Crypto market sentiment has plunged to its lowest level since the FTX collapse of November 2022, which had wiped out an estimated $183 billion from the digital assets in immediate impact that month.

The sell-off on Friday forced many traders and investors to cut positions, adding to the downward pressure, following Bitcoin’s sharp drop that dragged prices across the board.

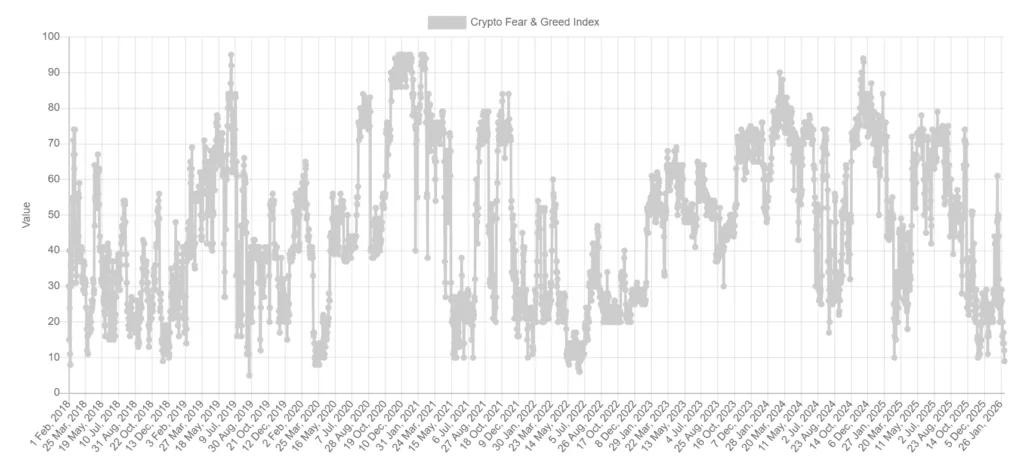

The Crypto Fear and Greed Index, a widely watched gauge of market mood, fell to 9 on Friday, a reading labeled “extreme fear.” Historically, such levels have only appeared during major crises in market confidence, showing just how cautious and jittery investors are right now.

While some see this as a potential buying opportunity, the low reading highlights the nervous state of the crypto market and the outsized impact that Bitcoin’s swings continue to have on the entire ecosystem.

The Crypto Fear and Greed Index mainly looks at Bitcoin and tries to measure how investors are feeling, rather than predicting whether prices will go up or down.

However, it does indicate that the market has reverted to the level of “fear” usually reserved for systemic disasters.

The fear and greed index combines different factors like how much Bitcoin prices are swinging (volatility), recent losses, overall market momentum, trading activity, how much people are talking about Bitcoin on social media, Bitcoin’s share of the crypto market, and how often people are searching for Bitcoin on Google.

The signals together give a sense of whether the market is feeling confident or scared at any given time.

Fear and greed index swing comes as Bitcoin plunges to $60,000

Crypto market sentiment took a hit as Bitcoin briefly fell toward $60,000 on Thursday before bouncing back near $65,000, a swing driven by forced sell-offs and buyers taking advantage of the dip.

While the rebound shows that some investors are willing to step in at key price levels, the overall reading of “extreme fear” suggests that most of the market is still cautious, acting on instinct rather than strategy.

In past cycles, such panic has sometimes marked local market bottoms, as short-term holders and leveraged traders get pushed out.

Market liquidations weight heavy on digital asset market

The crypto market has been severely impacted over the past few months, wiping out over $2 trillion in value since October 2025, when it stood at $4.27 trillion, and has now dwindled to a mere $2.22 trillion in early February 2026.

The recent market volatility, however, has seen liquidations rise as the market has lost over $2.6 billion in the past 24 hours, as per Coinglass.

Traders are clearly deleveraging to protect themselves, and the asset class that has suffered the most is Bitcoin, with $601 million in long positions and $247 million in short positions liquidated.

The numbers also show the speed at which the market is capable of moving, thus requiring investors to shift their strategies accordingly, especially when the market is still volatile.