Google parent company Alphabet’s shares have risen by roughly 6% to a record high on Monday, after investment conglomerate Berkshire Hathaway revealed a purchase of 17.85 million shares on Friday, as per a Reuters report.

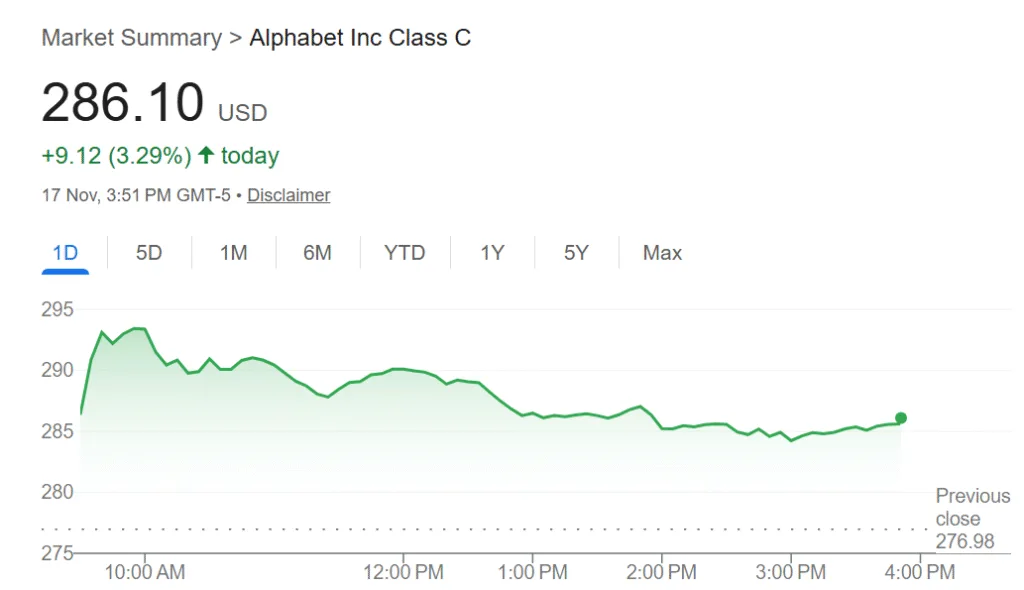

At the time of writing, Alphabet shares were trading at $286.10.

Source: Google Finance

As per the SEC filing, the shares were valued at a total of $4.9 billion. Berkshire Hathaway’s largest publicly traded investments are held in Apple, American Express, Bank of America, Coca-Cola, and Chevron, still making the Alphabet investment a relatively small part of the company’s portfolio.

The new filing shows an uncharacteristic departure from Berkshire’s avoidance of traditional technology stocks. Buffett previously said in an interview with CNBC that he missed out on investing in Google at an early stage, noting the lucrative margins in the business.

“I didn’t know enough about technology to know whether this really was the one that would stop the competitive race,” said Buffett in the interview. He also admitted to missing an early mover opportunity on Amazon, although the latest filing shows Berkshire now owns roughly $2.2 billion worth of its stock.

The update comes a week after Buffett said that he would no longer be writing Berkshire Hathaway’s annual report, saying in a shareholder letter that he will be “going quiet.” Vice Chairman Greg Abel will be assuming CEO responsibilities from the start of 2026.

This will most likely be the last sizeable technology investment made under Buffett’s leadership if no other is made by the end of the year.

Dealmaking activity has been sparse for the company, with only two sizeable transactions: the agreed-upon acquisition of OxyChem for $9.7 billion this year and the acquisition of Allegheny for $11.6 billion in 2022.

The lack of good deals that fit the company’s standards for value investing has created a strong cash pile for the company of roughly $381 billion, as shown in its Q3 2025 report.

At the time of writing, Berkshire Hathaway’s Class B shares were trading at $504.37.

Source: Google Finance

Alphabet secures position as top AI infrastructure stock

Alphabet has gained top-runner status as an AI infrastructure stock, with hedge fund managers pouring investment into the company. It has a reported deal with OpenAI and a $10 billion deal with Meta via Google Cloud for powering AI workloads and LLMs. TD Cowen gave a buy rating for the company with a price target of $335.

The company’s Q3 report showed triple-digit revenues of $102.3 billion, with a strong portion of growth driven by AI integrations across its services. Revenues for Google Services and Google Cloud were estimated at $87.1 billion and $15.2 billion respectively, up by 14% and 34% on a y-o-y basis.

“Our full stack approach to AI is delivering strong momentum and we’re shipping at speed, including the global rollout of AI Overviews and AI Mode in Search in record time. In addition to topping leaderboards, our first party models, like Gemini, now process 7 billion tokens per minute, via direct API use by our customers,” said CEO Sundar Pichai in the earnings release.