During last week’s market crash, Tom Lee-backed BitMine added more than 40,000 ETH to its Ether treasury, doubling down on its strategy even though it had billions of dollars in unrealised losses.

During last week’s market correction, Ether treasury business BitMine Immersion Technologies considerably raised its ETH holdings. This shows that the company is still confident in its long-term strategy, even if it has been losing money.

Treasury composition and operating resilience

The corporation reported Monday that it acquired 40,613 Ether (ETH) at $2,123 last week, raising its overall holdings to more than 4.326 million ETH, worth around $8.8 billion at current prices.

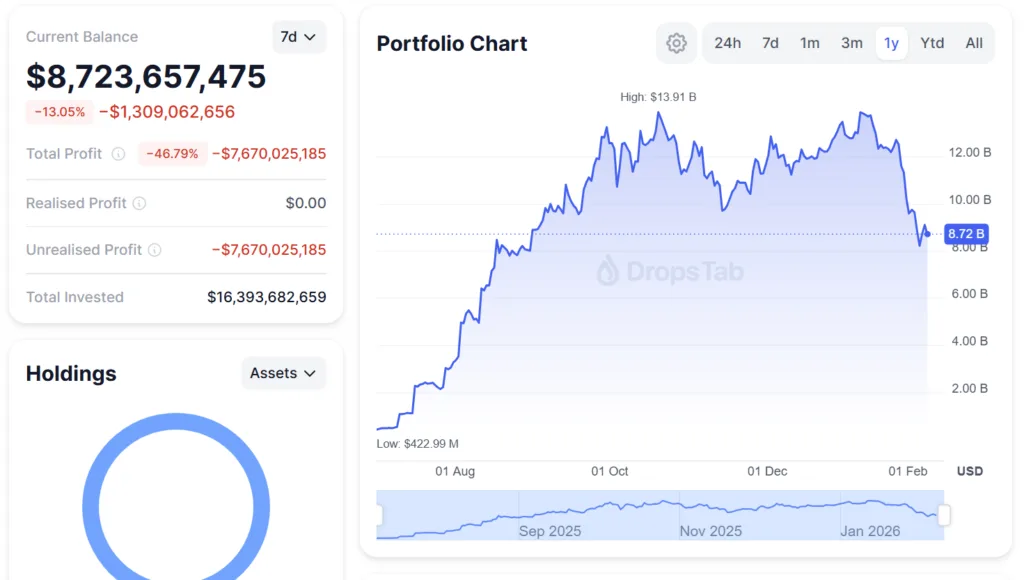

Despite the increase, BitMine is currently well underwater on its Ether position, according to DropsTab data.

A considerable chunk of its holdings, 2,873,459 ETH, is staked on the Ethereum network. Staked ETH is locked to help safeguard the blockchain and, in return, earns staking rewards paid in extra Ether, giving the enterprise a yield-based revenue stream.

The corporation announced Monday that the value of its crypto, total cash holdings and “moonshots” is $10.0 billion. It concluded the November 2025 quarter with digital assets worth $10.6 billion, according to a filing.

Although BitMine’s treasury policy has garnered criticism, the business continues to earn operating cash flow via Ethereum staking awards and from its traditional immersion-cooled data centre operations, which provide infrastructure services for high-performance computing.

BitMine chairman Tom Lee, co-founder and chief investment officer of Fundstrat Global Advisors, has defended the plan, stating that the company is structurally built to monitor the price of Ether. As a result, its portfolio and equity performances are projected to worsen during broader market downturns and recover with ETH price rises.

That volatility has been mirrored in BitMine’s stock. Shares are down more than 31% over the previous month and almost 60% over the past six months.

ource: DropsTab

Industry-wide pressure amid liquidation-driven sell-offs

Ether’s price, along with the broader crypto market, has been pummelled by huge liquidations since an October flash crash sparked approximately $19 billion in forced sell-offs. Prices have been in a sustained downturn since then, with selling pressure intensifying in numerous waves through November and again in late January.

Even so, most Ether treasury firms have thus far resisted selling into weakness. Industry data shows that while no company other than BitMine Immersion Technologies has added Ether over the previous 30 days, the more than two dozen firms holding ETH on their balance sheets have mostly maintained their positions.

The lone exception was Quantum Solutions, which offloaded around 600 ETH over the same period, according to CoinGecko.