Brazil-headquartered Nubank has received a milestone approval on bringing its banking services to U.S. — that hosts the world’s largest financial market. The Office of the Comptroller of the Currency (OCC) — that supervises national banks in the U.S. — has granted Nubank conditional approval to establish a “de novo” or independent national bank in the country.

Under its conditional approval, the OCC will guide Nubank through the multi-level regulatory and documentation processes. This could take upto 12 to 18 months.

David Vélez, founder and CEO of Nu Holdings said the development is of a great significance to fully digital banks like Nu — which he called the future of global financial services.

“While we remain fully focused on our core markets in Brazil, Mexico, and Colombia, this step allows us to build the next generation of banking in the United States,” Vélez noted.

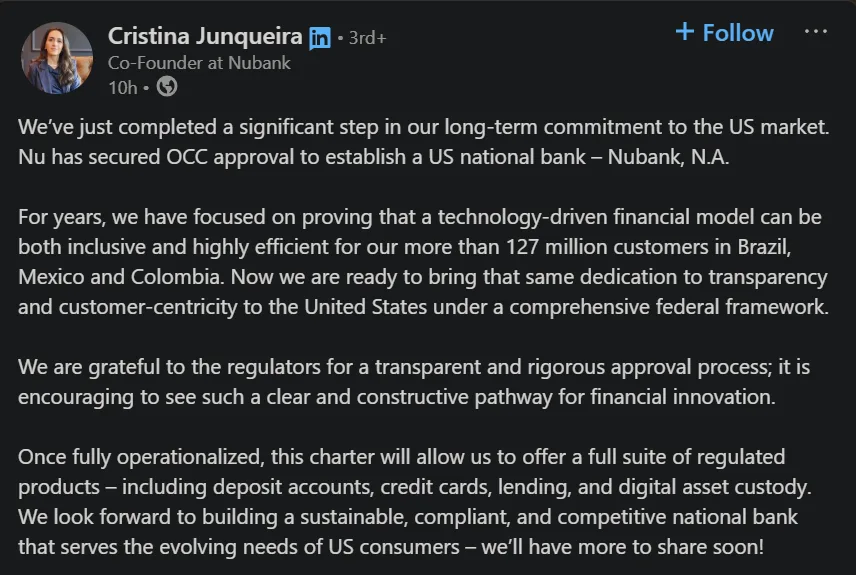

The U.S. unit of Nubank will be headed by co-founder Cristina Junqueira. The board of directors, meanwhile, will be chaired by Roberto Campos Neto, the former President of the Central Bank of Brazil.

Source: LinkedIn/ Cristina Junqueira

In the coming months, Nubank will have to get clearances from the U.S. federal reserve as well as the Federal Deposit Insurance Corporation (FDIC) — that insures bank deposits in the U.S.

Nubank, in Brazil, has been operating as a fully regulated financial institution since 2016. It has also been trading on the New York Stock Exchange since 2021 under the ticker symbol NU.

It had applied to obtain the OCC’s approval on September 30, 2025.

The OCC, meanwhile, made it to the headlines frequently last year for having crypto players like BitGo secure approvals to make inroads into the U.S. banking ecosystems. Fidelity and Paxos were also granted conditional OCC approvals last year alongside BitGo.