Mega Matrix, a small-cap publicly traded holding company, is doubling down on digital assets. The company filed a $2 billion shelf registration with the U.S. Securities and Exchange Commission (SEC) to fund a stablecoin-focused treasury strategy, signaling its intention to capture yield from emerging crypto ecosystems.

The filing targets the Ethena stablecoin ecosystem, with proceeds aimed at accumulating Ethena’s ENA governance token (ENA). Mega Matrix plans to leverage ENA to gain exposure to revenue generated by Ethena’s synthetic stablecoin, USDe, while also securing influence over the protocol’s governance.

A shelf registration allows a company to register securities for future issuance, giving it the flexibility to sell portions of stock over time rather than all at once. In this case, Mega Matrix emphasized that the strategy is exclusively on ENA, concentrating influence and yield in a single digital asset.

Strategic focus on ENA and synthetic stablecoins

Rather than holding USDe directly, Mega Matrix intends to accumulate ENA, which benefits from Ethena’s “fee-switch” mechanism — an on-chain feature that distributes a portion of protocol revenues to ENA holders once activated.

The company cited trends such as the rise of Circle, a leading stablecoin issuer, and growing adoption of digital asset treasury strategies as motivating factors. It also noted the US GENIUS Act, which prohibits stablecoin issuers from paying yield directly to holders, has ironically fueled demand for synthetic, yield-bearing alternatives like USDe.

Precisely because the GENIUS act banned issuers from providing yield directly to holders, investors are turning to yield-bearing stablecoins or staked stablecoins to get yield.

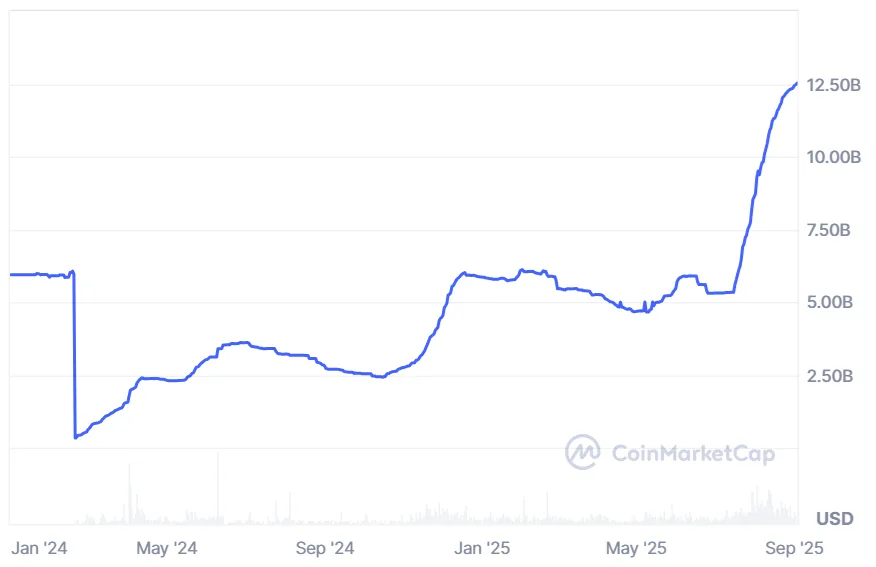

Source: CoinMarketCap

How Ethena differs from traditional stablecoins

Ethena’s USDe differs from fiat-backed stablecoins like USDC or USDT. It is a synthetic stablecoin that maintains its dollar peg through collateral hedged with perpetual futures contracts, enabling the protocol to generate yield from funding rates in derivatives markets.

Despite being smaller than its collateralized rivals, Ethena’s growth has been notable:

- Cumulative gross interest revenue: $500 million (as of August)

- Market capitalization of USDe: $12.5 billion, making it the third-largest stablecoin globally

Digital asset treasury strategies gaining traction

Mega Matrix’s $2 billion filing is exceptionally large relative to its $113 million market capitalization.

- Revenue: $7.74 million

- Net losses: $2.48 million

The firm’s core business remains FlexTV, a short-form streaming platform, but it has been gradually pivoting toward digital asset holdings, including a $1.27 million Bitcoin purchase in June.

Mega Matrix is part of a broader trend among smaller companies experimenting with digital asset treasury strategies. Notable examples include:

- ETHZilla: Accumulated hundreds of millions in Ether

- BitMine Immersion Technologies, SharpLink Gaming, Bit Digital: Diversified into corporate crypto treasuries

Risks of digital asset treasury strategies

Despite the potential upside, experts warn of significant risks. There’s this aspect where people take what is a pretty sound product, a mortgage back in the day or Bitcoin and other digital assets today, for example, and they start to engineer them, taking them down a direction where the investor is unsure about the exposure they’re getting.

Mega Matrix’s move reflects both the opportunities and complexities of adopting digital asset treasury strategies, highlighting the fine balance between yield generation and risk exposure in corporate crypto holdings.