Binance asserted that an internal assessment with outside lawyers found no violations of penalties and that it is still meeting its regulatory requirements for monitoring and oversight.

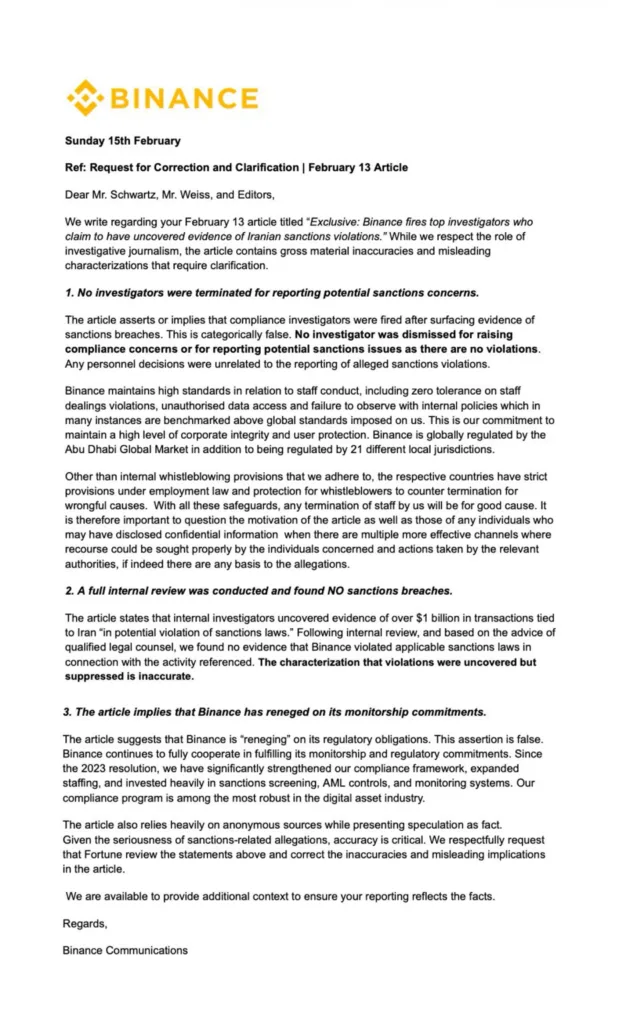

Crypto exchange Binance denied a recent story by Fortune that said the company allowed transactions that broke sanctions against Iran and fired compliance investigators who voiced concerns.

Fortune said on Friday that Binance’s internal investigators found over $1 billion in payments connected to Iranian groups that took place on the site between March 2024 and August 2025. It was alleged that the transactions used Tether’s USDt USDT$1 stablecoin on the Tron blockchain.

The study said that at least five investigators, some of whom had worked in law enforcement, were fired after writing down what they saw. The publication also said that several senior compliance staff had left the organization in the last few months.

In an official reaction, Binance disagreed with the description. “This is just untrue. The exchange sent an email to CEO Richard Teng saying, “No investigator was fired for raising compliance concerns or for reporting possible sanctions issues because there are no violations.”

Source: Richard Teng

Binance says internal review found no breaches

Binance said that after getting outside legal guidance, it did a complete internal assessment and found no proof that it had broken any sanctions laws in connection with the activity in question. It also rejected the idea that constant monitoring caused the exchange to break the rules.

The issue comes at a time when Binance is under greater scrutiny than ever since it settled with US regulators in 2023 for $4.3 billion for breaking anti-money laundering (AML) and sanctions regulations. Changpeng Zhao, the founder, stepped down as CEO and ended up spending four months in jail. Binance also agreed to be watched and vowed to make its compliance efforts tougher.

Binance denied claims that it is not fulfilling its regulatory duties and said that it is still following monitoring and control procedures. The paper states that Binance is “not doing its job” as a regulator. The exchange said, “This claim is not true.”

Financial Times report adds to compliance scrutiny

The Financial Times also said in a December story that Binance let a group of suspect accounts move large amounts of money through the exchange even after settling a criminal case in the US in 2023. The magazine looked at internal data and found that 13 of these user accounts had done roughly $1.7 billion in transactions since 2021, including about $144 million after the plea deal.