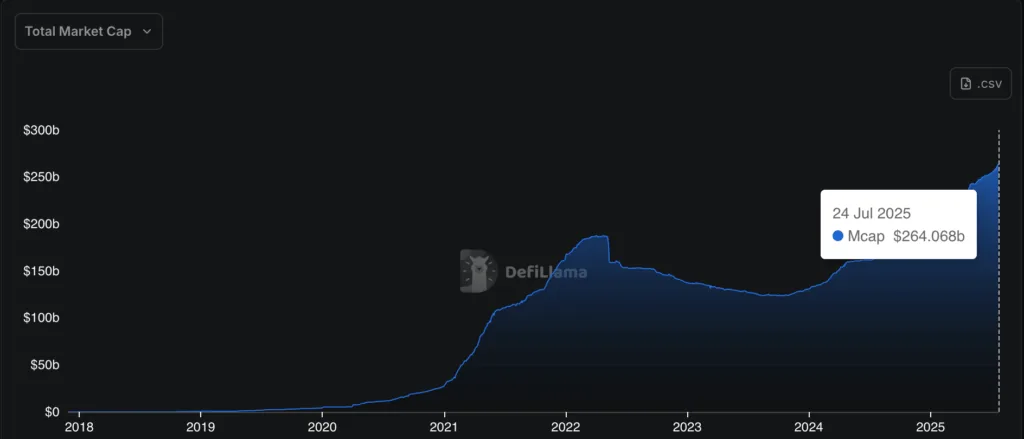

The GENIUS Act, signed into law just days ago, is already having significant effects on the stablecoin market. In just one week following its enactment, the market cap for stablecoins surged by nearly $4 billion, pushing the total market cap above $264 billion. This growth signals a substantial shift in the crypto industry, fueled by the regulatory clarity provided by the legislation, which paves the way for banks, asset managers, and other institutional investors to participate in the stablecoin market without facing the uncertainty of enforcement actions from the Securities and Exchange Commission (SEC).

With clear guidelines in place, capital inflows are expected to continue, attracting new players and intensifying competition in the space. Coinbase CEO Brian Armstrong stated in May that banks entering the market wouldn’t be a concern, and that everybody should be able to create stablecoins. As the market grows, attention is now shifting toward the design of stablecoins and the institutions backing them.

Source: DefiLlama

Fiat-backed stablecoins remain dominant

Stablecoins come in different types, but fiat-backed stablecoins continue to dominate the market, representing approximately 85% of the total supply. These coins are pegged 1:1 to a fiat currency, such as the U.S. dollar, and are backed by reserves like cash or short-term assets, such as U.S. Treasurys. The largest players in this category are USDt (Tether) and USD Coin (USDC), with a combined market capitalization exceeding $227 billion.

The GENIUS Act targets these stablecoins specifically, requiring issuers to hold full reserves, undergo regular audits, and be properly licensed to comply with the new regulatory framework. This will likely increase investor confidence and further solidify the role of fiat-backed stablecoins in the market.

New entrants flood the stablecoin space

Since the passage of the GENIUS Act, an increasing number of businesses, banks, and institutions have entered the stablecoin market, eager to leverage the newfound regulatory clarity. On July 18, Anchorage Digital, the only federally chartered crypto bank in the U.S., launched a stablecoin issuance platform in partnership with Ethena Labs. The platform will bring Ethena’s USDtb stablecoin onshore, fully complying with the new regulatory standards of the GENIUS Act.

Also entering the space is Wall Street asset manager WisdomTree, which launched the USDW stablecoin on the same day. The USDW stablecoin is a dollar-backed product designed to enable dividend-paying tokenized assets and will also operate under the GENIUS Act’s regulatory framework.

Even the world’s largest banks are now making moves. Bank of America CEO Brian Moynihan announced on July 16 that the bank is exploring the issuance of dollar-backed stablecoins once regulatory alignment under the GENIUS Act is complete. JPMorgan and Citigroup have also confirmed plans to enter the stablecoin market.

Rising interest in other stablecoin types

While fiat-backed stablecoins dominate the market, other types such as crypto-backed, algorithmic, and commodity-backed stablecoins continue to grow, though at a smaller scale. Crypto-backed stablecoins, like DAI, are backed by collateral such as ETH or tokenized Bitcoin, and their market cap stands at around $4.35 billion.

Algorithmic stablecoins, which maintain their peg by adjusting supply, have had a mixed history. The collapse of Terra in 2022 left a significant scar on the market, and as a result, they remain sidelined in regulatory discussions. Meanwhile, commodity-backed stablecoins, such as Pax Gold (PAXG), continue to gain some traction as potential inflation hedges, though adoption remains limited due to liquidity challenges.

The GENIUS Act has paved the way for a more organized and regulated stablecoin market. As institutional interest in stablecoins continues to grow, the role of regulated and compliant stablecoins will likely become central in the broader digital asset ecosystem. The upcoming launch of stablecoin ETFs and the continued growth of institutional players suggest that the stablecoin market will play an increasingly important role in global finance in the years to come.