scarcity-driven model breeds volatility and unreliability. As long as enough people keep playing the game, it limps along,” Geralde Passchier, the founder of blockchain firm Chain Solutions posted on LinkedIn.

In the last 24 hours, nearly 200,000 traders were liquidations with the amount hitting $821.82 million, as per CoinGlass.

Source: CoinGlass

BTC is expected to dip even lower to $71,000, analysts have warned.

“It is also worth noting that interest rate decisions are made collectively by voting members rather than unilaterally by the Fed chair, underscoring the need for prudent decision-making by market participants,” Chen reminded.