The digital asset custodian’s rocky start shows how investors’ feelings are changing and how closely fresh listings are being watched as crypto markets try to get back on track.

Since BitGo Holdings (BTG) went public on the New York Stock Exchange on Thursday, its stock has gone up and down a lot. Early gains rapidly turned into losses as excitement about the IPO faded and investors tried to lock in profits.

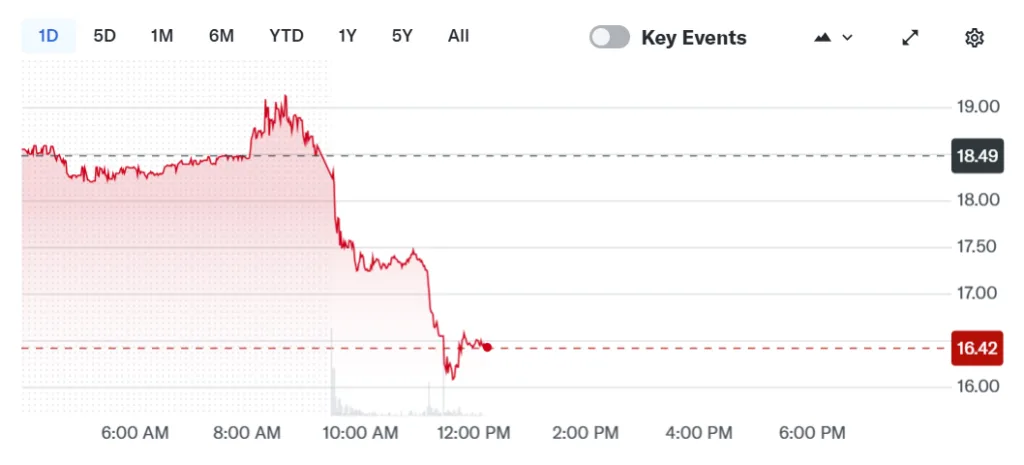

BitGo set the price of its initial public offering (IPO) at $18 a share. The stock experienced a 25% increase on the first day of trading, indicating a significant amount of demand immediately. The stock only went up a little bit in its first full session, but the surge didn’t last long.

According to Yahoo Finance data, shares have dropped below their IPO price and fell as much as 13.4% on Friday.

Source: Yahoo Finance

Factors driving post-IPO volatility

The volatility appears to be the result of a small public float, which is the norm for newly listed businesses; profit-taking after the first day’s significant increase; and a general lack of clarity regarding crypto-related equities, which have been known to experience significant price fluctuations as investors’ sentiments fluctuate.

The company initially said it wanted to go public in September 2025, when it sent documents to the US Securities and Exchange Commission. BitGo, which offers infrastructure and custody services for digital assets, says that its platform has more than $90 billion in assets.

Crypto IPO activity continues despite market pressure

Despite ongoing market challenges, several well-known cryptocurrency companies are said to be looking into going public, which shows that long-term investors still have faith in the system.

The Financial Times said this week that Ledger, a company that makes hardware wallets, is thinking about going public in the US with a value of more than $4 billion.

Kraken, a digital asset exchange, recently received $800 million at a $20 billion valuation, which has sparked new speculation regarding a potential IPO.The company is not in a hurry to go public, according to co-CEO Arjun Sethi.

But the performance of recent IPOs has been inconsistent. Bloomberg data shows that stocks of companies that went public in 2025 have done worse than the S&P 500. Mid-sized public listings have had the hardest time.

The most important thing to remember is that we are back in a market driven by fundamentals. Investors are being much more picky, and companies need to have a better story and clearer operational direction when they enter the market.