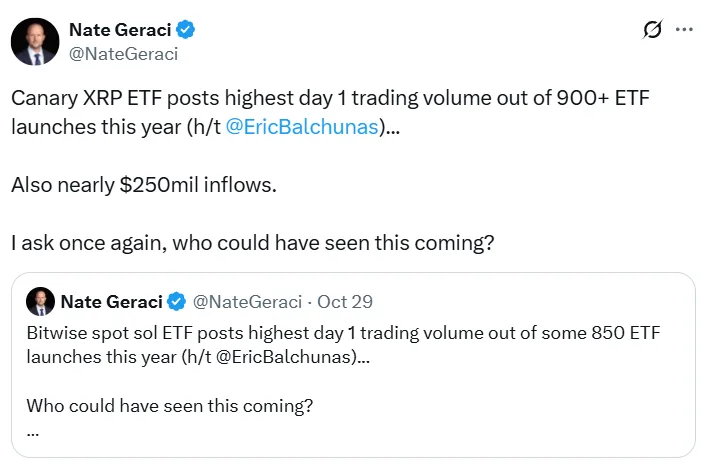

The Canary Capital XRP ETF made a strong entrance into the market, closing its first trading day with $58 million in volume and generating over $250 million in inflows, Bloomberg ETF analyst Eric Balchunas reported via X on Thursday.

Analyst Nate Geraci noted that the in-kind creation model contributed to the discrepancy between inflows and trading volume. This model allows investors to create or redeem ETF shares directly through underlying XRP tokens, rather than cash transactions. The US Securities and Exchange Commission (SEC) approved in-kind creation and redemption for crypto ETFs on July 29, 2025.

Source: Nate Geraci

Smart money traders show renewed confidence in XRP

The ETF debut has prompted a bullish rotation among top-performing traders, tracked as “smart money” on the crypto intelligence platform Nansen.

In the 24 hours following the launch, these traders added $44 million in net long XRP positions, while remaining net short on Solana (SOL$138.81) with $55 million in cumulative short positions on the decentralized exchange Hyperliquid.

XRP is holding near $2.30, showing relative stability but still feeling the effects of declining liquidity and cautious investor sentiment. For now, the setup looks like a healthy reset, with both SOL and XRP well-positioned to lead the next wave once confidence returns.

Bitcoin ETFs continue to face outflows

While XRP saw strong inflows, spot Bitcoin ETFs experienced $866 million in outflows on Thursday, marking the second-worst daily performance of 2025. The previous record was $1.14 billion in outflows on February 25, according to Farside Investors.

The contrasting flows highlight a shift in investor sentiment, as top traders pivot from traditional crypto ETFs toward promising altcoin offerings like XRP.