German automotive brand BMW has revised its fiscal guidance downwards, as per an official press release.

The main BMW brand delivered 514,620 vehicles for the third quarter, while the BMW M GmbH and the MINI brand delivered 52,220 and 72,376 vehicles, respectively.

While volume growth was positive on a year-to-date basis for Europe and the Americas, China’s performance did not come up to the company’s expectations. The official statement by BMW stated that its expectations on tariff reductions set by the end of the first half of 2025 have not been met, another reason for the downward revision.

BMW has also said it’s waiting for reimbursement on customs duties from German and American authorities, described by the German carmaker as a “high three-digit million figure” that is expected to be paid in 2026 instead of 2025.

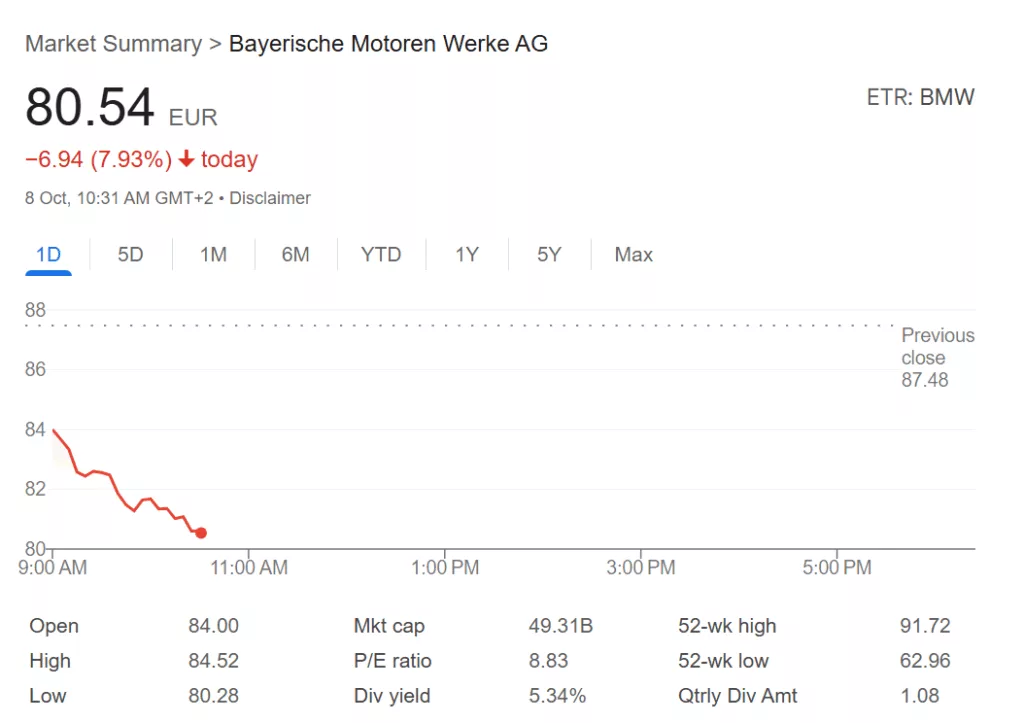

Source: Google Finance

U.S. Tariffs on car imports from European brands such as BMW, Mercedes-Benz, Volkswagen, and Audi have been dropped from 27.5% to 15% according to Co-pilot, while the EU’s tariffs on U.S.-made passenger cars have been brought down to 0%.

The new guidance expects return on capital employed to be within 8% to 10%, down from 9% to 13% and group earnings for the year to decline instead of holding steady.

BMW has said it will be maintaining its dividend payout ratio to be 30% to 40% of net income.

The car brand’s free cash flow has been declining from year to year since 2022 according to Macrotrends, and the company has kept a low estimate of just above 2.5 billion euros for 2025.