Crypto venture capital firm Pantera Capital has announced a $300 million investment into companies operating crypto treasuries, positioning these digital asset treasuries (DATs) as potentially higher-yielding alternatives to crypto exchange-traded funds (ETFs). Pantera’s general partner, Cosmo Jiang, and content head, Erik Lowe, explained that DATs can increase net asset value per share, translating into more token ownership over time than simply holding tokens directly or through an ETF.

The investments span multiple countries and tokens, including Bitcoin, Ether, and Solana. Pantera noted that these DATs are strategically using their unique positions to grow holdings in a per-share accretive manner.

Source: Pantera

BitMine set as example of success

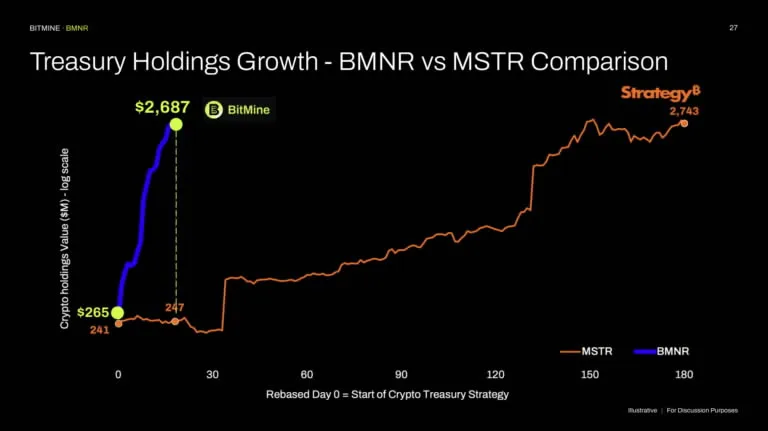

Pantera highlighted BitMine Immersion Technologies, chaired by Tom Lee, as a prime example. In just two and a half months, BitMine has become the largest Ether treasury company globally and ranks third among public companies for crypto holdings, managing nearly 1.2 million ETH worth about $5.3 billion. The company aims to acquire 5% of Ethereum’s total supply and uses strategies like stock issuance at premiums, convertible bonds, staking rewards, and DeFi yields to grow tokens per share.

The success is evident in BitMine’s stock, which has surged over 1,300% since initiating its ETH buying strategy in June, compared with an 89% increase in Ether over the same period. Institutional investors backing BitMine include Stan Druckenmiller, Bill Miller, and ARK Invest.

Risks remain for crypto treasuries

Despite optimism, experts caution that crypto treasury companies face significant risks. Ethereum co-founder Vitalik Buterin warned that overleveraging could lead to failure if mismanaged. Similarly, analysts at Standard Chartered noted that Bitcoin treasury firms could face trouble if prices decline sharply. Framework Venture’s Vance Spencer also highlighted that much of the ETH accumulated by treasuries will be deployed in on-chain borrow markets, potentially increasing exposure to market volatility.

Pantera remains confident that high-quality DATs, like BitMine, could attract broader institutional interest, delivering returns that surpass traditional ETFs and spot holdings.