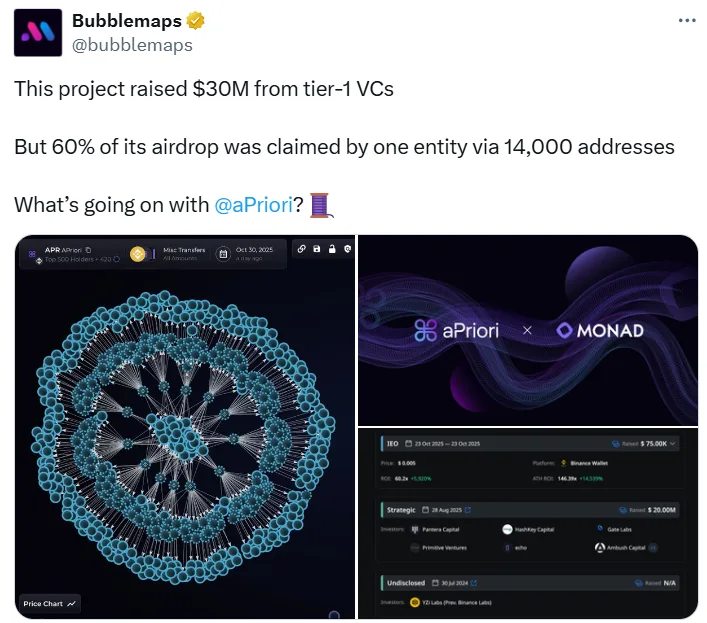

Web3 startup aPriori has come under scrutiny after blockchain analysts highlighted unusual patterns in its latest token airdrop. According to analytics platform Bubblemaps, a single entity claimed nearly 60% of the APR token airdrop through 14,000 interconnected cryptocurrency wallets.

The wallets were initially funded with 0.001 BNB each from Binance and subsequently transferred their APR allocations to new addresses, Bubblemaps reported. The entity continues to fund fresh wallets in an apparent attempt to claim additional tokens, according to a Nov. 11 post on X.

Source: Bubblemaps

Background on aPriori and the Airdrop

APriori launched its airdrop claim on Oct. 23, shortly before the BNB Chain-native token’s market capitalization surpassed $300 million. The airdrop allocated roughly 12% of the total APR supply to participants.

Founded in 2023 by former quant traders and engineers with experience at Coinbase, Jump Trading, and Citadel Securities, the San Francisco–based startup raised $20 million in August to expand its trading infrastructure platform. Investors included Pantera Capital, HashKey Capital, and Primitive Ventures, bringing its total funding to $30 million.

Silence Raises Questions About Transparency

APriori has not publicly addressed the allegations. Since announcing the airdrop claim, the company’s official X page has posted only one unrelated update.

Still no reply from the co-founder; the way they have given zero transparency makes them look no different from scammers,” commented on-chain researcher ZachXBT on X.

While the concentration of tokens raises suspicions of insider activity, analysts caution that it could also reflect a professional airdrop farming strategy. Airdrop farmers use multiple wallets to maximize rewards from emerging protocols, often engaging in highly coordinated transactions. For reference, Arbitrum’s 2023 ARB airdrop saw hunters consolidate $3.3 million worth of tokens from 1,496 wallets into just two main wallets.