As part of Gitex 2025, Future Blockchain Summit, a high-profile panel convened to unpack a bold question: What role is the UAE playing in the global asset tokenization race?

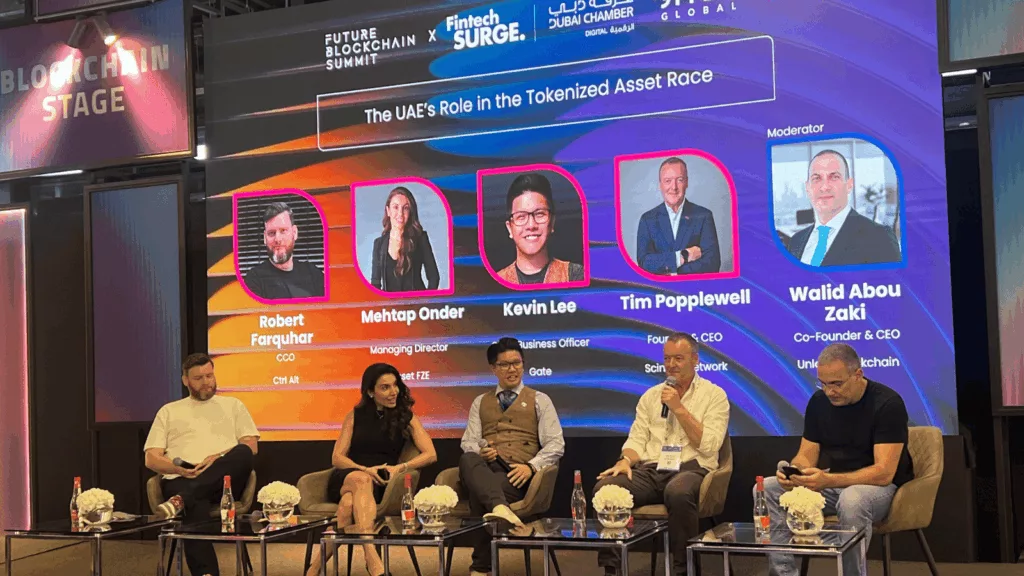

Moderated by Walid Abou Zaki of Unlock Blockchain, the panel was represented by Tim Popplewell of Scintilla, Mehtap Önder of Fasset FZE, Kevin Lee, CBO of Gate, and Robert Farquhar of Ctrl Alt. The panel probed how the UAE is not just experimenting but seeking lasting credibility in the asset tokenization arena.

From pilot projects to legal rights for investors

Robert Farquhar drew attention to the DLD pilot project, saying the core goal is investor security. “With tokenization, there are ample opportunities for malpractice; sometimes, issuers of tokens may not hold any rights to the underlying asset. DLD gave investors the legal rights to claim or own that asset.” The panel emphasized that mere technical tokenization is insufficient; token holders must have legal recourse and real ownership.

Beyond hype, the need for access and inclusion

Mehtap Önder pushed the narrative beyond technology. She said tokenization should be used as a tool for financial inclusion, especially in emerging markets (EMs). “We are trying to give people access to traditional finance through tokenization. It is not innovation that is the challenge, but the opportunity is to get access.” Kevin Lee from Gate argued that distinguishing between a hype project and a real one depends heavily on whether there’s demand for the underlying asset; fractional ownership must rest on assets people actually value.

Real-world tokenization as an asset class

Farquhar warned about investment without exit: “If you invest in an asset and you cannot exit … you are not investing.” The DLD project’s earlier exit window was only once every six months, which was seen as too slow; tokenization can enable constant, 24/7 trade in secondary markets. However, off-plan real estate tokenization presents valuation risks; Farquhar cautioned against skipping valuation phases, which could distort pricing and investor expectations.

Tim Popplewell gave a fitting anecdote stating, “You may lay the tracks, but if nobody trusts the train, then you’re in trouble”. He said the same would apply to digital assets. The panel noted recent enforcement actions by VARA (fines for non-compliant parties) as building confidence. Moreover, the DLD tokenization is positioned as a possible blueprint for global expansion.

UAE’s outlook vs other markets

When asked about how the UAE compares to Singapore ot Hong Kong in the race for RWA tokenization? Popplewell downplayed competition, stating that “It’s not a competition, it’s more of a collaboration.” Still, Kevin Lee said the UAE’s timezone, regulatory openness, and talent makes it stand out.

In the next year, the panel foresees progress in stablecoins, payment rails, real estate, and regulatory harmonization. There was a chorus that the framework for tokenization should be cohesive and that businesses would want all countries to work on similar models, so everyone can progress together.