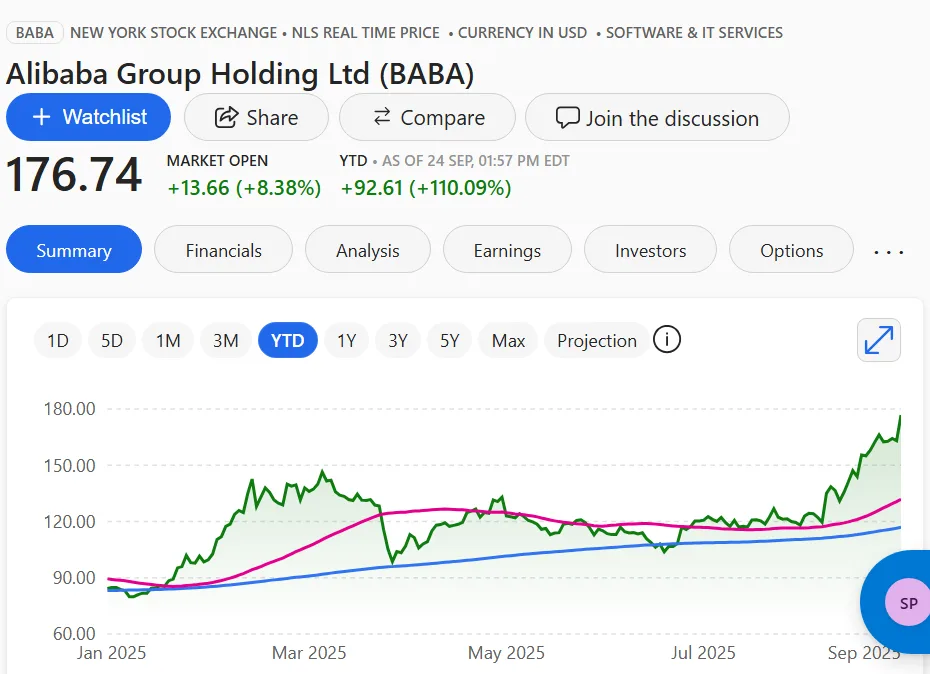

Chinese e-commerce player, Alibaba’s stock leapt sharply following its AI and data center announcement on September 24. The stock hit its highest levels in nearly four years, where its U.S.-listed ADRs jumped about 8–9 % intraday, while its Hong Kong-listed shares surged around 9–10 %.

In Hong Kong, Alibaba’s stock broke past a recent ceiling at ~HK$170 and pushed toward HK$174 territory. Meanwhile, in the U.S,. the stock touched $176.94, inching closer to its 52-week high of $180.16. This rally comes amid a strong YTD run, where it has already more than doubled year-to-date, gaining over 100% in 2025.

Source: MSN Money Watchlist

Analysts quickly responded by lifting price targets; for instance, BofA raised its target from $168 to $195 for the ADR after the news. The stock has finally managed to bounce back after trading sideways for the past 3 years. The slump was caused by government crackdowns and slow growth in China’s economy.

$50 billion AI infrastructure plan

Earlier in the day, Alibaba announced several initiatives around AI, including a new partnership with Nvidia, and plans to open new data centers around the world. It plans to open its first overseas data centers in Brazil, France, and the Netherlands, with additional planned facilities in Mexico, Japan, South Korea, Malaysia, and Dubai over the next 12 months.

Alibaba announced these developments at its Apsara conference in Hangzhou, while introducing its biggest large language model yet, Qwen3-Max, which boasts over 1 trillion parameters and is optimized for autonomous agent capabilities and code generation. Earlier this year, they had also pledged to spend $50 billion on AI infrastructure over the next three years.

Tech firms riding the AI wave

In recent years, tech and cloud/infrastructure stocks have seen increasing volatility tied to AI and data center plays. Some large tech names have already begun to globally diversify their compute footprint to mitigate regulatory, energy, and geopolitical risks.

For Alibaba, cloud was already a growth engine, but the strategy now is to anchor that growth with global AI infrastructure and to compete internationally with U.S. cloud and AI incumbents.