Google Cloud is currently in the process of creating its native Layer-1 blockchain dubbed the Google Cloud Universal Ledger (GUCL). At a time when large scale conglomerates are also working to develop their own native blockchains, a senior official from Google Cloud shared insights into the initiative.

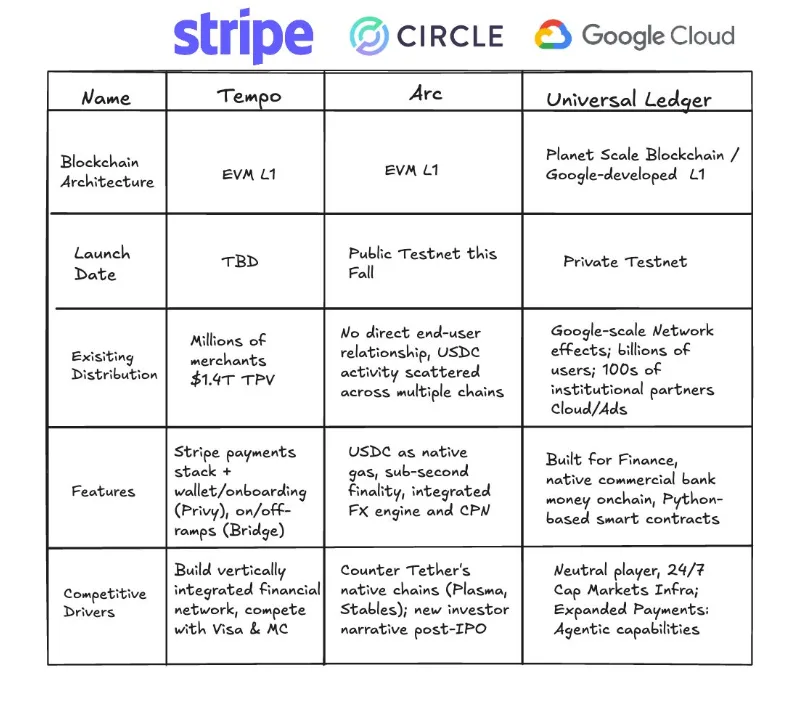

Rich Widmann, the head of Web3 strategy at Google Cloud, shared a post on LinkedIn comparing the under-development GUCL to those being designed by Stripe and Circle respectively named Tempo and Arc.

On his LinkedIn post, Widmann described the GUCL as a Google-developed “planet scale blockchain” capable of executing Python-based smart contracts. Temp and Arc, on the other hand, will be EVM L1 chains which will be able to facilitate smart conrtacts on the Ethereum network.

He went on to highlight that the GCUL is being built to support finance and native commercial banks to support money onchain.

“Besides bringing to bear Google’s distribution, GCUL is a neutral infrastructure layer. Tether won’t use Circle’s blockchain – and Adyen probably won’t use Stripe’s blockchain. But any financial institution can build with GCUL,” Widmann’s post said.

Comparing the distribution statistics of the three different blockchains, Google estimates that soon the GUCL would open experimental doors for “billions of users” as well as “hundreds of institutional partners” to support services like Cloud and ads.

Among competitive drivers, Widmann attested that the GUCL would establish itself as a neutral player — neither integrated with existing financial systems nor aimed at countering the native chains of other networks. The blockchain will also come with agentic capabilities.

“GCUL brings together years of R&D at Google to provide financial institutions with a novel Layer 1 that is performant, credibly neutral and enables Python-based smart contracts. We’ll be releasing more technical details in the coming months,” the post noted.

Source: LinkedIn/ Rich Widmann

Google Cloud’s work on the GCUL was first publicly announced in March 2025, in a partnership with CME Group, which is one of the largest derivatives marketplaces. The L1 will undergo assessment on a private testnet before going live.