Binance bought $300 million worth of Bitcoin for its SAFU reserve. This brought the fund’s total to over $720 million as the exchange moved its emergency buffer to BTC.

On Monday, Binance added another $300 million worth of Bitcoin to its emergency reserves. This is part of its ongoing experiment with a Bitcoin-backed protection fund as markets stay under pressure.

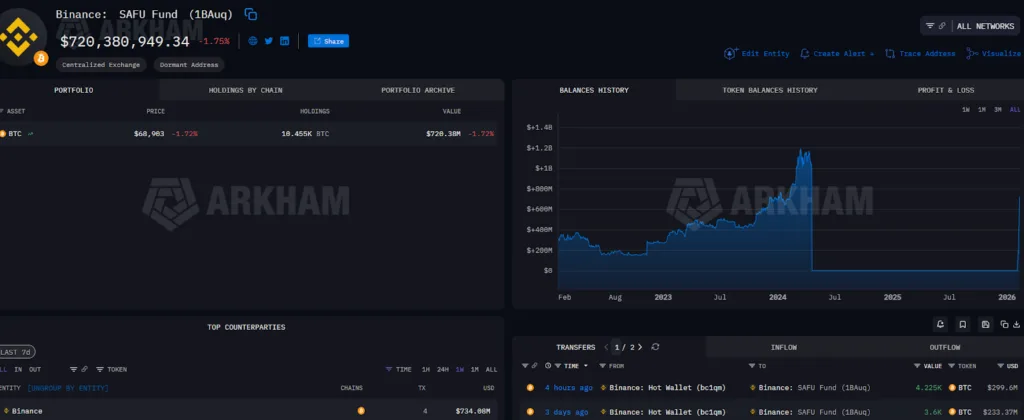

According to Arkham, a blockchain data platform, Binance bought another 4,225 Bitcoin BTC$69,250 worth $300 million for its Secure Asset Fund for Users (SAFU) wallet, which maintains its emergency reserves.

With this purchase, the fund now owns more than $720 million worth of Bitcoin at current pricing.

In a post on X on Monday, Binance said, “We’re still buying #Bitcoin for the SAFU fund, and we hope to finish converting the fund within 30 days of our original announcement.”

Source: Arkham

Confidence signal versus volatility risk

The world’s largest exchange buying Bitcoin shows that they believe in it, but it also puts Binance’s emergency fund at risk of losing value because Bitcoin’s price can change quickly.

On January 30, Binance said it would move $1 billion from its user protection fund into Bitcoin. The company said this was a sign of its belief in Bitcoin’s long-term prospects as the top cryptocurrency.

If the market’s ups and downs caused the fund’s worth to drop below $800 million, Binance stated it would bring it back up to $1 billion.

Market downturn frames the decision

Binance’s fund conversion happens during a bigger fall in the crypto market. On Friday, Bitcoin’s price dropped to $59,930, which is the lowest level it has been since October 2024, before Donald Trump was re-elected as US President, according to TradingView.

Sentiment is very fragile right now, as investors cling to the traditional four-year Bitcoin cycle, which has seen Bitcoin’s price go through a pattern of ‘boom and bust’ in the past.

Smart money positions turn bearish

The greatest traders in the business, known as “smart money,” are still betting on the crypto market to go down.

According to the crypto intelligence platform Nansen, smart money traders added $7.38 million worth of leveraged short positions and were net short on Bitcoin for a total of $109 million.

Most of the biggest cryptocurrencies, except Avalanche (AVAX$8.92), were expected to drop in price by smart money traders. Avalanche had $7.38 million in long holdings.