Wisconsin Republicans have presented a Senate bill that mirrors prior legislation in the state’s lower house and aims to strengthen restrictions on Bitcoin ATMs to combat fraud.The bill, was introduced by Democratic Representative Ryan Spaude on July 31. Filing similar measures in both chambers allows the proposals to progress concurrently, increasing the possibility that they will become law.

If passed, the legislation would require all crypto ATM and kiosk operators in Wisconsin to obtain a money transmitter license and collect detailed customer information, such as full name, date of birth, identification number, address, email, and a government-issued document like a passport or driver’s license. Operators would also be required to photograph and authenticate consumers’ IDs for each transaction, with daily transaction limitations set at $1,000.

The bills require machines to display a fraud warning label in the customer’s field of vision and on-screen, warning users about common scam tactics such as law enforcement impersonation or threats of jail time, as well as warning that fraudulent or accidental transactions may be irreversible. If law enforcement confirms a transaction as fraudulent within 30 days, the operator must repay the victim.Fee limitations are also proposed, with charges set at $5 or 3% of the transaction value, whichever is greater.

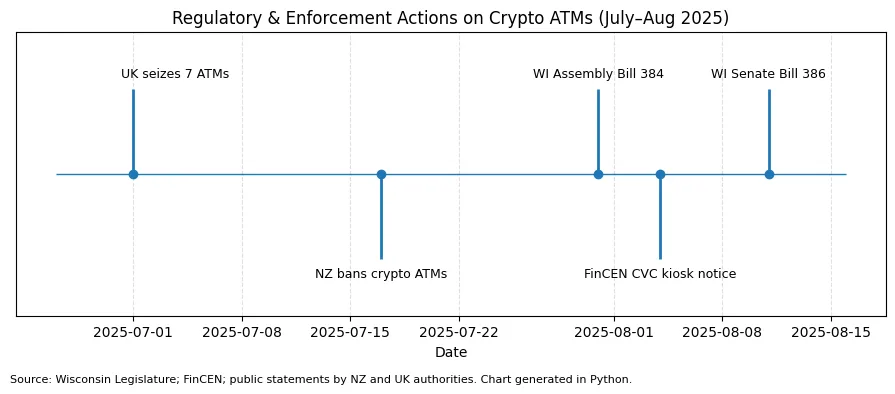

The chart represents the timeline for important regulatory and enforcement activities against cryptocurrency ATMs between July and August 2025. Legislative changes in Wisconsin, a FinCEN warning to financial institutions, and international crackdowns in the United Kingdom and New Zealand all occurred within July and Augustb2025.

FinCEN and global regulators escalate their war on cryptocurrency ATMs

The initiative coincides with a heightened regulatory attention on cryptocurrency ATMs. On August 4, the US Treasury’s Financial Crimes Enforcement Network (FinCEN) advised financial institutions to report suspect cryptocurrency ATM activity, stressing that criminals are increasingly using these machines for fraud, cybercrime, and drug trafficking. FinCEN Director Andrea Gacki warned that the elderly are particularly vulnerable to scammers posing as bank personnel or technical help.

Regulators are tightening their grip around the world as well. In July, New Zealand outlawed all cryptocurrency ATMs, alleging their use in money laundering, while UK officials seized seven machines and arrested people in London on suspicion of unlawful exchange operations. In the United States, Grosse Pointe Farms, Michigan, has even established preemptive local prohibitions despite the lack of cryptocurrency ATMs.