- 21Shares files with SEC for an ETF tracking the native token of Ondo Finance, ONDO

- Ondo Finance focuses on institutional-grade tokenized real-world assets (RWAs)

- Trump-backed DeFi platform, World Liberty Financial, holds ONDO tokens as part of its portfolio

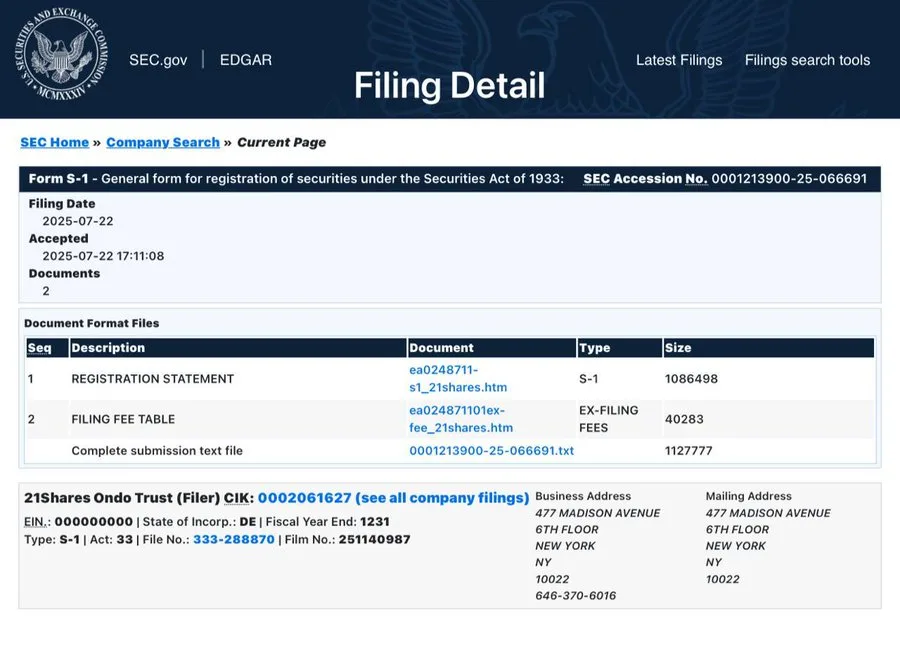

21Shares, a leading exchange-traded fund (ETF) issuer, has filed with the US Securities and Exchange Commission (SEC) for a new product that will track the spot price of Ondo, the native token of Ondo Finance. The ETF, named 21Shares Ondo Trust, will be the first of its kind to offer direct exposure to the Ondo (ONDO) token through CME CF Ondo Finance-Dollar Reference Rate.

The filing, made on Tuesday, proposes a passive investment vehicle with no speculative features or leverage. The ETF will directly hold ONDO tokens, which will be custodied by Coinbase. Authorized participants can buy and redeem shares in either cash or in-kind, making it a flexible option for investors.

This ETF comes as Ondo Finance is gaining traction within the decentralized finance (DeFi) sector, particularly for its focus on institutional-grade tokenization of real-world assets (RWAs) through Ondo Chain, its Layer-1 blockchain.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Source: sec.gov

The ONDO token is the native utility token of the Ondo Chain, which serves as a blockchain for institutions looking to tokenize real-world assets such as private credit and US Treasurys. As of now, ONDO holds a market capitalization of $3.5 billion, with a circulating supply of 3.1 billion tokens out of a total supply of 10 billion tokens.

Currently priced at $1.12, the token is down 48% from its all-time high of $2.14 reached in December, according to data from CoinGecko.

Trump family’s ties to Ondo finance and ONDO token

In addition to 21Shares’ application, Ondo Finance has garnered backing from World Liberty Financial, a DeFi platform associated with the Trump family. World Liberty Financial invested in ONDO tokens in December 2024, purchasing $250,000 worth of tokens at the time. The platform currently holds 342,000 ONDO tokens, which are valued at approximately $383,000, according to data from Nansen.

However, World Liberty’s ONDO holdings represent only 0.2% of its overall $208 million portfolio, which is predominantly composed of stablecoins, wrapped Ether (ETH), and Bitcoin (BTC).

Ondo finance’s institutional strategy and RWA tokenization

Earlier this month, Ondo Finance made headlines by acquiring Oasis Pro, a SEC-registered broker-dealer and Alternative Trading System (ATS). The acquisition, along with a strategic partnership with Pantera Capital, aims to advance tokenized securities and RWAs. Oasis Pro’s ability to manage the ownership of tokenized securities is expected to streamline the transition to fully tokenized financial markets.

In February, Ondo Finance announced Ondo Chain, a Layer-1 blockchain designed specifically for Wall Street institutions to tokenize real-world assets. This move further solidifies the company’s position as a key player in the growing RWA tokenization space.

RWA tokenization surges in 2025

The value of tokenized real-world assets (RWAs) has soared by 58% this year, reaching nearly $25 billion, according to RWA.xyz. Ethereum, which holds a dominant 55% market share of tokenized assets, continues to lead the way in providing a platform for RWA tokenization.

As interest in RWA tokenization grows, Ethereum remains the primary blockchain for issuing tokenized assets, while newer blockchains like Ondo Chain are making strides to attract institutional clients. The filing of the 21Shares ONDO ETF reflects the increasing mainstream acceptance of decentralized finance and institutional interest in blockchain-powered assets.