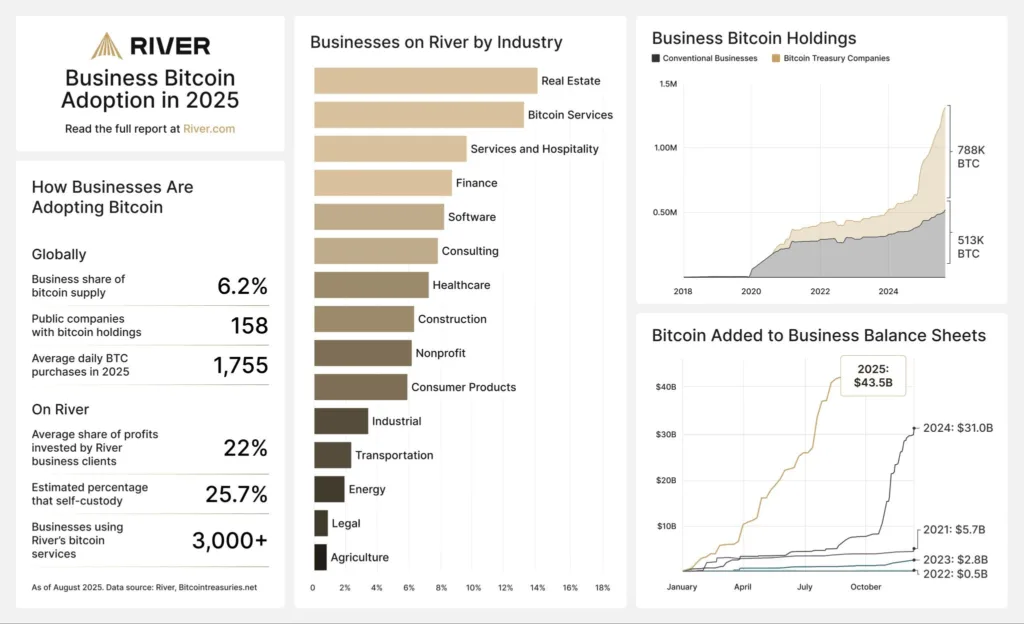

In 2025, Bitcoin adoption is moving past just institutions and ETFs, as private companies are quietly stepping up as significant players in the cryptocurrency’s bull market. Financial services company River reports that its clients are putting back an average of 22% of their profits into Bitcoin, enabling businesses to collectively gather 84,000 BTC this year. Although Bitcoin treasury firms and funds often capture the spotlight, smaller companies are progressively incorporating Bitcoin as a strategic element of their activities.

Real estate takes the lead with almost 15% of earnings invested in Bitcoin, whereas the hospitality, finance, and software sectors are each dedicating about 8% to 10%. The trend emphasizes how various industries, including fitness studios, roofing companies, and nonprofits, are incorporating Bitcoin into their financial plans. River analyst Sam Baker highlighted that these traditional businesses currently control about a quarter of the reserves held by institutional funds and corporate treasuries, emphasizing their increasing impact on the market.

Why smaller businesses drive momentum

The makeup of River’s client base shows why adoption is speeding up. Almost 75% of its business clients have 50 employees or less, enabling them to respond swiftly without the committee delays that typically hinder larger companies. The majority are making small investments, with more than 40% allocating between 1% and 10% of their income to Bitcoin. Recent instances, like Rhode Island’s West Main Self Storage acquiring merely 0.088 BTC, show how minor acquisitions can build up to substantial demand among countless businesses.

This surge in adoption is occurring amid favorable conditions such as clear regulations, better accounting practices, and a robust bull market that has driven Bitcoin to $124,450. However, River warns that many companies still do not grasp Bitcoin’s fundamentals, as surveys indicate a lack of understanding regarding its limited supply. Currently, the 2025 cycle demonstrates not only institutional momentum but also the gradual, consistent acceptance by companies turning Bitcoin into a conventional corporate asset.