The Bank of England (BoE) is reportedly reconsidering its plans to launch a central bank digital currency (CBDC), signaling a potential retreat from the idea of a state-backed digital pound. According to Bloomberg, growing skepticism within the bank and support for private-sector innovation may ultimately lead to scrapping the project.

Governor Andrew Bailey expressed doubts about the necessity of a digital pound during a recent Parliamentary hearing. He emphasized that if commercial banks successfully innovate in the payment space, there may be no need for a public alternative. “If that’s a success, I question why we need to introduce a new form of money,” Bailey said.

Privately, BoE officials have been encouraging traditional banks to accelerate their digital payment strategies rather than relying on the state to introduce central bank digital currency (CBDC) — a government-backed digital version of the pound designed for everyday transactions. This marks a sharp departure from the BoE’s earlier stance in 2023, where it said a digital pound would “likely be needed.”

U.K. trails behind in CBDC development

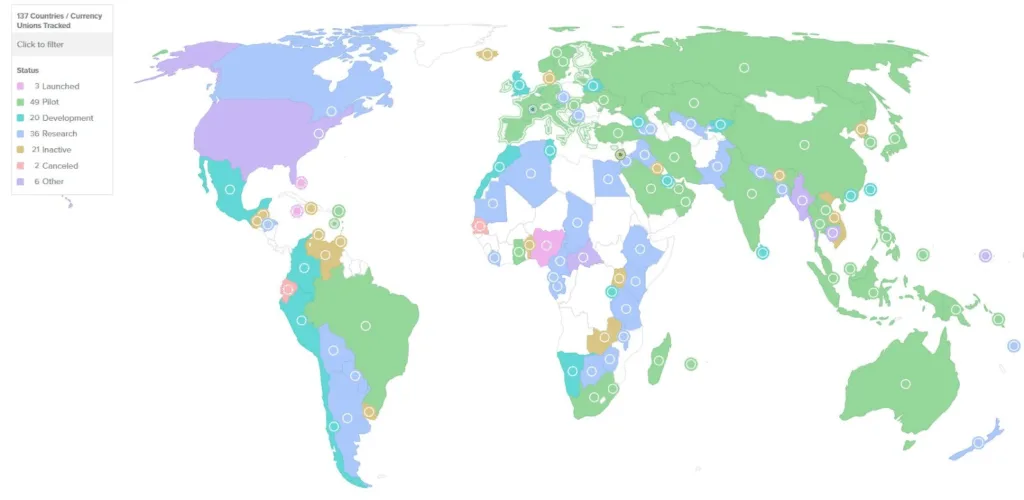

Source: Atlantic Council

The U.K. now lags behind other nations in the global race to develop digital currencies. While countries like the Bahamas, Nigeria, and Jamaica have already launched CBDCs, the U.K. remains in the development phase, according to the Atlantic Council.The proposed digital pound has also faced public backlash, attracting over 50,000 mostly critical comments. Lawmakers have raised concerns about potential bank runs, consumer privacy, and the threat of Big Tech or foreign stablecoins destabilizing the pound.

In contrast, the United States recently passed the Anti-CBDC Surveillance State Act, aimed at blocking the Federal Reserve from issuing a CBDC without congressional approval—highlighting growing global resistance to centralized digital currencies.