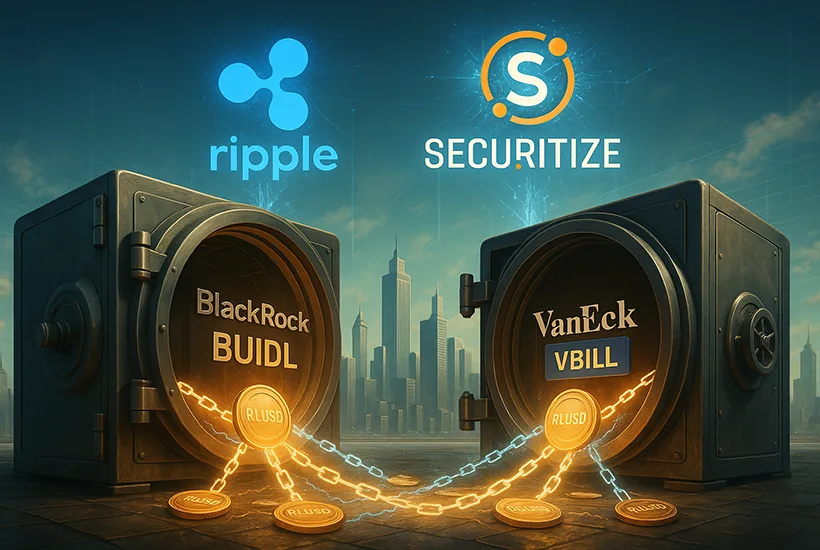

Ripple, a leading digital asset infrastructure provider for financial institutions, and Securitize, a top platform for tokenizing real-world assets, have announced a new smart contract enabling holders of BlackRock’s BUIDL and VanEck’s VBILL tokenized funds to exchange their shares for Ripple USD (RLUSD).

The contract provides an additional stablecoin off-ramp for these tokenized short-term treasury funds. Investors can now access RLUSD 24/7, maintaining exposure to on-chain yield while leveraging decentralized finance strategies. RLUSD is immediately available for BUIDL holders, with support for VBILL expected in the coming days.

Expanding institutional stablecoin utility

Jack McDonald, SVP of Stablecoins at Ripple, emphasized the importance of this integration:

Making RLUSD available as an exchange option for tokenized funds is a natural next step as we continue to bridge traditional finance and crypto. RLUSD is for institutional use, offering regulatory clarity, stability, and real utility.

RLUSD is purpose-built for enterprise applications, offering regulatory compliance, transparency, and high-speed financial operations. Its integration with Securitize represents the first deployment on the platform, with further assets and use cases planned. Securitize is also incorporating XRP Ledger (XRPL) functionality to enhance liquidity and accessibility across the ecosystem.

Partnering with Ripple to integrate RLUSD into our tokenization infrastructure is a major step forward in automating liquidity for tokenized assets. Together, we’re delivering real-time settlement and programmable liquidity across a new class of compliant, on-chain investment products.

Institutional safeguards and adoption

RLUSD maintains 1:1 USD backing with high-quality liquid assets, strict reserve management, asset segregation, and third-party attestations. It is issued under a New York Department of Financial Services (NYDFS) Trust Company Charter, ensuring robust regulatory oversight.

Since its launch in late 2024, RLUSD has been adopted across DeFi platforms and liquidity pools, integrated into Ripple’s cross-border payments, and supports seamless on- and off-ramps in the crypto ecosystem. It has surpassed $700 million in market capitalization, demonstrating growing institutional adoption.