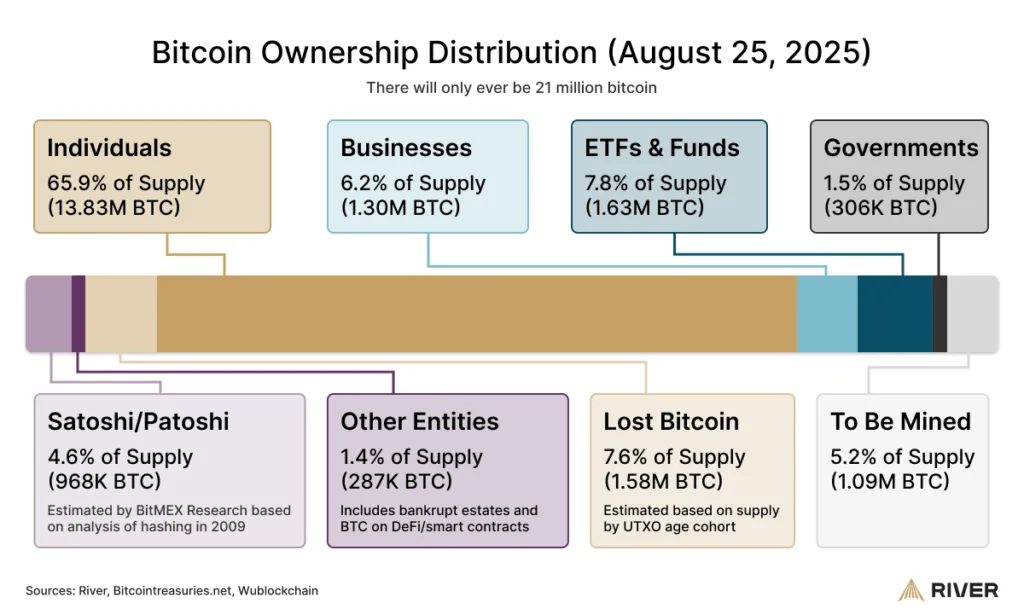

In 2025, the supply of Bitcoin is changing quickly as miners are outpaced by public and private enterprises by almost a factor of four, setting the stage for an impending supply shock. Businesses are buying about 1,755 BTC per day, while miners are only producing about 450 new coins every day, according to Bitcoin financial services company River.

The dynamics of supply in the market have been reshaped by this increase in private and corporate accumulation. While governments buy about 39 BTC every day, exchange-traded funds (ETFs) and other investment vehicles contribute an extra 1,430 BTC to daily demand. The risk of a severe liquidity squeeze is increased if institutional hoarding continues while exchange reserves continue to decline. Analysts caution that in the upcoming quarters, this imbalance can serve as a bullish trigger for the price of Bitcoin.

Bitcoin treasury companies lead demand

The biggest sources of institutional demand for bitcoin are still treasury companies. These companies bought 159,107 BTC in Q2 2025 alone, increasing their total corporate holdings to almost 1.3 million BTC. With an estimated 632,457 BTC in reserves, Michael Saylor’s Strategy is the most aggressive accumulation and the largest known Bitcoin holder worldwide.

The company’s unrelenting accumulation compresses the available float in a manner akin to Bitcoin’s scheduled halving events, according to author Adam Livingston, who has referred to Strategy’s buying behavior as “synthetically halving” Bitcoin. Shirish Jajodia, Strategy’s corporate treasury officer, has refuted the notion that these purchases immediately affect markets, pointing out that the company makes acquisitions through over-the-counter (OTC) transactions in order to reduce price volatility.

“Bitcoin’s trading volume is over $50 billion in any 24 hours that’s huge volume. So, if you are buying $1 billion over a couple of days, it’s not actually moving the market that much,” Jajodia said.

Supply shock potential

The data indicates a narrowing supply pipeline in spite of these guarantees. While companies, exchange-traded funds, and governments continue to purchase the equivalent of several daily miner outputs, individuals are net sellers of about 3,196 BTC every day. The long-term scarcity argument is only becoming more compelling, as there are only 1.09 million Bitcoins left to mine and nearly 7.6% of the supply has already been permanently lost.

The combination of institutional hoarding, declining exchange reserves, and AI-driven adoption cycles might pave the way for Bitcoin’s next meteoric rise if the current rate of growth persists. The digital asset is now a vital component of international business finance rather than just a substitute store of value.