Cayman Islands is accelerating policy work to regulate the market for tokenized mutual funds as it continues to attract Web3 interest owing to its tax neutral financial ecosystem. In a fresh development, the authorities there have released proposed rules for public and industry consultation.

A tokenized mutual fund, that represents traditional fund shares as digital tokens, would essentially issue equity interests in the form of blockchain-based digital equity tokens via smart contracts and automated managements.

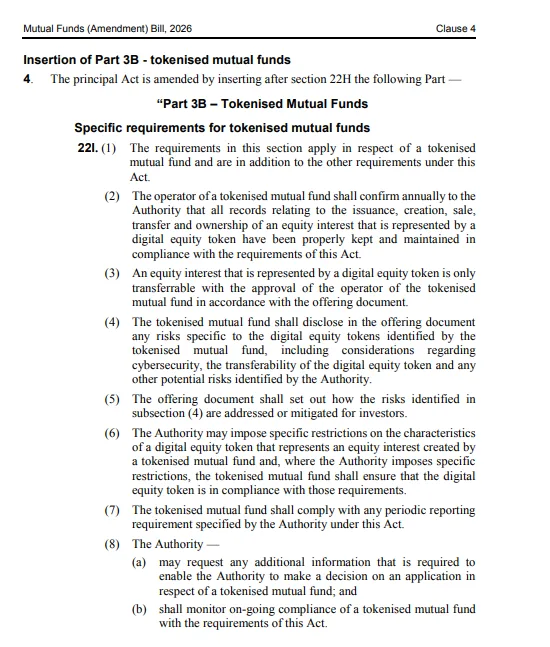

The proposed guidelines are encapsulated within the The Mutual Funds (Amendment) Bill, 2026. Under the proposal, Cayman Islands has updated the definition of “equity interest” to now include digital equity tokens.

If passed as proposed, the law would direct licenced mutual fund administrator to record all details including the issuance, sale, and transfer of an equity interest and present to the authority for audits as an when instructed.

The guidelines further mandates all tokenized mutual fund administrators to disclose related risks to the users in comprehensive details including cyber threats around the technologies in use.

The reaction to these proposed laws from Cayman Islands’ crypto community reflect optimism.

In communication with Coin Headlines, Haymond Rankin, Associate Director for the FinTech, Virtual Assets and Banking Sectors at Cayman Finance said the proposed amendments help reduce uncertainty around issuing and engaging with tokenized mutual funds.

“These amendments, together with the new market conduct measures, support the responsible development of tokenised funds by bringing innovation within a framework that is designed to protect market integrity and investor interests,” Rankin said. “As the consultation progresses, industry input will be important to ensure the rules are practical in implementation and deliver the intended clarity at scale.”

Cayman Islands-based hedge and crypto fund management company CV5 Capital also published a supporting statement for the proposed rules on Thursday.

“We expect this amendment to accelerate institutional adoption of tokenised fund interests, particularly among managers and allocators seeking on-chain efficiency with off-chain regulatory certainty,” the company said.

Source: legislation.gov.ky

For now, it remains unclear by when will this legislation be signed into a law.

In December last year, the Cayman Islands General Registry had shared that the British Overseas Territory situated in the Western Caribbean Sea had recorded a 70 percent year-on-year spike in foundation Web3 company registrations and that 400 new Web3 firms have set up offices in region.

Cayman Islands does not levy direct taxes on individuals or corporate entities — neither on capital gains nor on inheritance, gifts, and properties. The region, does, however imposes duties and annual fees on imports, stamp duties, real estate sales, and mortgages.