Bitcoin price took a plunge on Friday, hitting its lowest level in nine months as a mix of macroeconomic uncertainty and rising geopolitical tensions pushed investors away from riskier assets.

Bitcoin’s fall was in tandem with global financial markets seeing a sharp selloff with the risk-off mood spilling onto other altcoins as well.

The dampened sentiments dragged Bitcoin down 7.4 percent in 24 hours to $82,134, according to CoinGecko. Prices, however, staged a modest rebound in later trading hours of Friday.

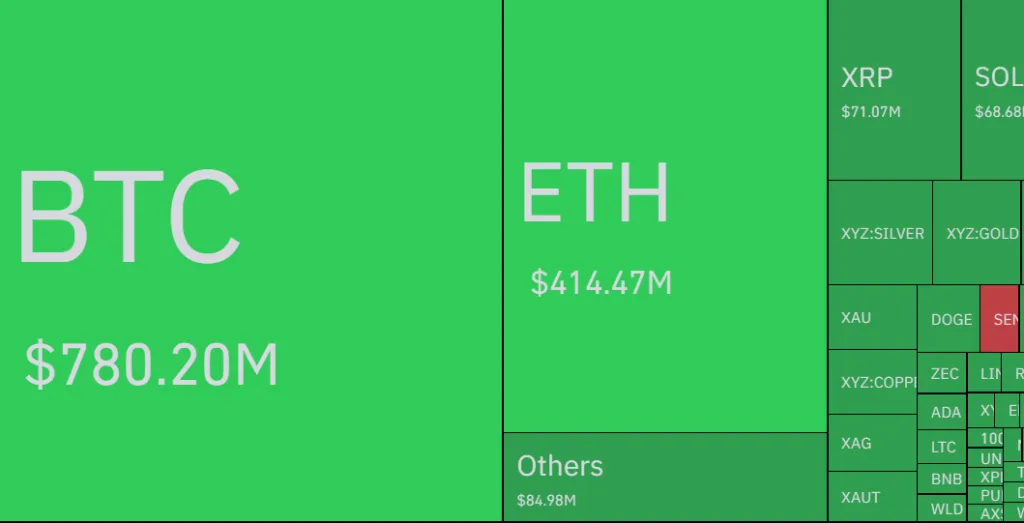

The total crypto market capitalization fell 6.7 percent with the sudden price drop triggered heavy liquidations, wiping out around $1.68 billion in leveraged positions as traders were forced to exit amid heightened volatility and tightening global financial conditions.

On the other hand, the dollar index, which tracks the U.S. dollar against a basket of six other currencies, fell 0.5% from the previous day’s high to trade at 96.54.

Markets retreat as Fed chair uncertainty rattles investors

Markets pulled back as nerves crept in over fresh signals from Washington. Investors hit pause after President Donald Trump said he would soon name his choice for the next Federal Reserve chair, a role that heavily influences interest rates and economic policy.

Nothing has been officially said yet, but according to Reuters, former Fed Governor Kevin Warsh met Trump at the White House on Thursday and reportedly made a strong impression.

With so much riding on who leads the Fed, even the hint of a change was enough to make markets cautious, as traders braced for the possibility of a shift in the direction of U.S. monetary policy.

Additionally, Trump’s national emergency order, which could lead to new tariffs on countries supplying oil to Cuba, added fresh uncertainty just when investors were already on edge.

On top of that, fears of the U.S. getting more directly involved in Iran pushed people to play it safe, pulling money out of riskier assets like crypto and stocks.

Interestingly, the downturn didn’t happen in isolation. The Russia-Ukraine war is still dragging on, tensions in the South China Sea haven’t cooled, and the situation in Iran is heating up.

With so many global pressure points at once, investors hit the brakes, which showed up quickly in the market slide.

Crypto volatility triggers mass liquidations across the market

Over the last 24 hours, the cryptocurrency market witnessed a major wave of liquidations, with a total of 266,661 traders being liquidated from the market due to the rapid change in prices.

The total value of the liquidations stood at $1.68 billion, which shows how unstable the market is at the moment.

The HTX platform had the biggest liquidation order, that too for a BTC-USDT position worth $80.57 million and was done with just one order.

Usually, these kinds of liquidations happen when prices change quickly, which causes stop-outs for positions that are too leveraged. The liquidations then cause the market to become even more volatile by creating a feedback loop.