Crypto mining firm MARA Holdings has posted a strong second-quarter performance, with revenues jumping 64% year-on-year to $238 million, exceeding analyst expectations of $223.7 million. The revenue surge comes as Bitcoin prices appreciated by 31% during the quarter, helping to drive the firm’s increased profitability.

MARA’s net income saw a remarkable 505% surge compared to Q2 2024, rising to $808 million, compared to a loss of nearly $200 million in the same period last year. The huge income increase is largely attributed to a $1.2 billion unrealized gain from Bitcoin appreciation over the three-month period ending June 30.

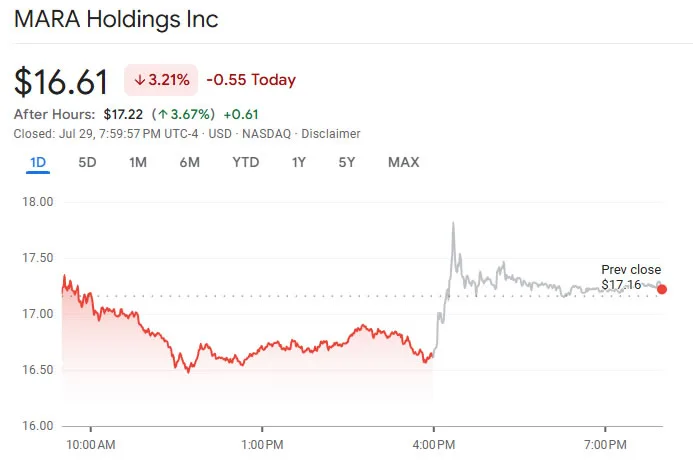

MARA shares rise in after-hours trading

Following the earnings release, MARA’s share price surged 7.5% in after-hours trading, reaching a high of $17.82 before stabilizing at $17.22. Although shares closed down 3.2% on Tuesday at $16.61, MARA’s stock has still gained 58% since mid-April, despite trading largely sideways for most of the year.

MARA also revealed that its Bitcoin holdings surpassed 50,000 BTC shortly after the end of Q2, cementing its place as the second-largest corporate holder of Bitcoin, behind MicroStrategy. The firm mined 2,358 BTC during Q2, a 3% increase from the previous quarter, and its hashrate grew by 6%, reaching 57.4 exahashes per second (EH/s).

As of the end of June, MARA’s Bitcoin holdings totaled 49,951 BTC, worth approximately $5.3 billion. With total assets now valued at $5.87 billion, the firm is positioned to leverage its growing Bitcoin treasury, which is only behind MicroStrategy’s massive 607,770 BTC.

Source: Google Finance

Strategic focus on AI infrastructure growth

In addition to its Bitcoin investments, MARA announced partnerships with Google-backed TAE Power Solutions and LG-backed PADO AI. These collaborations aim to develop grid-responsive, load-balancing platforms for next-generation AI infrastructure.

MARA has set a target of reaching 75 EH/s by the end of the year, with plans to tap into the expanding AI and data center market. CEO Fred Thiel highlighted the company’s vertically integrated mining operations, substantial BTC treasury, and growing international energy partnerships as key drivers for future value.