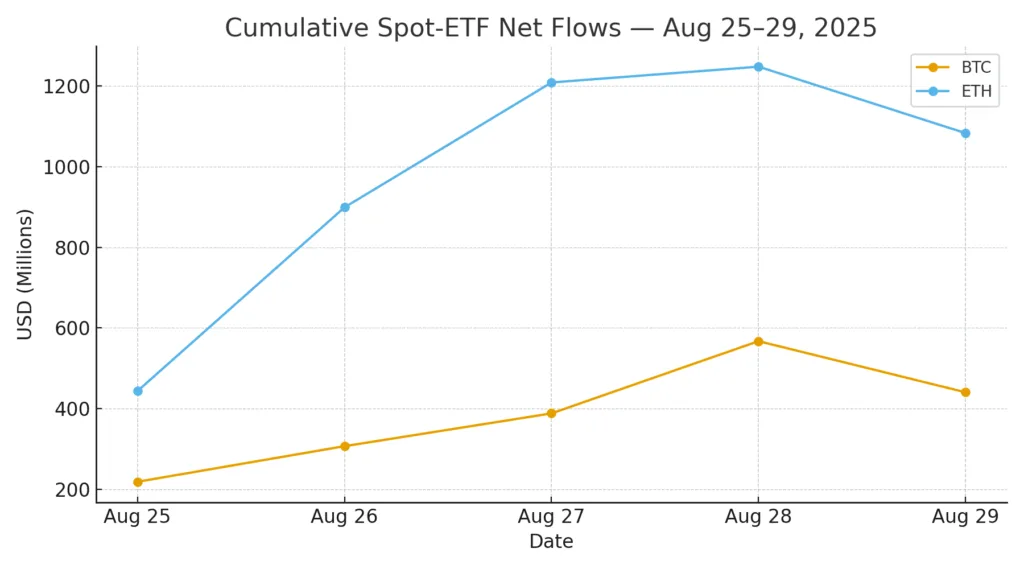

A planned WLFI unlock increased the circulating supply, and crypto ETPs drew in almost $2.5B today. Although there was a late outflow on August 29, five-day spot-ETF flows concluded positively: ETH +$1.08B and BTC +$440.71M

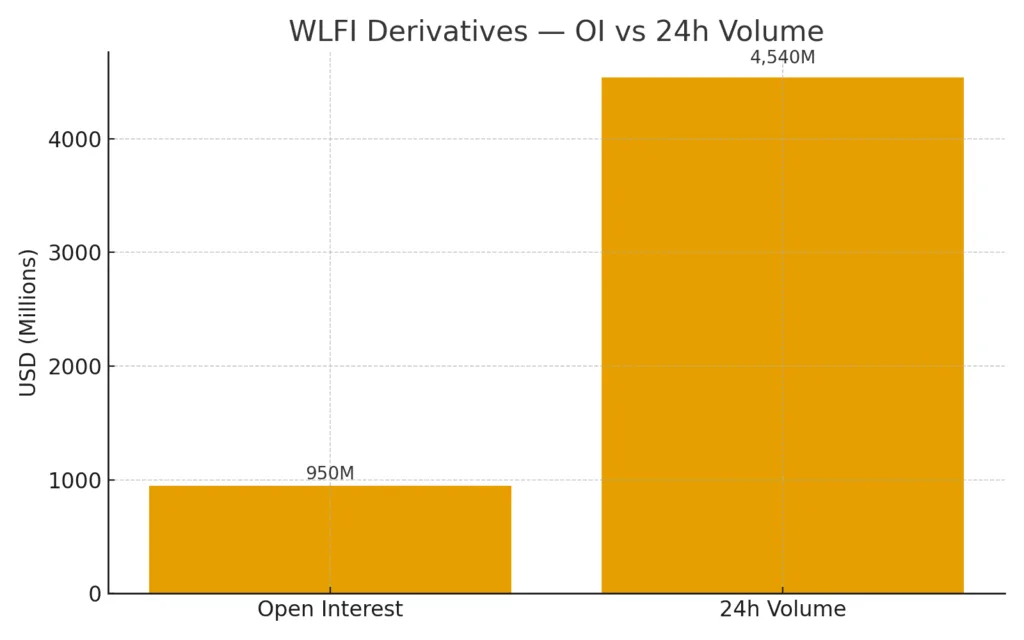

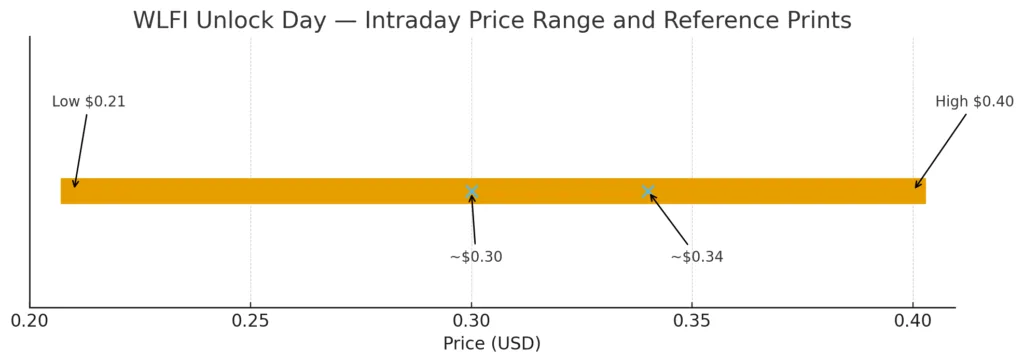

World Liberty Financial carried out its intended unlock, and at current prices, the Trump family’s associated assets are estimated at approximately $5 billion. Leading up to the event, derivatives positioning increased significantly, with open interest nearing $950 million and volumes reaching several billion. Price surged to nearly $0.40 before settling in the low-$0.30s.

Movements deviated from price. Investment products in digital assets saw approximately $2.5 billion in weekly inflows, reversing the outflows of the previous week and indicating that larger investors are still increasing their exposure via exchange-traded vehicles.

Five-day spot-ETF scorecard

Ethereum funds led primary-market demand throughout the five sessions, ending with a net of +$1,082.91 million, whereas Bitcoin concluded with +$440.71 million during the same period.

The rhythm was set from the start: large developments early in the week established the atmosphere, a minor positive result came next, and then one negative day occurred on Aug 29 with BTC at $126.64 million and ETH at $164.64 million as traders reduced risk heading into the weekend. Nonetheless, prior subscriptions more than compensated for Friday’s pullback, ensuring the week remained strongly positive for both groups. The key point is that primary flows continue to provide support despite fluctuations in secondary prices, indicating that larger investors are gradually buying into spot ETFs instead of pursuing upward trends. This context maintains focus on creations/redemptions as the immediate influence on market sentiment; should net creations continue, ETF AUM and underlying liquidity are likely to further increase despite occasional profit-taking.