David Sacks, Donald Trump’s key crypto advisor, criticises a New York Times article that speculates on how he could benefit from his government job. David Sacks, the White House’s AI and crypto czar, has responded to a New York Times article that said his status as a government advisor might help his investments and those of his close friends.

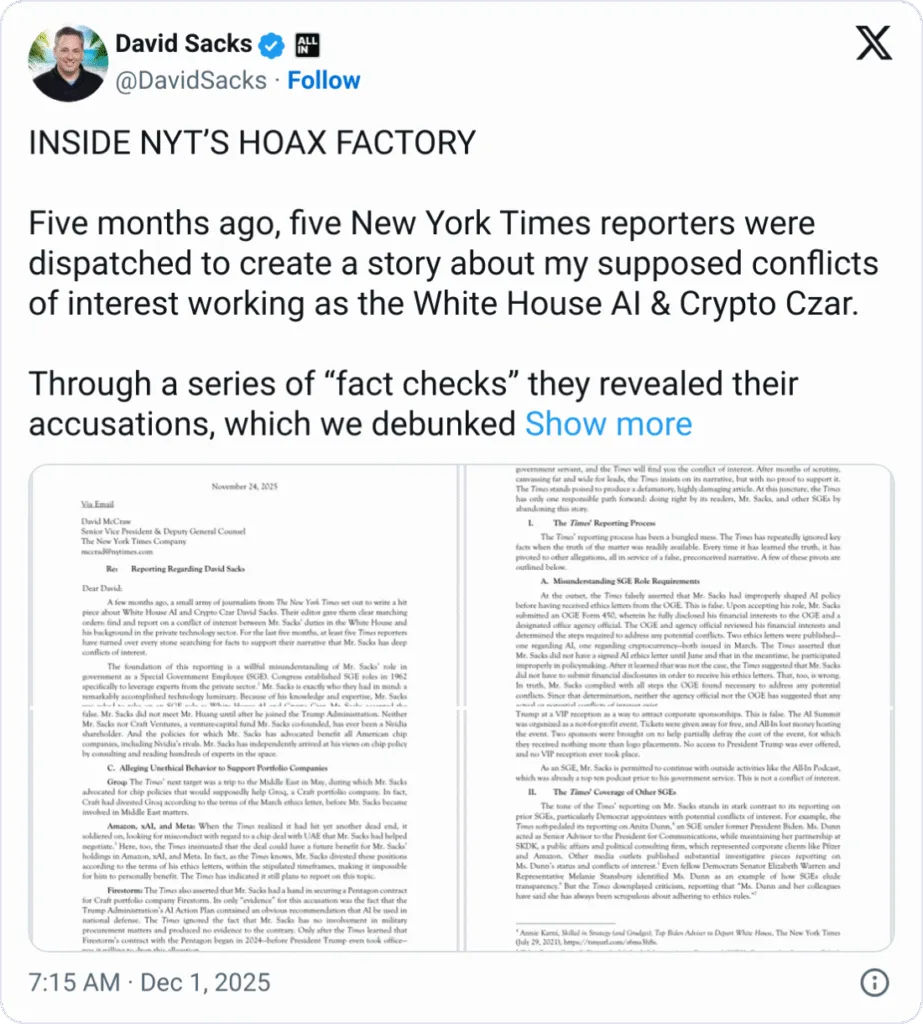

Sacks wrote on X that even though he had “debunked in detail” the Times’ reporting over the past five months, the paper nonetheless published an article on Sunday regarding his apparent conflicts of interest.

Sacks remarked, Today they clearly just threw up their hands and published this nothing burger. Anyone who reads the story closely can see that they put together several stories that don’t back up the headline.

Source: David Sacks

Financial stakes and past investment

Sacks is a co-founder and partner at the venture firm Craft Ventures. His job as a special government employee at the White House has come under fire in the past. In May, Democrat Senator Elizabeth Warren said that he is “financially invested in the crypto industry, positioning him to potentially profit from the crypto policy changes he makes at the White House.”

Before he became the crypto czar, Sacks and Craft sold off more than $200 million in crypto and crypto-related equities. Sacks controlled at least $85 million of these stocks, but he still had a stake in some illiquid investments in “private equity of digital asset-related companies.

The Times said that its look at Sacks’ financial statement showed that he still owns 708 tech interests, 449 of which are connected to AI and 20 of which are related to crypto. All of these investments might benefit from the policies Sacks supports.

BitGo, a crypto infrastructure business that offers stablecoin-as-a-service, has received investment from Craft Ventures. The acquisition is one example of a perceived conflict in Sacks’ job.

In September, BitGo sought to go public. Regulatory papers showed that Craft controlled 7.8% of the company. The Times reported that Sacks strongly backed the GENIUS Act, a law that regulated stablecoins earlier this year. Many people who write about crypto claimed that the bill would make institutions utilise and buy more tokens.

Legal response and ethics compliance

The Times reported that Sacks committed to divesting his stakes in AI and crypto, as per his ethical waivers made public in March. However, they do not disclose the timing of his asset sales or the value of his other investments.

Sacks thinks the NYT made up a bogus narrative.

Sacks posted a letter from his attorneys at Clare Locke to the Times in which they accused the paper of “writing a hit piece” and giving their reporters “clear marching orders” to identify conflicts of interest.

Jessica Hoffman, a representative for Sacks, told the Times that he has followed the regulations for special government employees. The Office of Government Ethics recommended that Sacks should divest his assets in some types of companies but not others.